The Ultimate Guide to Saving Money

Are you one 69% of Americans who have less than $1,000 dollars in savings? If so, this article's for you. I’m going to show you how to transform a haphazard mess into a logical, organized savings system. Even lifelong savers can boost their results using this system.

TLDR:

- Saving money is essential but challenging for most people.

- Counter to popular belief, savings are meant to be spent (at the right time on the right things).

- Money you invest is meant to grow and build wealth.

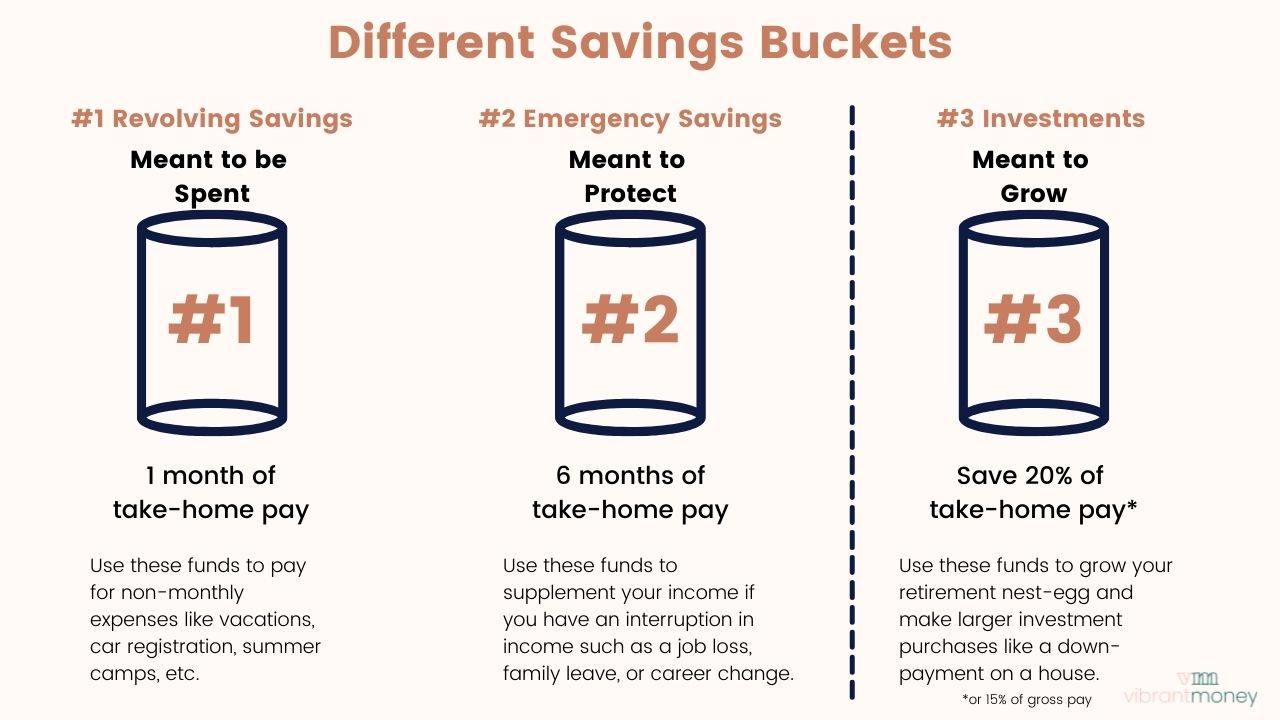

- There are three buckets of savings & investments:

- Revolving Savings - 1 month of take-home pay used to cover non-monthly expenses

- Emergency Savings - 6 months of take-home pay used to cover interruptions in income

- Investments - 20% of your take-home pay towards investments and retirement.

In this article:

Current State of Saving in America

Savings is a mere afterthought in an economy that’s 70% driven by consumer spending. We’re buying new iPhones, laptops and streaming services when 35% of us who don't have the cash to cover an unexpected expense of just $400.

That’s not to say we’re unaware of the need for savings. In fact, half of U.S. consumers believe they should have $10,000 or more in emergency savings. Yet in reality the average American family only has a combined $5,000 in their savings and checking accounts according to the Federal Reserve Bank 2019 Survey of Consumer Finances.

Even this $5,000 is a misleading statistic. It doesn’t account for the huge disparities in savings based on race and income.

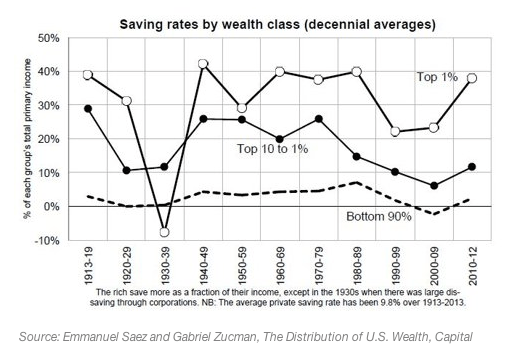

Not all Americans are saving equally.

Generally, if you’re not in the top 10% of earners, you’re not saving much at all. The chart below illustrates how income levels correlate to savings rates. Over the course of 100 years, those in the bottom 90% of earners save between -2% and 5% of their income. Compare this to higher earners who save between 8% and 42% of their earnings.

The disparity in cash on hand also cuts across racial lines. A 2019 Federal Reserve Board survey reveals a significant disparity in savings between whites and Blacks, Hispanics and other races.

2019 Federal Reserve Board Survey of Consumer Finances: Average Savings Balance by Race

- White: $51,400

- Other: $33,900

- Hispanic: $16,700

- Black: $8,600

How did we get here?

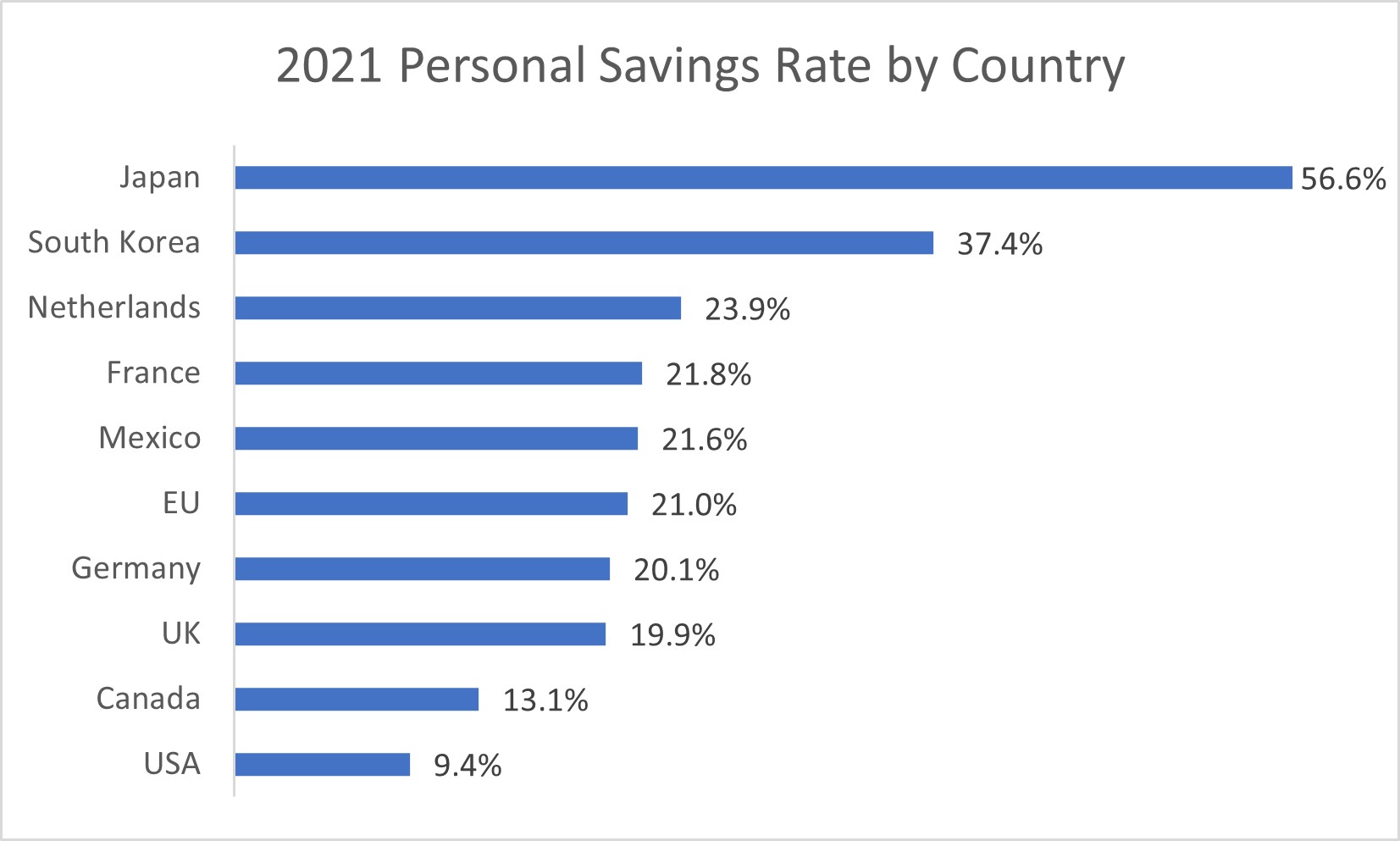

The U.S. is the richest country in the world, yet our personal savings rate lags way behind other countries that have a stronger tradition of saving and more generous social safety nets.

Source: tradingeconomics.com

There are several explanations offered for why Americans save less than other countries:

- Other countries have a culture of saving for the future and for larger upcoming purchases. U.S. society is built more around consumption.

- Other countries that top the list (Japan, South Korea, Netherlands and France) have more generous social programs which cover expenses Americans normally cover out of pocket (e.g. child care and healthcare expenses.)

- Other countries have a negative stigma surrounding the use of debt and borrowing. Meanwhile, U.S. household debt has maxed out at nearly $17 trillion in 2021.

- Income inequality in other countries is lower than in the U.S., leading to more equal distribution of wealth and therefore resources to save and invest.

- Some economists argue that even our language affects our relationship with the future (and therefore the need to save) like in this TED talk.

Our disconnect between spending and saving comes at a steep cost over a lifetime.

Consumer culture has us behaving as if it’s our patriotic duty to spend until we’re drowning in debt. This is exactly what the credit card companies want us to believe. That “cha-ching” they hear is the sound of us having nothing to show for our hard-earned money at the end of the month.

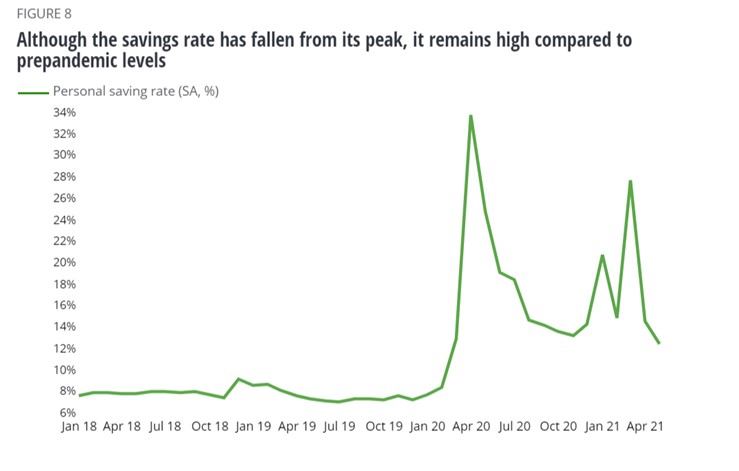

Americans Did Save More During the Pandemic

However, the pandemic did change the savings rate for the better in 2020. The U.S. personal savings rates from June 2015 through June 2021 have stayed pretty consistently below 10% up until the spikes that started in 2020.

Here are four reasons Americans saved more money in 2020 and why the habit’s not likely to last:

- Many of us held back on spending in 2020 because we didn’t know how bad or how long the recession would be.

- It was only natural for us to save more money when we were stuck at home.

- It was easier to save when we were no longer spending money in restaurants and on vacation.

- Many Americans also received stimulus checks and larger unemployment checks.

Glowing news stories about increased savings imply that the pandemic is correcting this imbalance between spending and saving. It’s true that the U.S. personal savings rate has spiked from an average of 7.25% from the end of the Great Recession (2008) through February 2020 to an average of 17.9% since the start of the pandemic.

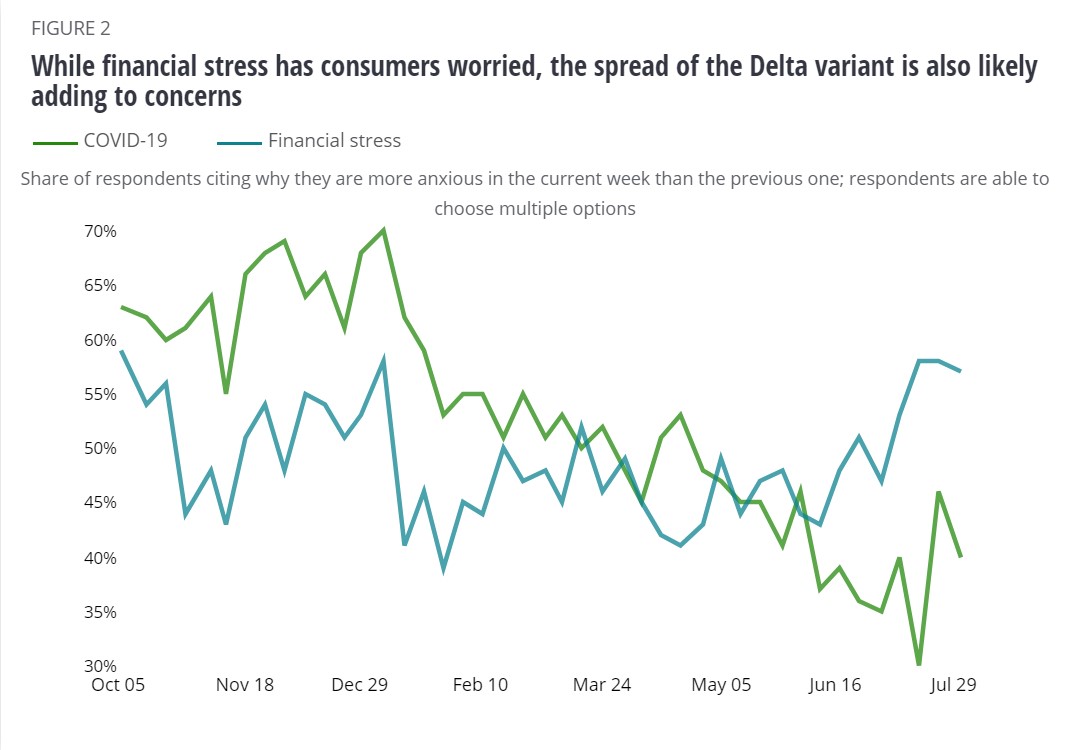

Source: Deloitte State of U.S. Consumer Report (August 2021)

But don’t break out your party hats yet. These figures can be very misleading. They ignore the huge income gulf between wealthy and lower-income Americans. The personal savings rate varies wildly depending on income. Lower-income Americans need most (or all) of their income to cover essential expenses and/or debt repayment. They don't have that extra layer to peel off for savings.

As the economy gets going again, the money people put aside from stimulus checks and reduced expenses will come roaring back into action. In fact, consumer spending jumped $330 billion in early 2021 when governments and businesses began to reopen. I expect savings accounts will begin to empty out as consumers will want to lift their pandemic fatigue.

Financial Stress is on the Rise

Starting in May 2020, consumers cited financial worries as a greater stressor than COVID-19 itself, according to a recent Deloitte survey.

The pandemic has been a wake-up call for many Americans. Many of us have faced major financial hardships that could have been lessened or avoided if we’d had a robust emergency fund. Instead, we had assumed our paychecks would keep coming like always. We’d used credit cards freely, assuming we’d always be able to pay on them every month. Now we know better.

We can’t ignore how much credit card debt and oppressive student loans cripple our ability to build savings. The average American undergrad leaves school with $28,950 in student loans. Piling up so much debt in your 20s and 30s makes it much harder to buy a home, fund your retirement or build your emergency fund.

Why You Struggle to Save Money

These challenges, on top of whatever money stories we’ve grown up with, can make savings seem almost impossible. Whether we like it or not, our parents’ attitudes and behaviors have shaped our thoughts and beliefs about saving money.

Our “saving stories” color our perceptions.

We get our first peek into the world of money in childhood. We may not have handled any transactions but we sure did hear our parents talk or fight about money. Or maybe money was never discussed and therefore seemed taboo or inappropriate. These experiences form the “money stories'' we take with us into adulthood.

We can expect to confront those patterns and beliefs when we rethink our relationship with money. Savings is just one of many aspects of our money story. Spending, earning, borrowing, giving and investing all affect how we interpret saving. That’s why I teach a holistic approach to money at Vibrant Money.

For example, many of us grew up hearing phrases like this:

- Savings is for losers.

- That’s why we have credit cards!

- Make other people's money work for you (AKA borrow with abandon!)

- I suck at saving.

- Crummy interest rates aren’t worth the trouble.

- I’ll end up spending it anyway.

These messages are baked into our money DNA. They lead to emotional blocks and unhealthy behaviors. When we follow our parents’ money moves, we sometimes end up overspending or digging ourselves into debt with loans and credit cards. We allow carpe diem mentality to rule our behavior without considering consequences.

To be fair, it’s only natural to follow your families' footsteps if you haven’t learned any differently. You may not trust yourself to manage your money if you’ve never had it. You may see savings as a back-up checking account, available for impulse spending.

Not saving money can even become a form of self-harm. For example, people in codependent relationships often give excessively in return for some kind of emotional response. This over-generosity ends up hurting all involved. Common examples include letting friends/relatives repeatedly borrow money, use your credit cards or live rent-free beyond their “expiration date.”

We’re also bombarded with messages that investing is more important than saving. Financial advisors will insist that investing is the holy grail of financial stability. They downplay the importance of everyday savings in favor of the high risk, high reward of stock market investing.

When we buy into this myth, we’re missing the much larger picture of what savings is for. To make matters worse, we feel like a failure when we tap into savings to pay for legitimate expenses.

The secret about savings is, it’s actually meant to be spent. You just have to structure it properly.

Now is the time to reset your relationship with savings.

Why Savings are Critical to Your Financial Health

Saving money can completely shift your experience of life. You’ll feel more powerful and in control. As your anxiety lifts you’ll be able to experience more and more of the present moment.

5 Benefits of Saving Money

#1 Gives you peace of mind.

A healthy savings practice relieves that grinding paycheck-to-paycheck stress. It allows you to respond better to life’s curve-balls. Knowing you’d be able to cover an unexpected dental emergency or buy a new radiator forestalls unnecessary worry.

I teach my clients to create annual budgets which build in funds for these kinds of expenses. Most of them are shocked to discover they’re actually spending the equivalent of an extra month or two’s worth of income every year.

The trick is to park this money aside in a revolving savings account so it’s ready when you need it.

How: Save 1 month of take-home pay in a revolving savings account.

#2 Speeds your way out of debt.

The connection between savings and debt is so important I’ll devote a whole section to it below. The short answer is you'll be able to ditch the debt once you've developed a solid savings practice. That’s because debt and savings are inextricably linked. When you put a little bit of money aside for non-monthly expenses, you won't go deeper into debt. Conversely, when you stop using credit cards you’ll save all that money that would have been siphoned off by interest charges.

How: Save 1 month of take-home pay in a revolving savings account.

#3 Allows you to build a rainy day fund.

Savings gives you freedom to adapt to life’s changes, planned and unplanned. You won't have to panic or feel trapped in case of an unforeseen health problem or layoff. The savings puts you in control, ready to roll with life’s changes.

How: Save 6 months of take-home pay in an emergency savings account.

#4 Expands your options.

A solid savings foundation gives you the freedom to take risks in your life and career. You can consider starting a small business, starting a family, taking a sabbatical, or taking a lower-paying job in an industry you’re passionate about.

How: Save 6 months of take-home pay in an emergency savings account.

#5 Protects your retirement savings.

Saving for your retirement is about today’s you taking care of the future you. Accounts devoted to retirement savings can grow significantly thanks to compounding interest. When you follow the savings structure I outline below, you won’t have to rob your retirement account in times of need. You deserve that security.

How: Invest 20% of your take-home pay

The Proper Savings Structure

Chances are good that nobody’s taught you about the proper savings structure. You’re not bad at saving, you’ve just never learned how to save for different purposes.*

Your savings should target three distinct areas of need. Organizing your savings this way prepares you for life’s curve-balls. These layers of savings will flow into three buckets: one to be spent now, one to protect you in the near-term and one to fund your retirement.

- Revolving Savings. This is savings that is meant to be spent! Examples include non-monthly expenses such as a car repair or annual vacations.

- Emergency Savings. This is savings that is meant to protect! You can tap into this supplemental income if your income is interrupted by family leave or a layoff.

- Investments. This is money that is meant to grow! You’ll build these funds to pay for retirement, purchase a home or fund college expenses.

One of the reasons people struggle with savings is that they lump all savings together. But different needs call for different accounts as outlined in the chart above. I’ll briefly outline the three types of accounts you’ll need.

Revolving Savings and Emergency Savings protect you in everyday life. That’s why they need to remain liquid. In contrast, Investments protect your future self. They’re less liquid because their purpose is growth.

Let’s break down each one in more detail.

Revolving Savings

You use revolving savings to keep you from borrowing money and to smooth out expensive months. Getting to the point where you can use savings instead of debt is a major milestone and the beginning of great things to come.

- Purpose: To be spent on non-monthly expenses that would normally bust your budget or get put on the credit card.

- Benefits: Stops you from borrowing money to supplement your lifestyle. Reduces money stress and anxiety. Smooths out months that have a lot of “surprise” expenses.

- Amount: 1 month of take-home pay to cover 12 months of non-monthly expenses. WARNING! You should calculate your exact resolving savings amount in this process. Use this spreadsheet to estimate all your non-monthly expenses.

- Account Type: Savings account with the bank where you have your checking account.

This is money you keep on hand to spend on non-monthly expenses. One month of take-home pay is usually enough but some people may need to save more in this step depending on their circumstances.

Remember! These funds are meant to be spent on non-monthly expenses so don’t get hung up on interest rates!

Examples of using Revolving Savings:

- Annual car registration

- Summer camp tuition

- Christmas gifts

- Vet visits

- Auto insurance

- Quarterly or annual taxes

- Membership dues

In fact, you can use my Budget Buster spreadsheet to brainstorm all of the “gotcha” expenses that come up throughout the year that would normally go on the credit card (or be avoided all together.)

Once you’ve saved up the appropriate amount, you’ll be able to cover unexpected or non-monthly expenses without using credit cards, which is a major victory!

Emergency Savings

Your next level of savings is your emergency savings. As with the first layer, you don’t need to worry about interest rates in this bucket. It’s money that’s available to spend if you experience an interruption in income.

- Purpose: To be spent if your income is interrupted (by your choice or not!)

- Benefits: Creates a deep sense of security in life. Can be used if you lose your job, start a family, or if you want to switch to a lower-paying job or career.

- Amount: 6 months’ worth of take-home pay.

- Account Type: High-yield savings account with a secondary bank (not your primary banking)

It’ll protect you from emergencies without putting you in debt or forcing you to raid your retirement accounts.

Emergency savings gives you flexibility to react to life’s ups and downs. It empowers you to make proactive decisions such as taking an extended maternity leave or changing careers. You may even want to start a small business or pursue a passion that yields a lower income.

If you lose your job you can use this money to supplement your income and stabilize your household.

Examples of using Emergency Savings:

- Loss of a job

- Extended medical leave from work

- Paternity or maternity leave

- Paying monthly expenses when you take the “big leap” toward a new career or small business

"But, I won’t be earning any interest!"

Interest isn’t the only goal of savings. In fact, revolving and emergency savings don’t need to earn interest. They're meant to cover irregular or unexpected expenses. Reserve your focus on interest rates for investment accounts.

Investments

Investments protect your future from your current self. You’re putting money away now so you can live comfortably in the future. These accounts most definitely need to earn interest since they’re funding your future. By definition they’re not liquid. You take more risk with this money because you need it to grow over time.

- Purpose: Earns interest and builds wealth.

- Benefits: Secures a comfortable lifestyle in retirement. Helps you put a down-payment on a house.

- Amount: 20% of your take-home pay or 15% of your gross (before-tax) pay.

- Account Type: Retirement accounts such as a 401(k), IRA, or ROTH IRA.

Consider your retirement and investment savings as “untouchable.” Do everything you can to protect these funds. Raiding these accounts would constitute a major loss. You’ll lose the money you’d have earned and you won’t have it when you need it.

Depending on your situation, you may make investments directly from your monthly paycheck or you’ll need to set up your own investment accounts.

The goal is to contribute 20% of your take-home pay towards investments. You can also use 15% of your gross pay as a benchmark.

Here are two examples where you may use 20% or 15%.

Let’s use Sally Salary as an example:

Scenario 1: Sally Salary makes $100,000 per year at her job. Her employer doesn’t offer a retirement account.

Strategy: Invest 20% of take-home pay.

- Sally receives roughly $5,600 per month in take-home pay (after paying state and federal income taxes from each paycheck.)

- Sally opens an IRA and a ROTH IRA (two types of retirement account) with a certified financial professional.

- Sally contributes $500 per month to these accounts to hit the $6,000 per year maximum.

- Sally also opens a retail brokerage account to start saving for a house.

- She puts $620 into this account and invests in mutual funds.

Total invested per year: $13,440 (20% of take-home pay)

Scenario 2: Sally Salary makes $100,000 per year at her job. Her employer offers a 401(k) with a 3% match.

Strategy: Invest 15% of gross salary

- Sally sign-ups for her employer's 401(k) account to get the 3% match.

- She contributes $250 per month directly from her paycheck.

- Her employer matches with $250 per month as well.

- Sally also opens a ROTH IRA to maximize her taxes during retirement and hit the $6,000 maximum.

- She puts an extra $250 per month into her ROTH IRA and invests in mutual funds.

- She also opens a retail brokerage account to start saving for a house.

- She puts $750 per month into this account and invests in mutual funds.

Total invested per year: $15,000 (15% of gross income) plus $3,000 matched by her employer = $18,000 per year!

In my Vibrant Money process, I recommend that you start devoting 20% of your take-home pay into investment accounts once you’ve filled your first two savings buckets.

How to Set up Your Savings Accounts

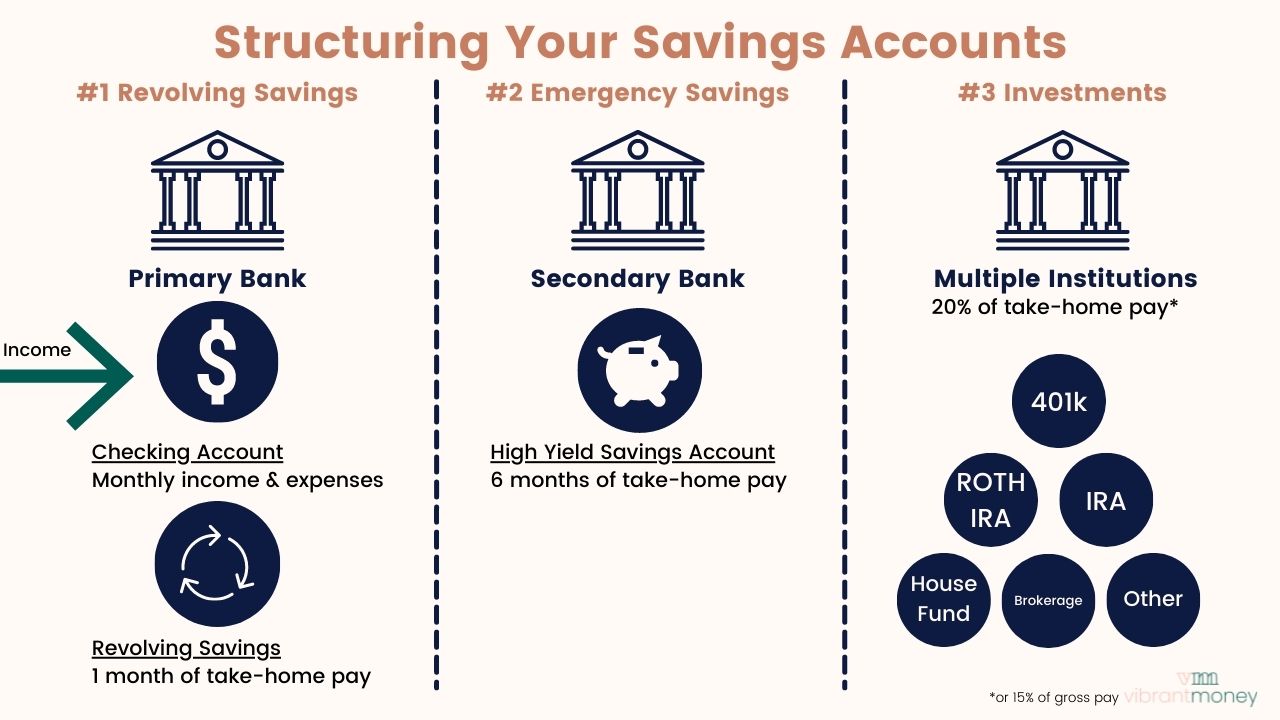

Each bucket of savings (revolving, emergency, and investments) require different account structures and levels of access:

#1 Revolving Savings

Open a savings account with your primary bank. You can do this online, over the phone, or in-person at your local retail bank.

Link this to your checking account to allow transfers. On some months you’ll deposit into savings and other months you’ll withdraw from it.

Remember! This is money that is meant to be spent!

#2 Emergency Savings

If you’re just getting started, open a high-yield savings account at an online bank other than where you keep your checking account so you’re not tempted to spend it. Safeguard these funds to protect your income.

These accounts may earn slightly greater interest, but that doesn’t matter since this money is meant to be spent in the case of an emergency of loss of income.

What about Certificates of Deposit "CD's?" I don’t recommend CD’s (Certificates of Deposit) because they lock up your money in return for a relatively low interest rate.

#3 Investments

Open a retirement account with your employer, financial advisor, or on your own. Establish a bank transfer link between your checking and retirement accounts.

Make monthly contributions either pre-tax (taken out of your paycheck automatically) or after-tax (you’d transfer these to your retirement account.)

These accounts are designed to purchase investment assets like stocks, bonds, mutual funds, ETFs and other types of investments. This money is meant to grow and ideally is not touched for many years.

If your employer offers a retirement plan, take advantage of it. If not, you can open an account on your own or through a financial advisor.

To learn more about how to plan for your retirement, read our Guide to Retirement Planning.

6 Ways to Build Your Savings

The only way you can build savings is by allocating your “money-in” to your savings account. Oftentimes, your monthly expenses soak up all of your available funds. So it’s hard to start saving immediately. Don’t be discouraged. You don’t need to fund all three of your savings buckets at once. In fact, funding them in stages increases your financial stability and freedom.

Here are six steps to start contributing to your savings accounts:

#1 Track Your Spending & Intentionally Reduce Expenses

Cut the fluff. Track your spending. Use cash or debit cards instead of credit cards. You’ll feel more connected to your money when it leaves your account as soon as you click “buy.”

#2 Live from a budget

Use zero-based budgeting to set up your spending plan. This system helps you track not just spending, but also debt repayment and savings contributions. To learn more about zero-based budgeting and how to get started, see my Complete Guide to Budgeting.

#3 Budget for saving

Include savings as one of your budgeting categories. Build the habit of saving a minimum amount every month. Save more on good months to balance out leaner months.

#4 Eliminate your debt so you debt snowball can go towards saving

Pay down your debt with the proven debt snowball method. Each time you pay off a debt, put the amount you were paying on it toward savings. To learn more about how to do this, see my No B/S Guide to Getting Out of Debt.

#5 Automatically earmark windfalls for savings

Decide ahead of time what you’ll do with any income windfalls like commission checks or tax refunds. Automatically put it toward debt repayment and/or savings. Temptation can get the best of anyone who hasn't consciously committed to financial health. When you get a cash gift, stimulus check or tax refund, use it to pay down debt or deposit anything you don’t need directly into savings. When this is automatic you won’t have time to talk yourself out of it.

#6 Increase Your Income

You can increase your income in lots of ways without switching jobs. Some options include selling stuff on eBay or Etsy, driving for Lyft or freelancing your professional skills. If you have a job, consider negotiating for a raise, even if you’re not getting a promotion. You can also look for a new job or start a new career. Finally, you can start a small business or go solo. To learn more, read my article on 7 Ways to Increase Your Income.

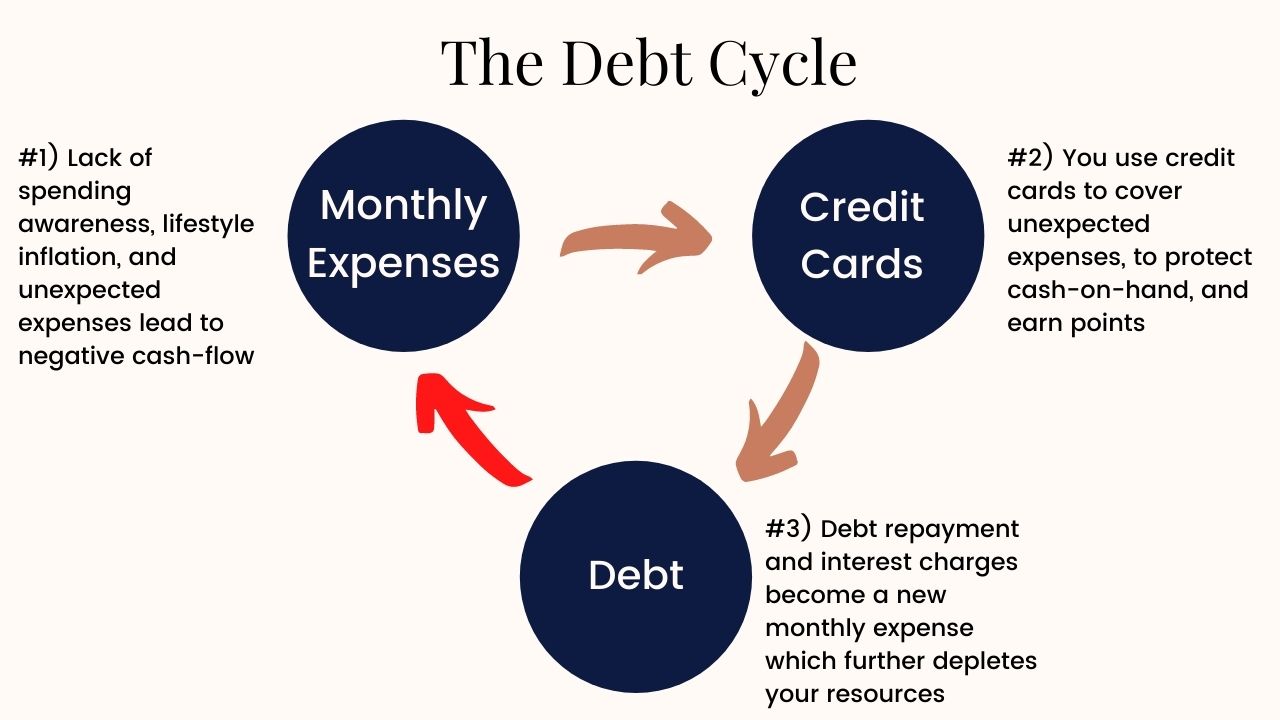

The Debt and Savings Connection

You can’t truly save without paying off debt and you can’t pay off debt without savings! Debt and savings are inextricably linked.

Most people try to focus on one or the other. In fact, the first bucket of savings (revolving savings) is actually a stepping stone to eliminating your debt. That’s why I teach clients to alternate between debt and savings milestones in my 5 step Financial Foundations process:

- Step 1: Stop borrowing.

- Step 2: Save one month’s worth of take-home pay (revolving savings.)

- Step 3: Pay off your debt using a debt snowball.

- Step 4: Save 6 months’ worth of take-home .

- Step 5: Invest 20% of your take-home pay.

Connection 1: Savings help get you out of debt.

Once you’ve stopped borrowing money (Step 1), set up a revolving savings account and build it to cover the equivalent of one month’s take-home pay (Step 2).

This savings account will be used instead of credit cards to cover non-monthly expenses instead of going further into debt. Without this savings account, unexpected expenses would go on your credit card! Or, you’d use cash to cover the “emergencies” and then put your groceries, restaurant expenses, and entertainment on credit. Once you have this savings bucket in place, you can confidently move on to paying off your debt using a debt snowball (Step 3).

Connection 2: Debt will prevent you from building wealth.

Once you’re debt free, you can really turn the savings on by funding your emergency savings (Step 4) and building investments (Step 5).

Your debt is an anchor weighing down your future savings. This dead weight makes Step 4 and 5 virtually impossible. That’s why it’s so important to achieve debt freedom before you start trying to save tens of thousands of dollars per year.

You Can Do This

Our lives can improve in so many ways when we get better at saving money. The first step is to honestly explore our unconscious attitudes and behaviors around money. This is a great time to redefine what money and savings mean to you.

Building savings may be a long game, but you can get started now! If you build each bucket of savings in order, you’ll surely achieve financial stability and peace of mind.

The three buckets are:

- Revolving Savings - 1 month of take-home pay

- Emergency Savings - 6 months of take-home pay

- Investments - 20% of take-home pay

My 3-pronged savings structure promotes discipline and builds protection against life’s financial ebbs and flows. Following this structure makes it easy to know what accounts we set up, how to budget and how to spend and save. Having our savings organized like this prepares us for today’s everyday expenses, tomorrow’s planned and unplanned changes and finally, our retirement years.

If you have any questions, please don't hesitate to contact me or schedule a money coaching consultation.

*Contains concepts taught by Karen McCall / Financial Recovery Institute.

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.