Consumer Spending is Up! How to Manage COVID "Snap-back" Spending

Spending is back! And with it comes the temptation to overspend or blow up your budget. Stay connected and build spending into your plan!

Table of Contents:

- Consumer Spending is Up!

- Chaotic Schedule = Chaotic Spending

- Emotional Triggers to Watch Out for

- Recommendations

Consumer Spending is Up!

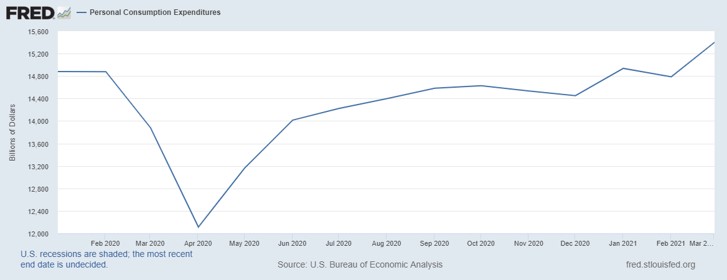

In 2020 consumer spending completely dropped off in April. Then spending slowly started to creep up and resumed some normalcy even though it remained under pre-pandemic levels.

As we entered 2021 there's a spike up. The reason for this increased spending? Well, many people received stimulus payments combined with the fact more governments loosened restrictions and businesses started to re-open.

All of this increased spending, money in savings and extra government stimulus, it's easy to get caught up in the COVID "Snap-back" spending cycle.

As always, everything we teach at Vibrant Money, begins with connecting to your spending. It's so important to continue to increase your awareness with your money so that additional spending doesn't cause any harm to you.

Consumer spending Increased to it's highest levels since the pandemic began.

Here are the facts according to the Bureau of Economic Analysis:

- Consumer spending rose almost 11% equal to over $330 billion. The biggest three categories that that we've seen an increase are durable goods (cars, appliances, etc.), restaurants, and travel.

- Disposable personal income increased $2.36 trillion, or 67.0 percent, in the first quarter.

- The personal saving rate was 21% in the first quarter, compared with 13% in the fourth quarter.

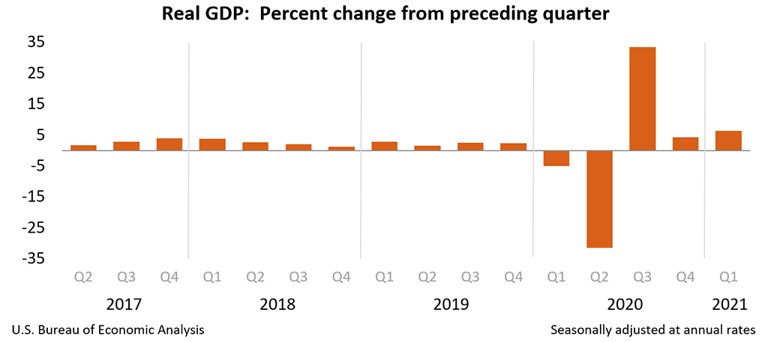

- Gross Domestic Product (GDP) rose 6.4% in Q1 2021

Gross Domestic Product measures all economic activity in the United States. It rose by 6.4% in Q1 of this year.

A chaotic schedule leads to chaotic spending

Life is starting to get "back to normal" and for many it's very abrupt. One of the top things that I'm seeing with my clients is that a chaotic schedule equals chaotic spending.

Here are some examples of a newly chaotic schedule:

- Children are back in sports again

- Schools have reopened

- Coffee and lunch meet-ups are more common

- People are returning to work in the office

- Visiting with family on the weekends is happening more

This can create a chaotic schedule because life has been so slow for the last year. There is more activity than normal. This can lead to chaotic spending because everything is happening all at once:

- The kids need new clothes to go to school

- The restaurant budget is getting spent faster and faster

- You're spending more on gas or car maintenance to travel to work

- You want a new wardrobe before heading back in to the office

- You renew your gym membership

All of this can lead to more spending than you planned.

Here are a few tips to calm down chaotic spending:

- Create a schedule to see when you will be out of the house in the coming week or month. Anticipate upcoming expenses.

- Create meal plans or meal preparation to avoid over spending while you're out of the house.

- Refresh your wardrobe by looking through your closet (or a friends closet!) instead of assuming you need to go shopping.

It's just important of take a breath as you ease back into old activities.

Be on the look out for these thoughts or emotions regarding spending

The name of the game is awareness and intention! Watch out for these types of thoughts and emotions.

Justifying wants as needs Now it's very easy to say,

- "I really need a new car"

- "I really need that new wardrobe"

- "I really need a vacation away"

These may be valid and relevant needs or wants. However, you want to be careful that you're not justifying excessive spending as needs. Everybody went through a really hard year in 2020 and there are legitimate needs. I think a lot of people have been starved for social activity, physical activity, and mental activity. So there are many needs that we're going to spend money on. So when you're about to make a big purchase coming up, just taking a moment to really tune in and ask yourself whether it's a need or a want.

Pandemic Fatigue Spending - “I deserve it!”

Many people are experiencing pandemic fatigue. Many people feel drained after so much restriction and change in life. This is where emotional spending can creep back into your life.

To be honest I thought "I deserve it" recently as well! It was recently my birthday and I fully allowed myself to enjoy it. The difference in this situation was that I was intentional about my spending. Were there extras? Yes! So I can personally attest that this one is floating around out there.

The key here is to catch yourself when you say to yourself "I deserve it!" It's not that you don't deserve to be comfortable to be happy to be fulfilled. Sometimes you might use money to to fulfill on what you deserve. You just want to be honest with yourself about it.

Disconnecting from Your Spending

“I don’t care what it does to my plan.”

Finally, it can be tempting to disconnect from your spending during this "snap-back" spending. This is probably the most dangerous thought during these times. Disconnecting from your spending can lead to more and more overspending. It's better to stay connected even if you know you're going to spend more than you originally planned or wanted to.

Stay Connected to Counter Act Snap-Back Spending

So here are some recommendations to counter-act COVID "Snap-back" spending:

- Put new spending into your plan

- Keep tracking your spending

- Start tracking/managing your time

- Allow yourself to want and indulge – raise your point of awareness!

- Review your short-term savings account and non-monthly expenses

Sign-up for the next Wealthy Wednesdays Live!

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.