The No B/S Guide to Getting Out of Debt

The step-by-step guide that banks credit card companies don’t want you to see!

Introduction:

This step-by-step guide will show you how to get out of debt. I'll cover how debt is hurting you and give you what you need to know to get out and stay out of debt and rebuild your credit. Banks and credit card companies would rather you not know a lot of what I’m about to share with you.

As a money coach, I’ve spent my career counseling people on their financial lives. One of the top concerns my clients start with is debt. The minute my client says they want to get out of debt, I feel like an Olympic-level personal trainer who knows her out-of-shape new client is gonna be a total badass by the time I’m done with her. So what do you say? Let’s get to work.

Table of Contents:

- What is debt?

- 4 Steps to Help You Get and Stay Out of Debt

- Pitfalls to Avoid on Your Way to Debt Freedom:

What is debt?

Debt is borrowing money that you have to pay back in the future plus interest. It seduces us with pleasure today but pounds us with pain tomorrow. To most Americans, debt is a totally normal, if not inevitable part of life. But it isn’t and doesn’t have to be.

We're Drowning in Debt

Debt cripples our lives. This debt doesn’t just pile up because we have “spending issues.” It’s also a consequence of life, such as medical issues, divorce, going to college or taking that dream vacation. Either way, it all adds up. And the result is, we’re quivering under the weight of massive debt. That’s no surprise though. Banks and credit card companies know our sweet spots and weaknesses better than we do. By now things have gotten downright ridiculous. Social media has micro-targeted us with such precision that we wonder if they can see into our souls.

Visa and Mastercard started grooming us early on, “surprising” us with our first credit card when we were barely out of high school. They cribbed sales strategies from drug dealers and tobacco companies: sell early and you’ll own your customers for life.

How bad is it?

Incredibly, the average American is in debt nearly to the tune of nearly $100k. Here’s how average balances break down by debt type:

- Retail credit card (e.g. TJ Maxx, Macy's, Best Buy): $1,155

- Bank credit card (e.g. Delta, Citibank, Amex): $6,194

- Personal Loan: $16,259

- Auto Loan: $19,231

- Student Loan: $35,620

- Home Equity Line of Credit (HELOC): $45,191

The devastation of this kind of debt goes way beyond finances. It leads people to give up, believing they’ll never get out. Others justify the debt by saying “everyone’s in debt so it’s no big deal.” Either reaction is music to lenders’ ears. All the better to distract us from the fact that their multi-trillion-dollar racket is sucking us dry. The fact is, every day we’re in debt we pay more for our purchases, delay building wealth, and get screwed in the process.

3 Ways Debt is Sabotaging You

Debt Makes Everything More Expensive

Debt Prevents You from Building Real Wealth

Debt is a Psychological Mind-Fuck

#1 Suckers Always Pay More (Don’t be a Sucker)

When you want or need something you can’t afford, you grab the credit card or take out a loan. If you can’t afford something in the first place, you really can’t afford to pay more than the sticker price, right?

Paying for anything through borrowing automatically jacks up the sticker-price. This holds true whether we’re buying a house, an education, a sofa or a pair of Nikes.

These are some everyday examples:

- A $79,520 student loan becomes $98,896 ($79,520 in principal + $19,376 in interest @ 6%)

- A $25,000 auto loan becomes $35,024 ($25,000 in principal + $2,624 in interest @ 3%)

- A $10,000 vacation becomes a whopping $24,423 ($10,000 in principal + $14,423 in interest @ 18% APR)

- A $250,000 home loan becomes $404,140 ($250,00 in principal + $154,140 in interest @ 3.5%)

We get ourselves in so much debt that we end up financing our whole lives. This debt has metastasized to every area of life: cars, trips, mattresses, appliances or even bras. Sometimes this debt is hidden in monthly bills like payments for your new iPhone.

#2 Poverty is Nobody’s Drug of Choice

Paying tons of interest isn’t the only cost of debt. It’s also keeping you from taking advantage of opportunities to save and invest. Don’t fool yourself: unless you’re purchasing a home (that you can afford) or investing in an established business, going into debt is NOT investing.

It’s NOT building assets. You’re just buying shit!

Those same drug-dealer/bankers who got you hooked on credit cards can keep that stranglehold on you for life. Zoom out to see the big picture and sit yourself down in the driver’s seat.

Unpleasant fact: It’s impossible to build true wealth when you’re in debt. We build wealth by saving and investing. Every dollar you put towards debt is a dollar you’re not saving or investing. Look at the table below and guess which approach the lending industry wants you to choose.

Scenario 1: You pay ~ $200/month on a 20% APR credit card with a $10,000 balance. In 10 years you’ll finally pay off the debt PLUS $13,001 in interest. Now you're OUT $23,001!

Scenario 2: You invest ~$200/month in low-fee index or mutual fund that returns 7 % on average each year. In 10 years you'll have saved $24,000 in cash and earned $8,165 in interest! You now have $32,165!

I know I'd rather have that $32k in the bank in 10 years instead of hemorrhaging $23k!

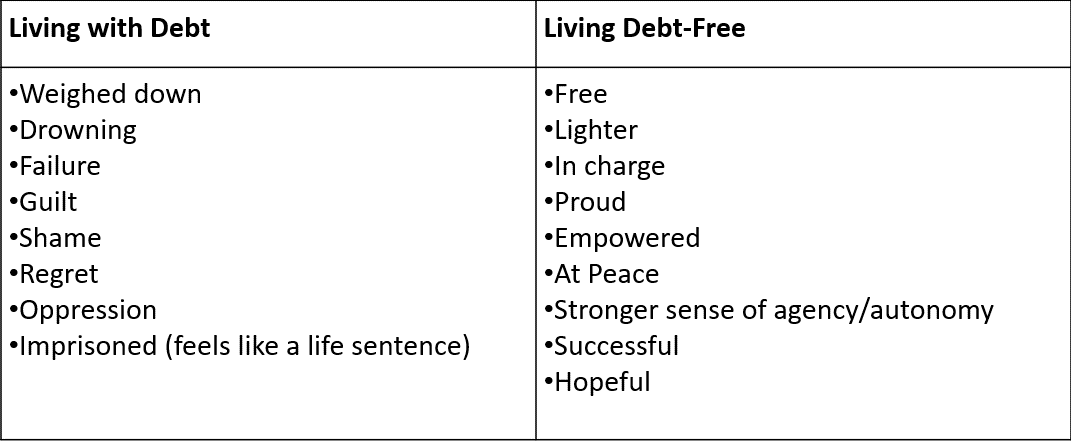

#3 It’s a Psychological Mind-Fuck

Once you’ve joined fellow hamsters on the debt treadmill you’ll do whatever it takes just to be able to pay the bills. Sometimes that means going to a soul-sucking job every day to keep creditors at bay. Every aspect of your life gets harder when you're in debt.

Staying in debt for most of your adult life is like living on an airplane where your ears are always plugged up. You just get used to it because your ears never pop. But once you do get out of debt, POP! You’ll realize how crummy your hearing was for so long. You’ll never want to go back again.

My clients report a huge sense of relief once they’ve paid off their debt. They realize the extent to which debt was holding them back from living a fuller life.

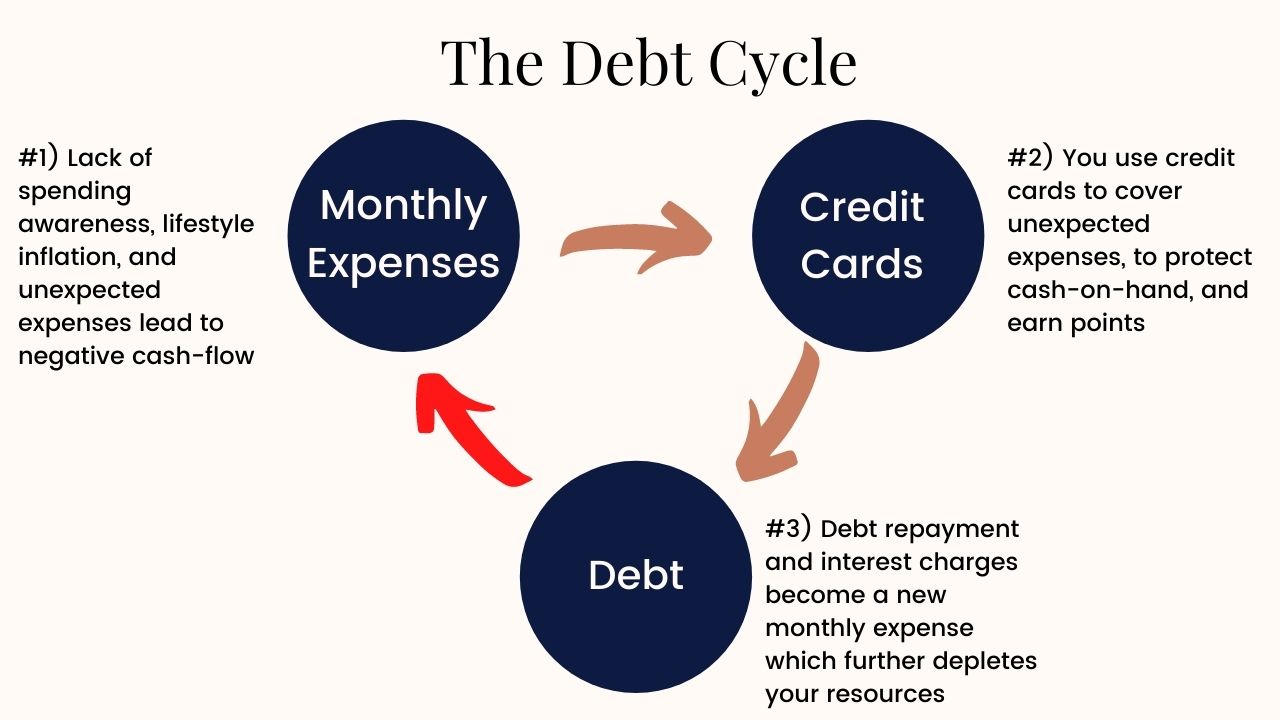

Keep in mind that even if you’ve managed to get out of debt in the past, you can still easily fall back in (see the debt cycle below.) Millions of people use “zero percent” balance transfers, loan consolidation, or even declare bankruptcy expecting to “wipe the slate clean.” But many often end up back in debt. That’s because they haven’t addressed the underlying issues. I recommend a more holistic and empowering approach to clearing your debt once and for all.

4 Steps to Help You Get and Stay Out of Debt

I’ll tell you everything I wish I’d known about getting and staying out of debt in my 20’s. This No BS guide will show you step-by-step how to dig out and stay out of debt once and for all. Vibrant Money’s Financial Foundations lays out four steps to get you there.

I’m not saying it’ll be quick, but if you stick with it, you’ll get there. It took me several years to finally eliminate all my debt and get to the end of Step 4 below. It took my husband 2.5 years to pay off $58k and save enough to cover six months’ worth of expenses. If you stick with it, it will change your life forever! This is the exact program I used to help Ed and all of my clients get out of debt.

Vibrant Money’s Financial Foundations

The 5 steps below are the milestones on the path to permanent change.

Step 1 - Stop Borrowing Money

Many clients come to me because they’ve been living beyond their means. They’ve relied on credit cards to cover unexpected expenses. They’ve stubbornly stuck to using those cards because of the enticing points. They often keep more cash on-hand than they need. But when they become aware of these self-defeating habits, it hits them. All these years they’d been allowing debt to become one of their monthly expenses. Think about it: why do we just accept that as a given?

Watch this video explaining how to break the debt cycle with savings!

Switch from Credit Cards to Cash and Debit Cards

The first step is to stop borrowing money. This seems like a “no-duh” step but it’s important to get to a place where you no longer need or want to use debt for your monthly living expenses. So if you’re using credit cards, switch to debit and cash. This may take some adjusting but you’ll notice a shift in your behavior when you see that money disappear from your purse or checking account immediately. This gets you much closer in touch with your money than opening monthly credit card statements, if you even do that!

Start to track your spending and create a plan every month

Track your expenses more closely. Even more important than kicking off your debt-reduction, tracking expenses will get you in closer touch with your spending habits. This is the financial equivalent of flossing your teeth. If you don’t do it, it’s only a matter of time before there's gunk building up in your money.

To track your spending and create your monthly plan, you’ll want to:

- Create a budget (I call it a spending plan) using a spreadsheet, journal, or online software. I’ve created a free Monthly Spending Plan Template you can use to start creating your own spending plan!

- Set aside 1 hour per week where you’ll review your spending - think of this as your money date! During your money date, review your spending and update your spending plan. You can also use this time to pay bills including making your debt payments.

Temporarily stop automating your finances!

Automating your finances decreases your connection to your money. That connection is essential to creating and maintaining a debt-free life. The winning approach is the opposite of set it and forget it. You win by taking charge of your money. The earlier the better.

Some easy steps you can take include:

- Turn off auto-pay on your credit cards

- Turn off auto-transfer into savings

- Turn off auto bill payments

- Stop using 1-click checkout on Amazon

- Remove your credit card or debit card information from online stores you shop on

- Stop using Apple Pay and/or Google Pay

Many people will argue this is foolish. Technology has helped us simplify, increase efficiency, eliminate bookkeeping, earn your rewards points, streamline bill and subscription payments. However, these gimmicks all gleefully promise we can set it and forget it! (emphasis on the “forget” part!) Remember, automation is brought to you by the same folks who put you in debt in the first place! As tempting as all this sounds, the costs outweigh the benefits.

Congratulations, you’re now ready for step 2!

Step 2 - Save 1 month of take-home pay

Now that you’ve stopped borrowing, it’s time to create a “savings buffer,” AKA a revolving savings account. You’ll use this short-term savings account for non-monthly expenses such as quarterly insurance premiums or annual membership fees. It's also used for unplanned events such as when your car breaks down or you need surprise dental work. When these situations come up, instead of reaching for the credit card, you’ll use this short-term savings to cover the expense.

Getting to step 2 is a major victory in your debt free journey!

It takes a minute for your brain to get used to this idea. Savings is considered “untouchable.” Any dip into savings to pay for unexpected expenses brings out the voice of the inner critic. But this didn't happen overnight and it’s going to take some time to reverse course. So don’t feel bad if you have to use credit cards for non-monthly and/or unexpected expenses until you’ve funded this savings account. Everyone starts where they are.

Once you’ve weaned yourself all of your credit cards, you’ll be able to go straight to your short-term savings account to cover non-monthly and/or unexpected expenses. Taking charge and being proactive will send your confidence through the roof. So congratulate yourself for having “planned” for it. As soon as you can, replenish it to one month’s worth of take-home pay. Keep this account active.

By step 2 you know pretty well how much of your paycheck is left after expected/unexpected expenses. You’ll no longer head into a tailspin when non-monthly expenses like these arise:

- Car Registration or maintenance

- Summer vacations or summer camps

- Annual subscriptions or payments

- Routine medical or dental appointments

- Maintenance on your house

- Holiday Expenses

Savings is the main muscle-group we’re building to help you to kick debt’s ass.

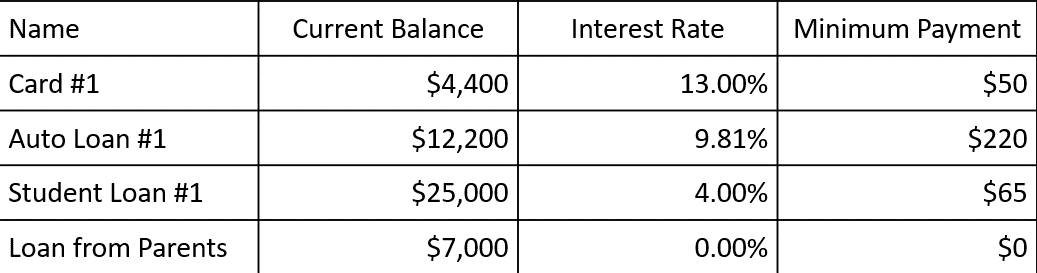

Step 3 - Pay off all your debt (except your mortgage) using a debt snowball

Don’t be Scared: it’s Just a Number!

Now that you’ve stopped using your credit cards and created a saving buffer, it’s time to go a little deeper. Yes, time to figure out how much you owe. It’s way less scary to deal with real numbers, no matter how bad they are. Skip the fear and guilt. Instead, sit down with your calculator or a spreadsheet or use the table below.

Breaking Free Using Debt Snowball

You’re now ready to map out your road out of debt-hell using the snowball method. To start your snowball rolling, list all of your debts by name of creditor, interest rate, balance, length of loan (if applicable) and minimum monthly payment. Include all debts, including personal loans, student loans and credit cards.

Now that you have the real numbers you can decide what you want your total payoff number to be. Don’t leave out any debt. Whether you borrowed 20 bucks from your bestie or $1,000 from your sister, write it down. Listing all of it gives you a tangible goal and mini-goals along the way to the big one. This is extremely motivating.

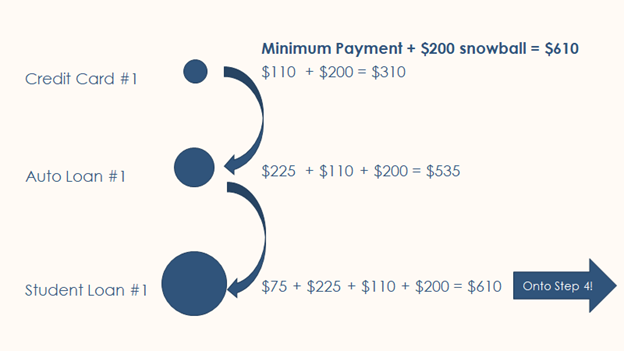

Start by paying off the debt with the lowest balance first, regardless of interest rate. Pay the minimum amount on everything EXCEPT the debt with the lowest balance. Each time you pay off one debt, you'll roll the extra over into paying off the next-lowest balance. Continue this until the snowball obliterates your debt.

Why Debt Snowballs Work

Some financial gurus argue that paying the debt with the highest interest rate first (AKA the debt avalanche) is a more efficient debt repayment plan. While this is technically correct, it ignores the fact that your highest interest rate may also be tied to one of your largest debts. My approach is all about building that muscle, that momentum, that endurance. You get that lift as soon as you pay off a small debt, rather than slogging though years to pay off a larger one.

Your patience will pay off, saving you thousands of dollars in interest and shaving years off your repayment timeline.

Let’s Get that Snowball Rolling!

Calculate your numbers using this debt repayment calculator. The key to creating a debt snowball is setting a dollar amount above your minimum payments that you can consistently pay each month. Even if it’s only $100 or $200 more than your minimum payment, the snowball effect will build momentum!

If your minimum payments total $270, a $500 monthly debt payment equates to $230 EXTRA per month you'll pay towards the lowest balance first.

Watch this video explaining how to use the debt snowball calculator

Now that you’re rolling, don’t break the flow by taking on new debt. Keep using debit cards/cash instead of credit cards as you learned in step 1. Resist the temptation to yo-yo contribute. Staying the course with a consistent plan will give you best results.

What to do When You Need to Dip into Your Short-term Savings

While you’re paying off your debt you’ll still have non-monthly expenses come up. This is where the money you saved in step 2 will be put to use! You should keep replenishing your short-term savings account while you're paying off your debt.

Example:

- Savings contribution: $200

- Debt snowball: $500

- Free cashflow required each month on Step 3: $700

If your short-term savings account gets wiped out you may want to temporarily pause your debt snowball to refill your short-term savings account to 1-month of living expenses. Once you’re back to 1-month of take-home pay in your savings account, you can resume your debt snowball payment.

Speed Up Your Way Out of Debt

You can try lots of different ways to earn a little extra to help pay off your debt more quickly. For example, I used to Airbnb my apartment when I was traveling. My husband Ed took on a roommate to speed up his debt repayment. Here are some other things you could try:

- Sell some items in your home and put the money directly into your safety-net savings.

- Pick up extra work on the side including freelance or gig work.

- Re-negotiate your salary or ask for a raise at your work.

- Consider finding a higher-paying job.

- If you get a lump-sum windfall of cash like a tax refund, a bonus, or even inheritance, apply as much as you can toward the debt. It can mean years of difference in how long it takes you to become debt-free.

Homeowner's Note

If you have a mortgage, keep making your minimum payments. Once you finish this step you’re officially debt-free. BUT the journey isn’t over. Step 4 is your key to staying out of debt for good.

Step 4- Save 6 months of take-home pay

Now that you’re debt-free, it’s time to build a second emergency savings account designated for any interruption in income. This account, which I call your Emergency Savings, will be the equivalent of 6 months of take-home pay. That’s in addition to the one month’s take-home pay fund for non-monthly expenses (step 2). Your emergency savings is there to keep you from going back into debt in case you lose your job or you decide to leave it. You couldn't ask for a more apt PSA for the emergency savings than COVID-19.

If you’ve been paying off your debt in step 3 using a debt snowball, you've already established a habit of putting a chunk of money towards debt. Now, start using that same debt snowball amount to build your safety net. The trick here is to avoid backsliding. When you finally get the monkey off your back you may be tempted to start using your debt snowball amount as a “reward.” This kind of knee-jerk reaction can set off a chain reaction that could end up putting you back into debt all over again.

Now, I’ll admit that many of my clients do allow themselves to celebrate once they get out of debt. That’s OK. If you want to go out to a nice restaurant, buy yourself some jewelry or some other indulgence, go for it! Just stay on track with building your emergency savings!

By the end of step 4 you'll have accomplished what many Americans only dream of. You've created a final layer of protection against going back into debt. You’re free from consumer debt and you've built 7-months of savings (1-month in short-term and 6-months in an Emergency Savings.)

P.S. There is a third bucket for "savings" and that is actually investing money.

Here are the three buckets of savings side-by-side:

Related: Retirement Planning 101

Related: The Ultimate Guide to Saving Money

Welcome to the beginning of financial stability!

Once you’ve stopped borrowing and saved 7 month’s equivalent take-home pay (whew!) relax! You’re well on your way to building a secure financial future.

Congratulations on making it this far! Keep going, and, along the way, steer clear of common pitfalls.

Pitfalls to Avoid on Your Way to Debt Freedom:

Everybody’s debt “starting line” is different. Depending on how much leeway you have, try to avoid these pitfalls if possible. One easy test is, if you’ve seen it advertised on daytime television, it's NOT a good idea. These “solutions” usually make matters worse. Sometimes you may have no choice but to resort to one of these but try to avoid them.

These are all temporary fixes that don’t address the underlying behavior.

Balance transfer credit cards

Sometimes it may be worth it to consolidate all of your credit card debt onto a single, 0% interest card. It'll cost money but if you can pay off the credit card balance within the 0% grade period, it can save you thousands of dollars in interest.

But be aware you’re dancing with the devil. The credit card companies WANT you to carry a balance beyond the grace period so they can slap you with a whopper interest rate. That’s their business model. So if you choose to accelerate your debt reduction with this tool be very careful. That “zero” interest rate can skyrocket to 30 percent if you go one day past the introduction period. Mark your calendar accordingly with huge red letters!

Filing for bankruptcy

Filing for bankruptcy can be tempting but it has several downsides. For one thing, it’s expensive in terms of money, energy and reputation. It ruins your credit for 7 to 10 years. If you are filing for bankruptcy , you'll choose whether to file under Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7 (AKA Liquidation Bankruptcy) makes you sell some or all of your property to pay off your debts. People who don't own a home or have limited income often choose Chapter 7.

- Chapter 13, (AKA Reorganization Bankruptcy) offers you the opportunity to keep your property (including your home and car) if you can successfully complete a court-mandated repayment plan. These plans usually run from one to five years long.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types.

With Chapter 7, those types of debts are wiped out with your filing's court approval, which can take a few months. Under Chapter 13, you have to continue making payments on your balances throughout your court-instructed repayment plan. Afterwards the unsecured debts may be discharged.

Bankruptcy doesn’t eliminate all debt (e.g. student loans, alimony and child support.) John Oliver's LAST WEEK TONIGHT does a great job of explaining how it works.

Cashing out your IRA or 401(k)

If you have no other choice but to tap into your IRA or 401(k), be meticulous in following instructions. Check to see if your employer has any special rules you need to follow. In some cases, you may be better off taking out a 401(k) loan than a traditional hardship withdrawal.

Loans and withdrawals from workplace savings plans offer different advantages and disadvantages. If you take out a loan, you’re borrowing money from your retirement that you’ll have to pay back over time, plus interest. These loans are usually only available to active employees. If you take a withdrawal, you’re permanently removing the money from your retirement so you can use it right away. The downside is that you’ll have to pay taxes and possibly penalties.

Either way, if you dip into your retirement, make a plan with deadlines to rebuild those savings. Money in your 401k or IRA is meant for your retirement, your future self. It builds on the positive impact of compounding interest, which you lose when you cash it out. If you borrow against your 401k you’re making your future self poorer. So do everything you can to catch back up once you’re able to.

If you must borrow from your 401(k), use it to pay off higher-interest debt like credit cards.

Note that borrowing from your 401k often carries fees and penalties:

- There’s usually a 10% early withdrawal penalty (unless your age is over 59.5)

- You’ll pay taxes on the amount you withdraw because it’ll count as income on your tax return

- You may be selling your assets at a loss (meaning you lost money on your investment)

- You’ll likely need to repay the loan within 5 years plus interest.

Borrowing from friends/family

Oh boy, this one’s a mess. Borrowing from friends and family often damages or ruins relationships. No matter how much you think your situation is different, personal loans shift the dynamics of your relationships. Unless you draw up a legal contract, you’ll have no protection in case of default. Disagreements over personal loans can cause rifts that last generations, a price nobody should have to pay.

Now that you're out of debt, let's keep you out!

Congratulations, You’re Out! Here’s how to STAY Out!

Borrowing Again

Two “BUT’s:” the only 2 Legit Reasons to Borrow Again

After all this borrow-bashing, it may sound cray for me to suggest ever borrowing again. But, in a couple of cases, it can still be justified if necessary.

- You can still make a case for taking out a home mortgage, which is the number-one reason people go back into debt. This is understandable given Americans’ desire for homeownership.

- It’s also reasonable to take out a commercial or business loan under certain circumstances. However, I only recommend this for established business owners/entrepreneurs who are connected with their finances. Small solopreneur businesses should avoid taking out loans. I don't recommend anyone use credit cards to finance their business.

Rebuilding your Credit: Do’s and Dont's

Get Your Official Credit Report

Now that you can breathe more easily, let’s give a little TLC to your credit score. Order your full credit report for free. This is the link to your official credit report. Be careful not to click on any of the many look-alike links. You can also request your report by phone at 1-877-322-8228.

Get ready for a trip down memory lane as this report will contain accounts you haven’t thought about in years. Carefully review the report and update any incorrect information. Dispute any fraudulent or incorrect records. The dispute button is right on the website.

Check your credit scores, which are not the same as the full report. FICO is the most commonly used score. You can sometimes find yours on your bank or credit card statements. You can also get one directly from Experian, Equifax and/or TransUnion although that might incur a fee.

Consider credit-boosting tools like Experian Boost

Another way to build up your score is to add your telecom, streaming and utility bills to your credit report through a product such as Experian Boost. Credit bureaus typically don’t include these bills. This allows you to “get credit” for your financially responsible behavior. You’ll need to provide access to your bank accounts in order to sign up. This product only affects your Experian score; it does NOT affect Equifax or TransUnion reports.

Consider using a secured credit card

Secured credit cards can be a safe way to start building your credit again. These cards can help rebuild your credit. Just note that they have lower credit limits than unsecured credit cards.

Note for Wanna-be Homebuyers

The ONLY scenario for which I'd recommend my clients use credit cards again is if they intend to purchase a home in the coming years and need to rebuild their credit in order to get financing. If you're going to use a credit card be extremely careful and diligent.

Only open one credit card and use the card for a recurring purchase each month that doesn't fluctuate. Don't use it to go out to restaurants or for entertainment. This can lead to overspending, sending you right back into a debt cycle.

Pay the balance off IN FULL before the end of the month. Not only does this eliminate extra interest but it's also an important way to stay connected to your spending. Carrying a balance from one month to the next creates money fog, which is exactly what the credit card companies are counting on.

Conclusion

Yep, it’s a long road. Your first step is acknowledging all the ways debt is hurting you. By taking a step-by-step approach to getting out of debt, you can safely take your hands away from your eyes and look at your numbers. Look at them through the eyes of your future self and knots will start to work themselves out. Following my plan will streamline your process for getting out of debt. Energized by clarified wants and needs, you’ll plow through the steps with greater focus. This clarity will help you avoid lots of mistakes and pitfalls that might have slowed you down. Good luck and I’ll see you on the other side!

If you have questions please don’t hesitate to contact me at [email protected] or schedule a complimentary money coaching consultation with me using the form below.

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.