The Complete Guide to Budgeting

Money is the top anxiety for nearly 3 out of 4 of Americans. We worry about earning it, saving it, spending it and investing it. That’s a lot of worrying!

The best way to reduce your money stress is the thing you least want to do: make a budget.

This article provides step-by-step instructions about how to set up a realistic, easy-to-follow budget. Once you’re ready to choose online budgeting software, check to see which of my top picks suits you best.

My Top 5 Budget Software Picks

Why People Hate Budgeting

The road to financial security involves budgeting but most Americans don’t want anything to do with that. Nearly half of Americans say they want to be financially prepared for the future but only 3 percent do anything about it.

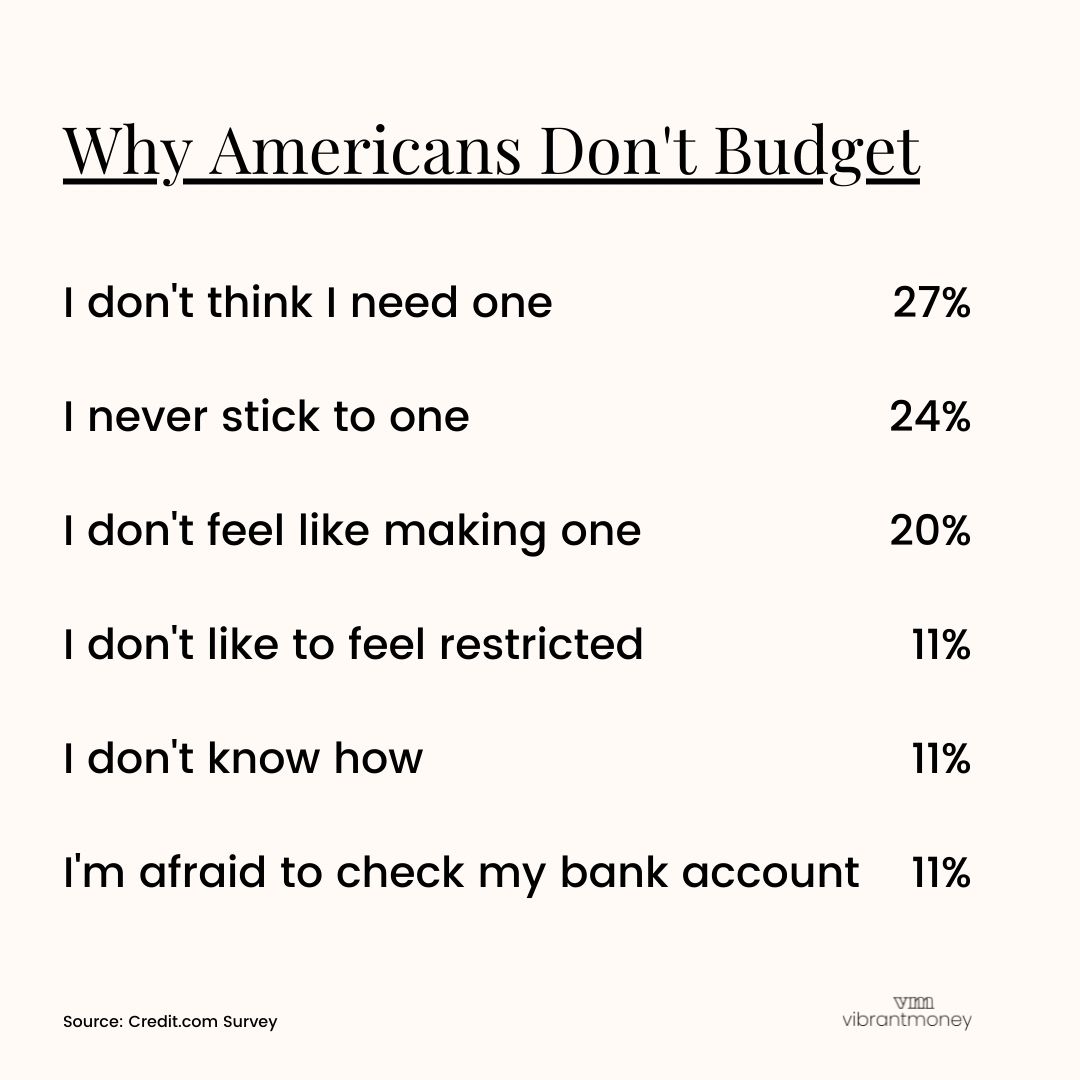

Check out the top 6 reasons Americans avoid budgeting.

Source: Credit.com survey.

Let’s take a closer look at each one:

#1 You don’t think you need one

A common myth is that if you just make enough money you’ll earn your way out of needing a budget. Regardless of your income, you’re going to need to know how much comes in and how much goes out. Your nerves need you to create a budget too! Once you’re in the budgeting groove, your anxiety, guilt and FOMO will begin to settle down.

#2 Why bother? You won’t stick to it anyway.

You may have given up on past attempts at budgeting. That’s completely understandable, especially if you’ve done so without guidance and the right tools. I’m going to show you how to overcome this mental resistance with tips on scheduling, methods and great tools.

#3 You don’t feel like doing it.

People think of budgeting as a burden or a hassle. But a simple plan and the right software can speed things up so you can manage your money efficiently and painlessly.

#4 It feels restrictive.

No. No. No. That’s what you hear when I say budget. But ironically, planning your spending can end up feeling liberating. Once you get to the point where you’ve planned for and saved enough to take care of your needs you can finally start to relax. Spending money without guilt feels amazing.

#5 You don't know how.

Most Americans didn’t grow up knowing anything about personal money management. Luckily, these days technology simplifies and speeds the learning curve. You can either enter your information yourself or in some cases your transactions can automatically show up in your budgeting tool. Even the most budget-averse people can find something that works for them.

#5 You’re afraid to look at your bank account.

Okay, there’s no getting around this one. It’s the hardest part. You dread it like you’re about to rip off a nasty band-aid. But you feel so much relief once you’ve done it. Hey, at least you know what you’re dealing with now!

I get it.

I’ve had all of these reactions myself. Nobody taught us how to budget. Just the word itself feels restrictive, scary, even pointless. So we avoid it, adding to the stress and the disarray.

I’m going to show you the awesome power of creating a spending plan. We’ll do it in a way that recognizes that there’s no such thing as a normal month. This takes courage and persistence, but the relief you’ll feel will be well worth the effort.

Even if you’ve tried and failed in the past, I’m here to teach you another way. After that, you might discover that living from a plan is more liberating than restrictive!

Enjoying this article? Get the Vibrant Money weekly email.

5 Reasons You Should Use a Budget

Budgeting is one of the highest forms of self-care. It shows respect for all the hard work you do to generate income.

As you build stronger connections between your money and your needs and values, you’ll experience emotional and practical benefits which will help keep you motivated to stick with the process.

#1 Eliminate Unconscious Consumption

Without a spending plan you end up spending money on stuff you don’t need or even care about. You’d be surprised by how much of your paycheck you’re siphoning off on meaningless expenditures.

#2 Stop Feeling Guilty When You Spend Money

You’ll feel less guilty right away. Once you realize that you can take care of your needs and still have an enjoyable life, that guilt will give way to empowerment and confidence. Impulse-buying can cause some of the worst hangovers around! A spending plan is like your wing man/woman tapping you on the shoulder when you’ve had one too many cocktails. Preventing the binge saves you from guilt spirals that undermine your progress.

#3 Get out of Debt!

Paying down debt feels great! Knocking off one debt after another is empowering! It opens new opportunities for you to finally build savings. Celebrate each time you pay off a credit card or loan! Claim the victory! Knowing that you’re acting responsibly feels amazing. You’ll be able to enjoy your purchases without added stress and guilt. Kiss the paycheck-to-paycheck drama goodbye!

A spending plan provides the needed structure to help you get out of debt. It trains you to end each month with money left over. When you put that extra money straight into debt repayment you’ll become debt-free even faster. After that it can all go into saving and investing.

#4 Build Savings!

A robust spending plan makes space for savings and investing. It shows care and respect for the future you.

#5 Accumulate Wealth and Achieve Your Money Dreams

Over time, you’re going to build wealth, buy a home, and build your retirement nest-egg. You’re also taking loving care of your future-self. She deserves it!

Budgets Suck, That's Why I Use a Spending Plan

The word “budget” is a four-letter word that triggers anxiety for many.

That's why I don't budget. I create a “spending plan” instead.

That's because when it comes to your money, you're in charge of it so you get to plan how it will be used!

Budgets feel restrictive because they are restrictive.

Let's say you set some unrealistic food budget at the beginning of the month. You inevitably overshoot your spending, and then feel guilty or foolish for even trying. This leads you to want to give up and just live your life without a budget.

Sound familiar?

It's time you created a spending plan instead!

View this post on Instagram

Budget's don't account for the #1 truth about life:

There’s no such thing as a normal month!

The reason budgeting sucks so much is because they don't adapt or change to your circumstances easily.

There are three reasons why your budget will change over the course of a month:

- You under-estimated the true expense of a category

- An unexpected expense came up

- You intentionally disregarded your plan

A spending plan accounts for these "adjustments."

In normal budgeting tools you simply override your old budget number.

Psychologically this feels like a loss because you "failed" to stick to a number. Judgment, restriction and perfectionism don’t help anyone. We all have ups and downs.

Practically, you lose insight into what you originally planned and what changed. That's why spending plans allow for a category to be adjusted (increased or decreased) so your entire month can balance-out.

The difference between a budget and a spending plan:

Switching from a restrictive budget to a flexible spending plan takes away some of the guilt you feel when you spend more than you’d planned to spend.

To keep things familiar, I will continue to use the word budget in this article but just know that I mean spending plan!

Setting Up Your Budget

Let’s lay the groundwork for (re-)building a solid, lasting relationship with your money. We will combine two budget principles to get your first budget started:

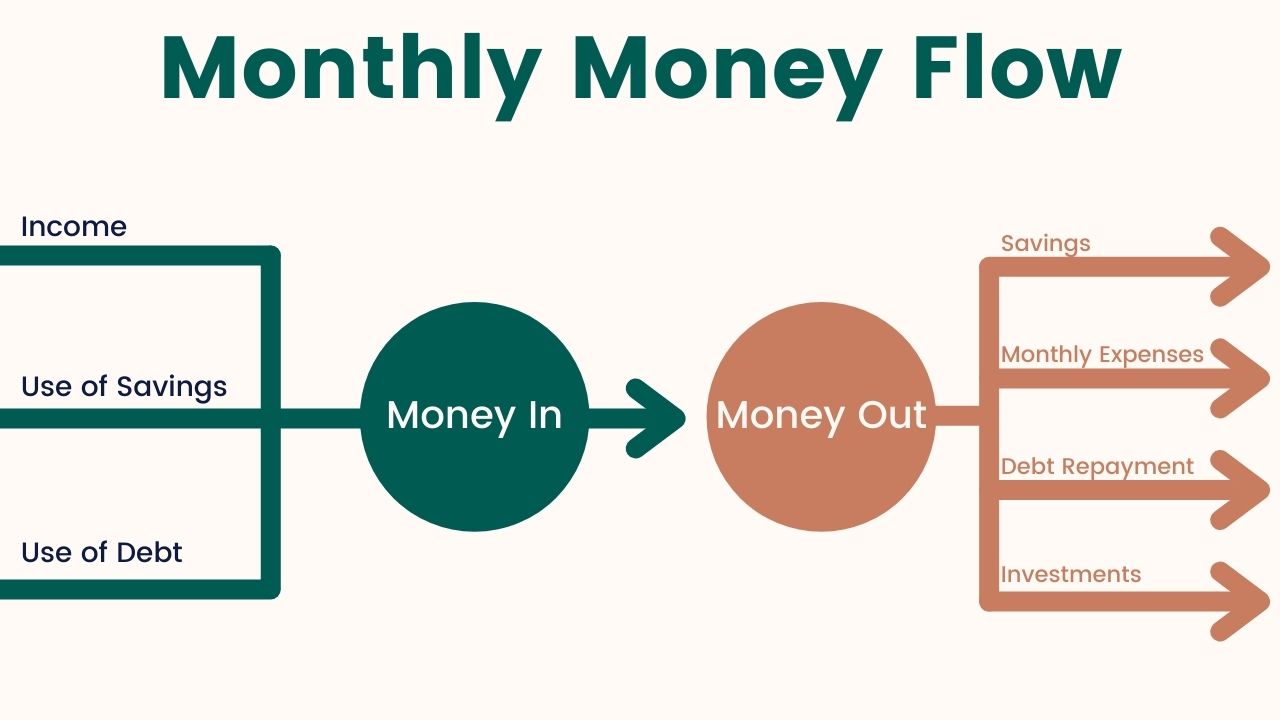

Principle #1: The Zero-Based Budget - a method for accounting for money-in and money-out

Principle #2: The 50/20/30 Budget - a ratio to allocate your money each month to needs, wants, and your future.

Principle #1: The Zero-Based Budget

Using a zero-based budget you will plan how much you’ll spend, save, re-pay, and invest every month. When you do this correctly, your budget should “zero out” every month - meaning there is $0 left over at the end of each month (don't worry though!).

Old school budget mindset

Most people think the goal of budgeting is to have extra money left over every month. The problem with this approach is that savings and debt repayment get deprioritized. Old school budgeting can be summed up with the mantra - Spend less than you make.

This equation for this type of budgeting is:

Income - Expenses = Remainder → Savings & Debt Repayment

Zero-based budget mindset

If I were to sum up zero-based budgeting with a mantra it would be:

Every dollar needs a job.

Here’s the simple equation for a zero-based budget:

Income - (Savings - Expenses - Debt Repayment) = $0.

So money-in, money-out looks like this:

When you haven’t assigned a job to money left over at the end of the month, that money can end up being spent on anything! You may not even notice what you’re spending it on. This disconnection from your money works against your ability to save, which is the key to achieving your big money goals.

“Do not save what is left after spending; instead spend what is left after saving.”

- Warren Buffett

Here’s an example of zero-based budgeting:

- You start the month with $1,000 in your bank account. Nice.

- You earn $5,000 take-home pay. Sweet.

- You put $500 into savings.

- You spend $4,000 in living expenses (rent, food, etc.).

- You put $500 towards debt.

- You will have $1,000 in your bank account when you start the next month.

Your budget "zeroed-out" back to it's original balance of $1,000.

If you have big bills on the 1st of the month like rent or mortgage, your budget may not actually be $0 but rather it will end with enough money to cover your expenses until your next paycheck. This is called cash-flow management and it’s one of the features in my recommended budgeting software.

Zero-based budgeting creates discipline and prioritizes saving. Deciding in advance how much goes into savings, debt repayment and retirement supports your long term goals. Without this plan, un-spent dollars usually get absorbed into other categories.

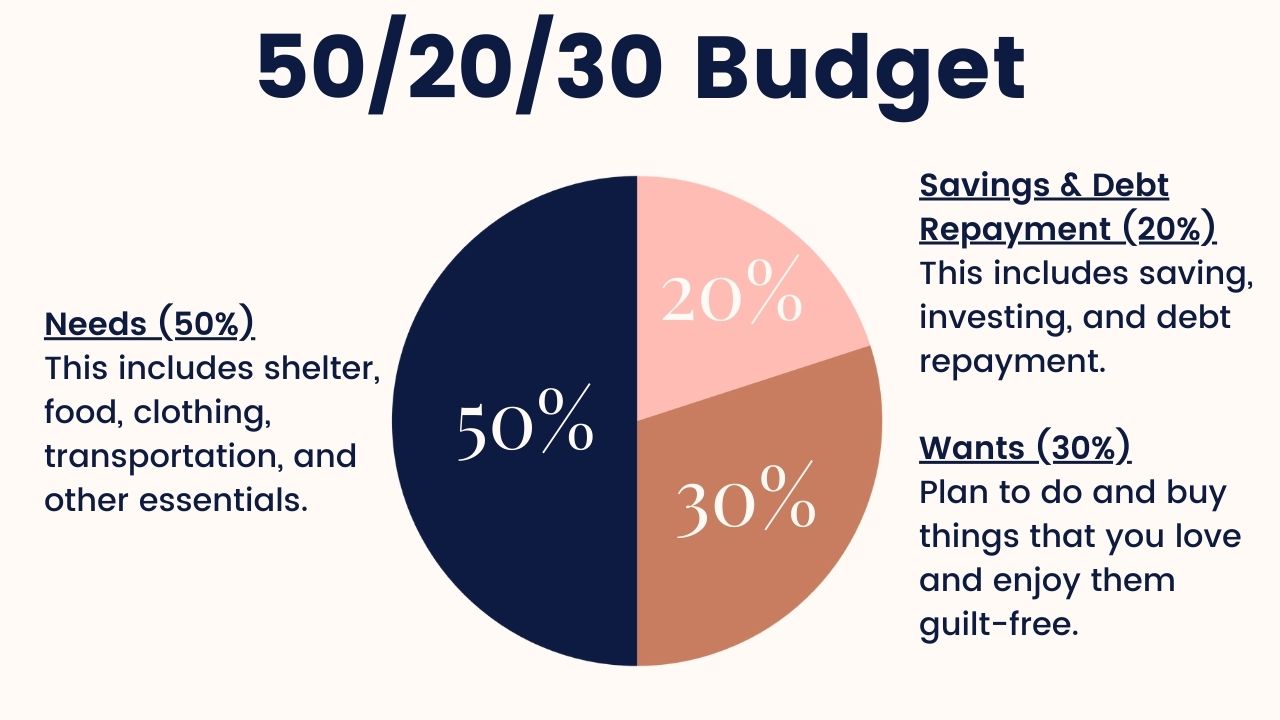

Principle #2: The 50-20-30 Budget

Most people get stuck when they first create a budget because they don’t know how much to allocate for their categories. That’s why I recommend starting with the simple 50/30/20 budget formula.

Later on you’ll create your budget based on your actual spending but for now we’ll start here.

The 50/30/20 formula is just a way to begin mapping out your spending in relation to your future needs and wants, including debt reduction and savings.

This formula splits your take-home pay into three big buckets:

- 50% on needs like rent, food and clothing

- 20% on savings and debt repayment

- the remaining 30% to be spent on whatever else you might want.

Let’s break down each one:

#1 - 50% on needs

This includes shelter, food, clothing, transportation, and other “musts.”

#2 - 20% of savings and debt repayment

This includes such items as personal or student loans and retirement contributions. In my Vibrant Money Financial Foundations program, I have my clients focus first on savings until they save the equivalent of one-month’s take-home pay. After that, they tackle debt repayment.

#3 - 30% on wants

This is the bucket that makes your life enjoyable! Plan to do and buy things that you love and enjoy them guilt-free. This could be anything from a summer vacation, Christmas presents, a new purse or even a latte.

This last 30% is really important. Give yourself something to look forward to! Deprivation doesn’t work.

The point here is to start with broad categories to get into the habit of living within a budget. All of the data you’ve gather over the next 3 to 6 months will give you a solid baseline from which to plan a more tailored budget later.

Budget Checklist

If you're ready to get started with budgeting, use this check list before you start using budget software or spreadsheet.

#1 - Calculate your 50% needs budget.

#2 - Calculate your 30% wants budget.

#3 - Calculate your 20% savings & debt repayment budget.

#4 - Identify your unique spending categories.

Click here for a list of common categories (pdf)!

#5 - Gather up all your bill statements including utilities, credit cards, student loans.

#6 - Select a budget software (below).

Get my free budget spreadsheet!

My Top 5 Budget Software Picks

Now that we’ve created a solid foundation of the “why” of creating a budget, let’s get a look at the “how.” I recommend using one of the budgeting apps below.

I’ve done extensive research on the top budgeting apps and these are my top picks.

- Mint

- Quicken

- Tiller

- You Need A Budget (YNAB)

- MoneyGrit.TM

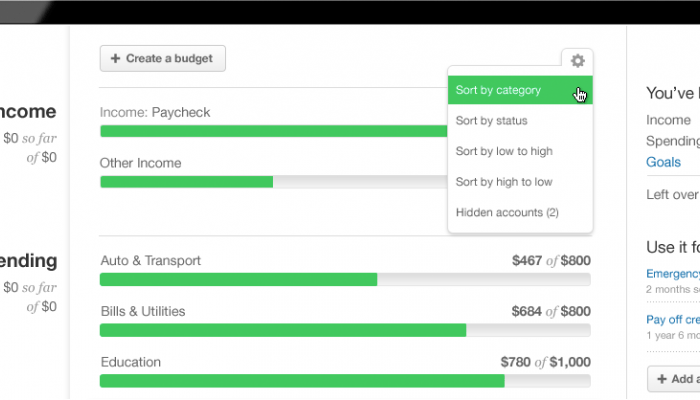

#1 Mint

Mint is a free web and mobile budgeting app focused on helping people track their monthly spending. It’s ideal for people who want to casually track their spending.

Benefits of Mint:

- It’s free

- It’s simple and easy to use and includes a mobile app

- It generates reports and charts that show trends

Disadvantages of Mint:

- Mint makes money by offering you credit cards and other loans. If you’re trying to focus on getting out of debt, this may be a temptation or distraction. Ads are annoying.

- It’s only focused on the current month and/or rear-view accounting. You can’t create projections beyond your current month.

- You can’t adjust your budget within the month (a crucial aspect of budgeting!)

Read more about Mint on its website.

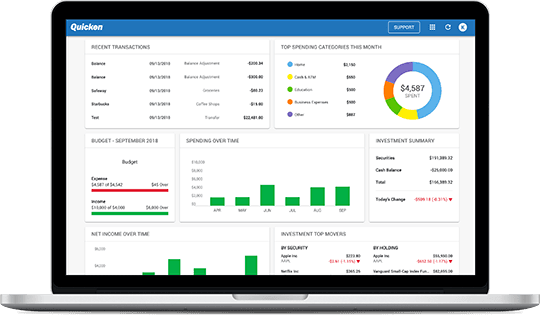

#2 Quicken

Quicken is primarily a desktop-based budgeting and personal finance tool designed for individuals and couples who want to manage all aspects of their finances from one tool. Quicken offers budgeting, retirement planning, debt management, and bill payment.

Benefits of Quicken:

- It offers a secure connection to your online bank accounts so you can pull in the latest transactions automatically

- It’s a comprehensive tool designed to help you keep track of everything including debt, investments, bills, and more.

- A recently launched web-based version of Quicken now syncs with the desktop version called Quicken on the web.

Disadvantages of Quicken:

- Some people have issues syncing data between the desktop and web accounts. Back-up files can also become corrupted or broken if you use multiple laptops/computers for the desktop version.

- The desktop version looks old and is unintuitive to most tech-savvy users.

- The budgeting tool requires a lot of configuration to work. For example, if you add a new category to your system, you need to manually add it to your budget for it to show up.

Read more about Quicken on its website.

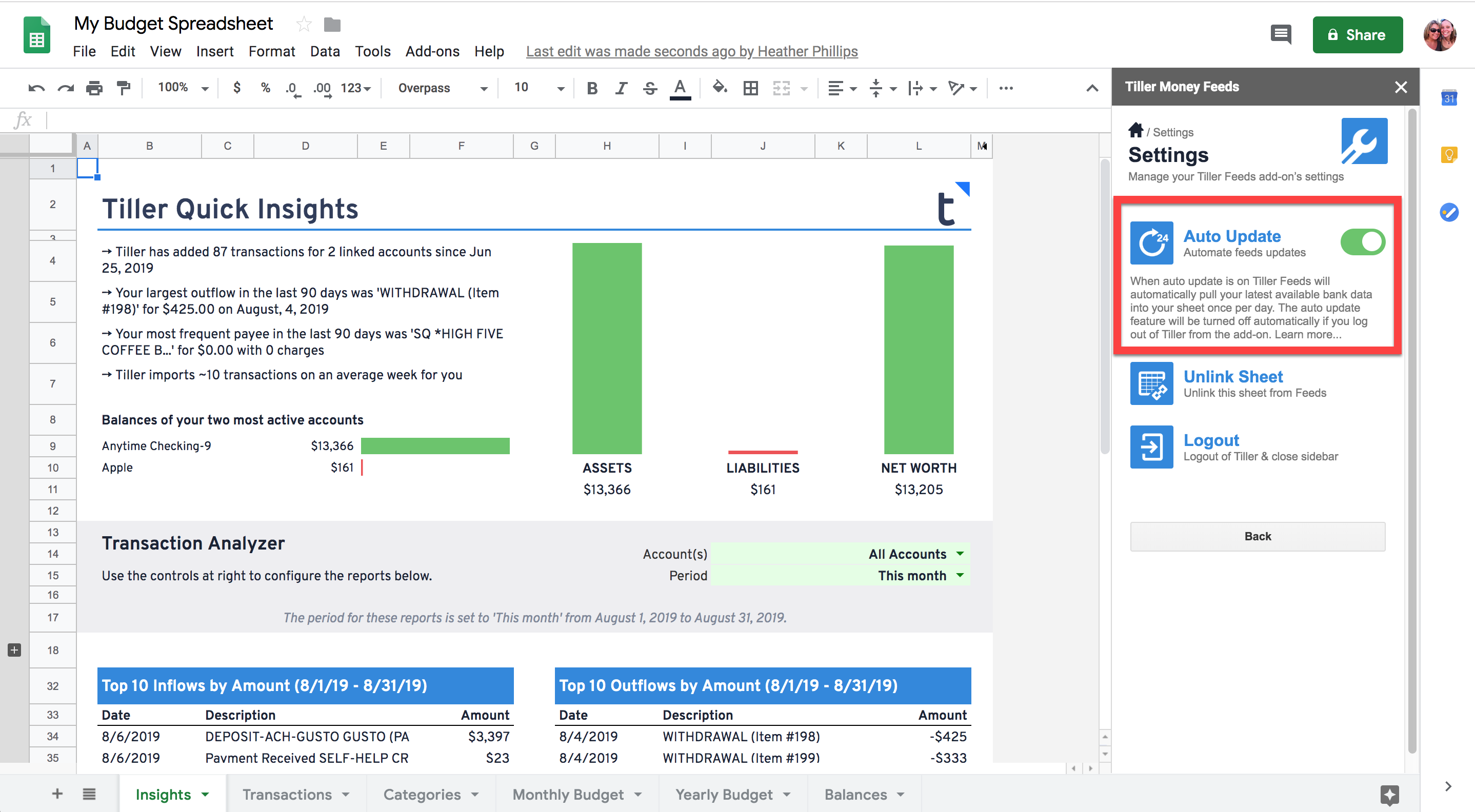

#3 TillerHQ

Tiller is a Google Spreadsheet budgeting tool designed for your inner money nerd. If you love spreadsheets you might like Tiller.

Benefits of Tiller:

- If you're a spreadsheet nerd, you'll love using Tiller!

- It's affordable yet includes a lot of great tools and dashboards

- It syncs directly with your bank accounts

Disadvantages of Tiller:

- If you’re not a spreadsheet person, you may not like it.

- It doesn’t include an annual budget tool.

- You can’t track your current assets (such as savings and debts.)

Read more about Tiller on its website.

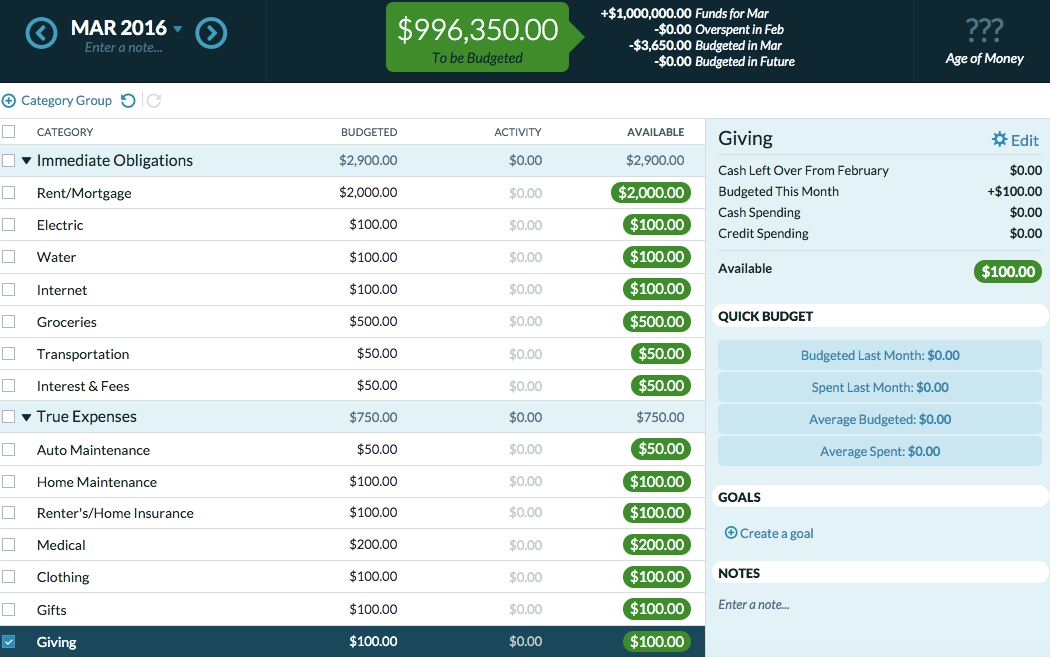

#4 You Need a Budget! (YNAB)

YNAB is a web and mobile app based budgeting tool designed for digital native individuals and couples. It’s easy to use and built upon their “Four Rules."

Benefits of YNAB:

- It has the look and feel of other modern digital tools like Gmail and Apple Calendar

- It provides a lot of education about its methodology in a step-by-step process

- It embraces some advanced budgeting concepts like unexpected expenses and adjustments

Disadvantages of YNAB:

- It’s tailor-built for its own methodology so you have to go “all-in” and learn its approach to budgeting. One of its tenets is that you should always keep 30 days’ worth of spending in your checking account.

- It doesn’t include annual budgeting or any planning tools that let you see the “big picture” for the year.

- It doesn’t include an adjustments (just over-rides) column, which can prevent you from learning about your behavior

Read more about You Need A Budget on its website.

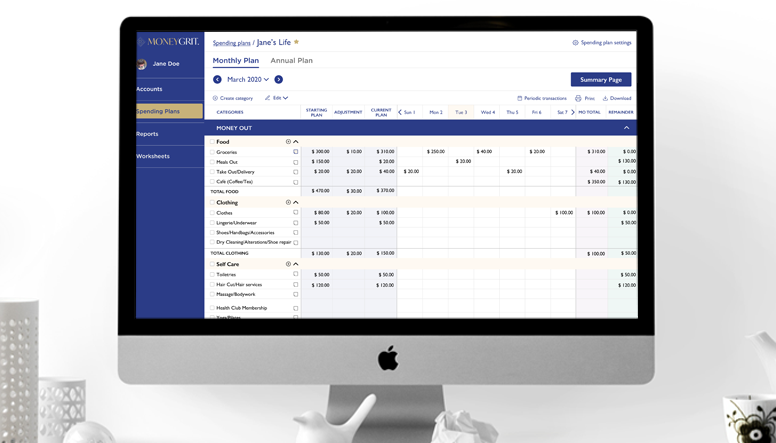

#5 MoneyGrit.TM

MoneyGrit. is a web-based budgeting tool that’s ideal for individuals and couples who want to deeply understand where their money’s going. This tool helps you create powerful plans that include debt repayment and savings.

Benefits of MoneyGrit.TM:

- It is built around the principle of spending plans vs. budgets

- It has both monthly and annual budgets that incorporate non-monthly income and expenses to get a complete picture of your money.

- Its design is intuitive and easy to pick up

Disadvantages of MoneyGrit.TM:

- It doesn’t have a mobile app although it does work ok using tablets like iPads. MoneyGrit. plans to launch a mobile app in the future.

- It doesn’t offer direct linking to banks. MoneyGrit. plans to launch direct bank linking in the future.

- It’s includes some unique concepts like periodic expenses, annual spending plans, and balance adjustments that often require a money coach or financial counselor to teach you about.

Read more about MoneyGrit.TM on its website.

Not ready for budgeting software? Try my spreadsheet instead.

Fill out the form below to get a free copy of my budget spreadsheet.

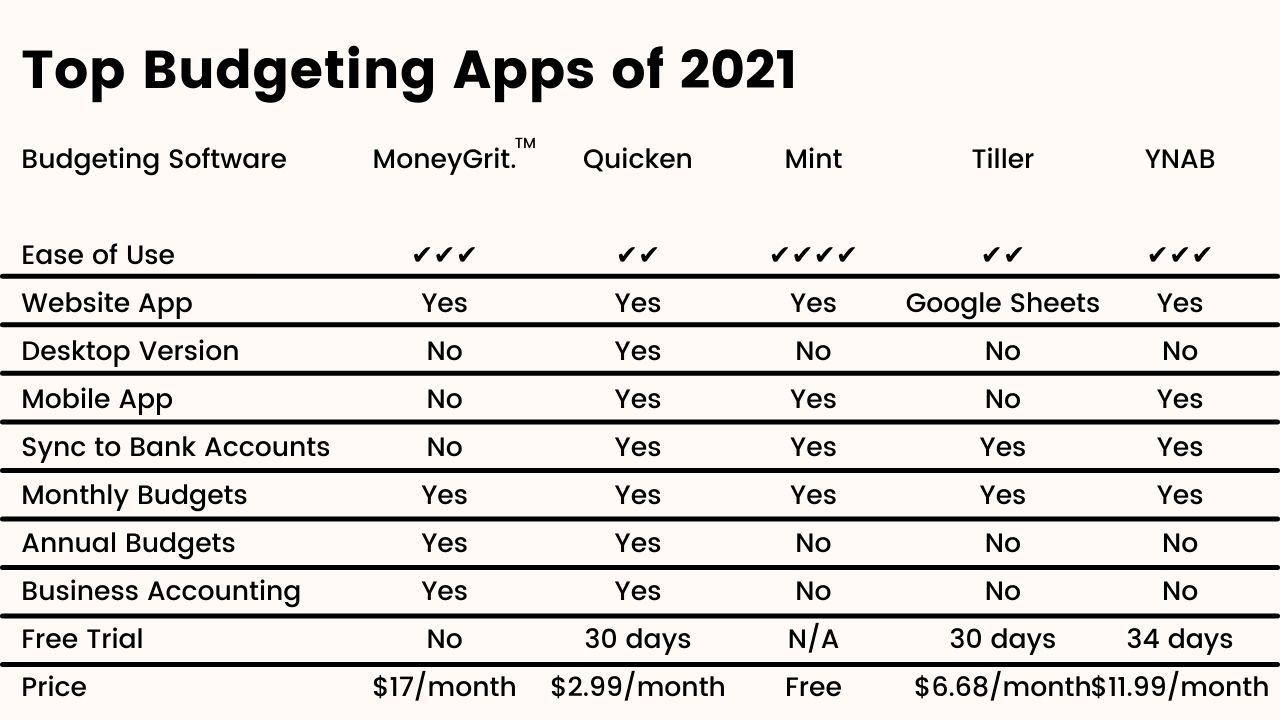

Top Budgeting Apps of 2021

Below is a side-by-side comparison of the top budgeting apps of 2021.

Creating Your Budget in MoneyGrit.TM

Of all the tools above, I recommend MoneyGrit. most often.

MoneyGrit. embraces the key budget principles we've covered so far:

- Every dollar needs a job - MoneyGrit. uses zero-based budgeting including prioritizing saving

- Budgets get busted, plans get adjusted - MoneyGrit. embraces spending plans (rather than budgets) which allows you to adapt within any given month to make your numbers work.

- There's no such thing as a normal month - MoneyGrit. also incorporates the concept of non-monthly expenses (called periodic expenses) that happen throughout the year. These are often budget busters that ruin your plans and make you want to quit. Instead of ignoring them, MoneyGrit embraces them.

Since it's cloud-based, you can easily log in from any web browser.

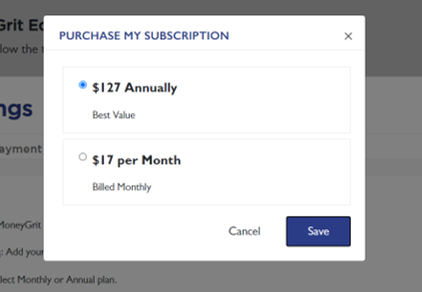

MoneyGrit. costs $17/month or $127 per year (38% discount). You can purchase a plan once you sign-up as a user.

Getting Started in MoneyGrit.

MoneyGrit. has you jump right in by setting up your first monthly plan.

Create your Spending Plan

A spending plan is the primary tool you'll use in MoneyGrit.

The first step is to name your plan. This helps you zero in on your goals and values every time you use this software. For example, you could name it “Jane’s Healthiest Year” spending plan.

- Click "New Spending Plan"

- Name your plan

- Select your currency

- Select "Yes" for the Main Spending Plan option.

- Click Add Spending Plan

Set up your Checking Account

- Click Accounts on the left hand side

- Click "Add New Account"

- Enter the name of your account

- Select the type of account (checking)

- Select the currency

- Enter the opening balance - this is the amount of money in your account today.

- Enter today's date

- Select "Yes" for Connect to Spending Plan

- Select the spending plan you just created

Create your Categories

Set up your spending categories such as rent, utilities and tuition. MoneyGrit. comes with a default set of categories to get you started.

Click here for a list of common budget categories.

You can easily change these and/or add sub-categories later.

Create your First Budget

Enter in your 50/20/30 numbers from your checklist in the "Plan" column.

Don't worry about adjustments for now.

- Enter in your income

- Enter any planned use of savings (transferring money from savings to checking)

- Enter any planned use of debt (making purchases using a credit card)

- Enter estimated amounts for each category including home, food, etc.

- Enter your minimum debt repayments

- Enter any savings contributions you will make this month

- Click "Will this plan work?" to to check if your plan "zero's out."

How to Stick to Your Budget

Now comes the hard part. Sticking to your budget.

Below are three areas to work on:

- Set-up a weekly money meeting

- Watch out for budget busters

- Consider hiring a money coach

Set-up a Weekly Money Meeting (aka "money date")

The crucial habit of budgeting is to sit down and look at your money every week.

Your budget is a living, breathing representation of your priorities in life. Weekly money meetings help you stay on track with your priorities.

“Don't tell me what you value, show me your budget, and I'll tell you what you value.”

--President Joe Biden

Use this checklist to run your money meeting efficiently:

#1 - Track Your Spending - On every money date you’ll track your spending. You do this by importing or syncing your transactions and classifying each one in the categories you’ve set up. After that, you’ll easily update your budget based on the latest imported transactions.

Click here to download our Weekly Budget Checklist for free (no email required!)

#2 - Adjust Your Budget - Evaluate if you're on track for the month. If you're not, adjust your plan so it "zero's out" at the end of the month. Remember, every dollar needs a job! Double check for any non-monthly expenses that are happening this month.

#3 - Pay or review bills - Pay any outstanding bills for the month or schedule upcoming payments including utilities, cell phone, etc.

#4 - Make or review savings transfers - If it's in your plan, move money from your checking account to your savings accounts. Verify previous savings transfers have gone through.

#5 - Make or review debt payments - Pay your monthly credit card or other debt repayments. Verify previous debt payments have gone through.

#6 - At the beginning & end of every month - On the first week of the month review your prior month's spending. Make adjustments to your new month based on lessons from the previous month. On the last week of the month, create your budget for next month.

Watch Out for Budget Busters!

You can be skipping along with all of these steps when, suddenly you fall into a hole. It happens to everyone. So many things can come along and zap your checking account before you’ve even noticed. Now that you’re more connected with your money, you can be on the lookout for budget busters like these:

- Non-monthly expenses

- Emotional triggers

- Food

- Online shopping

- Over-automation

#1 Non-monthly Expenses

One of the main reasons people end up adjusting their spending plans is somewhat preventable. Everyone has certain non-monthly expenses that they can plan for. Not every bill is monthly; some are quarterly or annual. But you know they’re coming. These are the expenses that feel like “emergencies” but with a little planning and honesty you can anticipate these expenses and include them in your plan.

Common examples include:

- Summer camp tuition

- Christmas gifts

- Car registration

- Vet visits

- Auto insurance

- Quarterly or annual taxes

- Membership dues

- Subscription renewals

Unexpected income is also a thing. So decide ahead of time where you’d spend any unexpected income, bonuses or tax refunds. Otherwise it’ll just get absorbed, a lost opportunity for you to have made progress on your goals.

In fact, I created a spreadsheet to help you brainstorm all of these non-monthly expenses.

#2 Emotional Triggers

Life events, good and bad, can trigger overspending. Whether it’s a birthday, a graduation or a divorce, your emotions can play out in your bank account. If your purchases just make you feel worse you probably weren’t addressing an underlying need. This leads to a cycle of overspending.

This is so common my husband and I discussed how to break emotional spending habits on a recent webinar:

Sometimes you get so angry, upset or sad that you strike back by retaliating against your newly planned budget. You may spend your whole month’s food budget at a fancy restaurant or say “F it, I’m going to Nordstrom!” This is all totally normal. But begin to notice the emotional triggers that cause such impulsive spending. Then dig deeper to explore what underlying need those emotions are pointing to.

Raise your point of awareness. Even as you understand the underlying triggers you may still choose to spend that extra money and make adjustments later. The difference is that you’ve done so consciously without denying the emotional trigger.

Over time, you’ll be able to spot these emotions earlier and earlier, thereby allowing yourself to address those deeper needs proactively in your plan. Add these values-based needs to your budget such as quality time with friends, dates with your partner, or self-care like massages or manicures to ensure you're managing your emotional well being so you don't want to retaliate against your own future by blowing up your budget.

#3 Food

Food’s a biggie.

According to SlickDeals, four of the top 10 budget busters are food related

Top 10 Budget Busters:

- Online shopping 40%

- Grocery shopping 39%

- Subscription services 37%

- Technology products 36%

- Buying lunch everyday 35%

- Household essentials 32%

- Coffee 32%

- Food delivery 32%

- Gym memberships 30%

- Entertainment (movies, concerts, etc.) 29%

Food is a need but it’s also often a want. You can see a direct correlation between your food and your emotions (e.g. stress eating in my case.)

Tracking your spending can be a real eye opener to these emotional connections.

Social activities like going out with friends and family get-togethers directly affect your food spending. We all had a chance to get in tune with those ups and downs during the pandemic.

In my case, all the money I saved by not going out to eat ended up being spent on take-out. Here and there I reached a sweet spot with solid stretches of home cooking.

At this point, I accept that takeout and dining out are legitimate subcategories of my food budget and I plan accordingly.

Here are some tips to help you avoid chaotic spending that can blow your food budget:

- Add sub-categories to your food budget to pinpoint your spending. For example, you could add sub-categories such as "date night" or rename your trips for froyo as "treats for the kiddos."

- Order delivery as a reward once or twice per week. Once you’re really a pro at this, you can even try for "no take-out weeks" where you cook at home for 7 days in a row!

- Before you go grocery shopping make a detailed list and stick to it.

- Go shopping on a full stomach.

- Keep a list of favorite meals to reduce decision fatigue.

- Plan for the week ahead and make batch meals.

- Go to less expensive grocery stores.

- Go food shopping less frequently. For example, try shopping for two weeks at a time instead of one.

#4 A Chaotic Schedule

Our lives are so crammed with stuff we have to do that self-care gets shunted off to the side. We become more reactive than proactive. Food is a great example of a category that’s directly affected by how time-crunched we are. Put your weekly money meetings on your calendar and make them a priority. If something pops up one week, just don’t let it go to two weeks. Bounce right back. These simple check-ins are a form of self-care. They help you stay on track with your goals and decrease your daily money anxiety. Make that money meeting a priority every week.

#5 Online Shopping

It offers the best of times and the worst of times: the black hole of online spending. Mass retailers like Amazon, Target and Walmart are masters of manipulation. They figure out what’s irresistible to you based on your online behavior. With that intelligence, they micro-target you with such sophistication that you’ve clicked “buy” before you’ve even realize what's in your shopping cart.

They’ve made it so easy to purchase and return unwanted products that you can easily drain hundreds of dollars out of your account every month. I recommend that my clients track all their Amazon purchases in one budget category called “Amazon” or whatever company you buy from. Review this in your weekly check-ins. As you become more aware of the total amount spent on Amazon or other retailers each week or month, you can create sub-categories in your spending plan for each type of purchase.

I also recommend tracking individual transactions, rather than orders. Tracking transactions lets you see what the purchase was and which debit or credit card it will be charged on.

My husband wrote a great article explaining How To Escape the Amazon Black Hole.

If you review this activity weekly you can better assess whether these purchases are meeting your highest needs or wants.

#6 Over-Automation

I’m not opposed to automation. I’m opposed to over-automation. When we automate all of our finances we weaken our connection to our money which leads to losing agency. Over-automation can also hide overspending. For these reasons I recommend that you turn off automations at least while you’re getting started. I’m talking about automated savings, retirement contributions and debt repayment too. Once you have the hang of what you’re doing and you know your numbers you may want to resume any and all of those automations. But just remember that’s not a substitution for connecting to your money. That’s on you! There’s no set it and forget it. That myth is the very reason people have so many problems with their money in the first place!

This is a major lifestyle shift in how you relate to yourself and your money. You’ll quickly get more confident and competent. Things will get easier so you can finally move on to bigger gains. Every month that passes deepens your relationship with your money.

Hire a Money Coach

If all of this seems a bit overwhelming, help is available. Sometimes what you need most is emotional support. A money coach works with you side by side to set up your spending plan. You build a relationship with your coach who in turn helps you improve your relationship with your money. A money coach will encourage you and hold you accountable without judgment. You set the terms of how frequently you meet and what you’ll focus on. The coach’s goal is to get you to the point where you don’t need a money coach.

Click here to learn more about the money coaching services I offer.

You can do this.

Don’t let money anxiety freeze you in place. That’s only going to stress you out more. We all know budgeting can suck. But if you follow the advice in this guide you have a good chance of hating it less and loving life more.

Once you see that budgeting helps you get what you want, it’ll be easier and more rewarding to stick with it. All of your courage, hard work and self-reflection will pay off for a lifetime.

These days you have lots of excellent online software to choose from. Tools like MoneyGrit. can make it a breeze to track your progress weekly and monthly. No matter what budgeting method or app you chose, watch out for those budget busters!

If you need some encouragement and personal guidance, consider hiring a money coach.

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.