How to Get Started with Retirement Planning

At some point, you’ll want or need to stop working. You'll also want to live in peace and comfort which means you have to save enough money to be able to do so.

Whether you’re just getting started in your career, or if you’re closer to retirement than you’d care to admit, this guide will teach you the basics of retirement planning and how to get started.

Planning and saving for your retirement is about consistently saving money (that you don’t touch until retirement) so you can afford to live comfortably after you stop working.

Legal Disclaimer: Vibrant Money is an education company. Professional retirement planning is not our field. The information contained below is for informational and entertainment purposes only. If you have questions please seek the advice of a certified financial professional.

The Top Four Retirement Planning Questions:

- How Much Money Do I Need to Retire?

- How Much Money Do I Need to Save Each Month for Retirement?

- What Types of Retirement Accounts Can I Open?

- How Do I Catch Up if I'm Behind?

I’ve also included a glossary of important definitions and terms in this article.

I promise you’ll be proud of yourself for investing a few minutes in considering your plans for retirement.

Retirement Assumptions

In the interest of simplicity, we’ll make these assumptions:

- You’ll retire at age 65

- You’ll put money aside each month for retirement in both pre-tax and post-tax retirement accounts like 401(k), IRA, and ROTH IRA plans

- You’ll invest in low-fee index and mutual funds instead of taking a riskier, more active approach.

- You have a W-2 job that pays into Social Security, giving you the option of receiving social security and Medicare benefits during retirement.

- You didn’t contribute to a pension fund during your career.

- You’ll have enough money saved that you won’t need to work during retirement.

How Much Money Do You Need to Retire?

I know the feeling of getting extremely drowsy when you hear people talk about IRAs, tax-deferred accounts, inflation, and average rate of return.

If you want to wake people up, ask them how much they’ll need to retire. I’m not talking about lottery winners or trust fund babies. Just regular people like us.

Of course you know the evergreen answer: “it depends.” Which is true.

But if you want to make any headway in being able to answer that question you’ll need a little education and data collection.

I’ll answer this question from a broad perspective down to a granular level. Stick with me and you’ll be able to calculate your own “rough estimate.”

You can use a bunch of different methods to figure out how much you’ll need to retire.

The most common are:

- Save $1 to $2 Million Dollars

- Use a Retirement Calculator

- Save 12x Your Pre-Retirement Salary

- The 4 Percent Rule

Regardless of which one you use (and you can use them all!) I encourage everyone to use the use a retirement calculator.

Method 1: $1 to $2 Million

Okay this isn’t really a method. But I’m including it here because this is likely something you’ve heard a lot. Since there’s no one-size-fits-all formula, I don’t recommend this one. In fact, it’s almost insulting how simplistic a take this is on retirement planning. Everyone’s situation and needs are wildly different.

Nevertheless, many websites will tell you that you’ll be able to retire comfortably if you save a million bucks. Some even say two million! For example, most of Charles Schwab’s 401(k) investors in 2021 estimated they’d need $1.9 million for retirement.

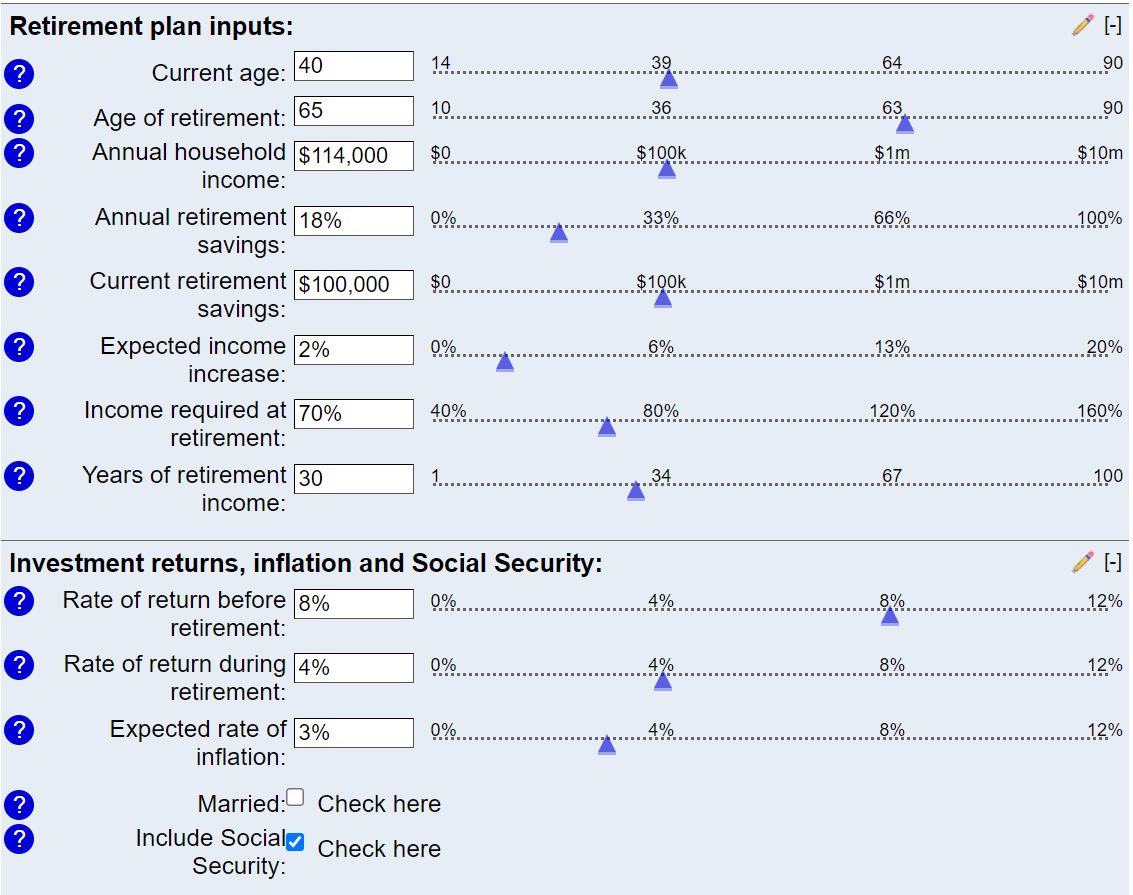

Method 2: Use a Retirement Calculator

Everyone should use a calculator to estimate your retirement goal. It’ll force you to take your specific circumstances into account. Even if you’re using any or all of the other methods, put all of your information into a calculator. This is a powerful tool that can improve the accuracy of your estimates.

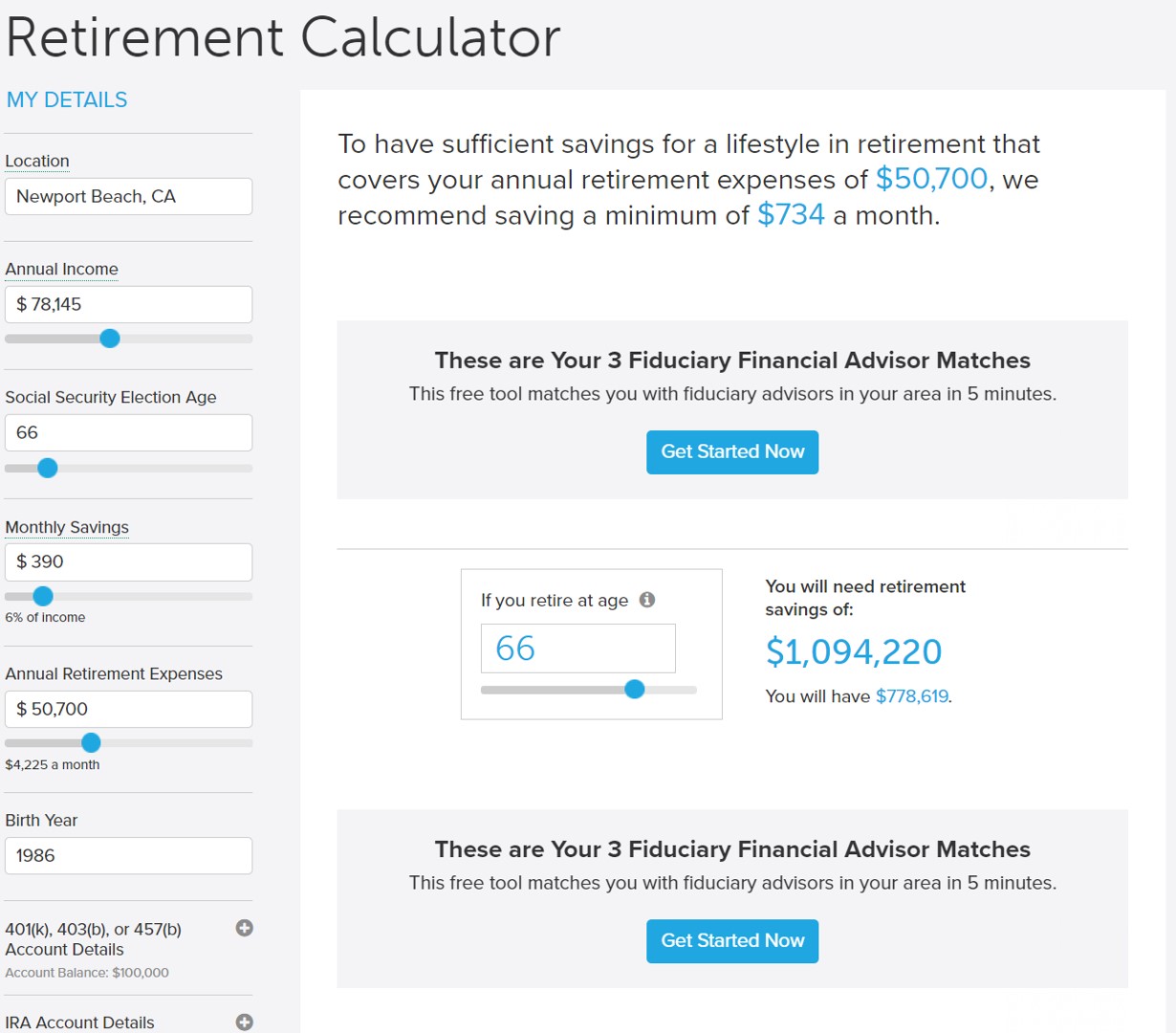

Try This Retirement Calculator

BankRate has a great calculator on its website. I like this calculator because it’s simple but powerful with the types of assumptions you can change, add, or remove.

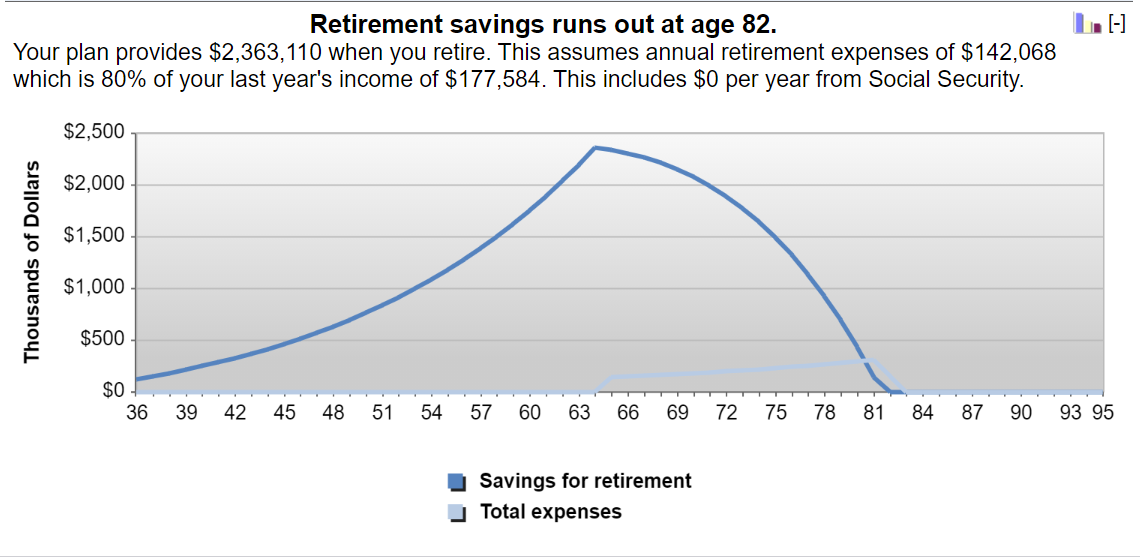

Below is the output of the BankRate calculator:

Free Retirement Calculators:

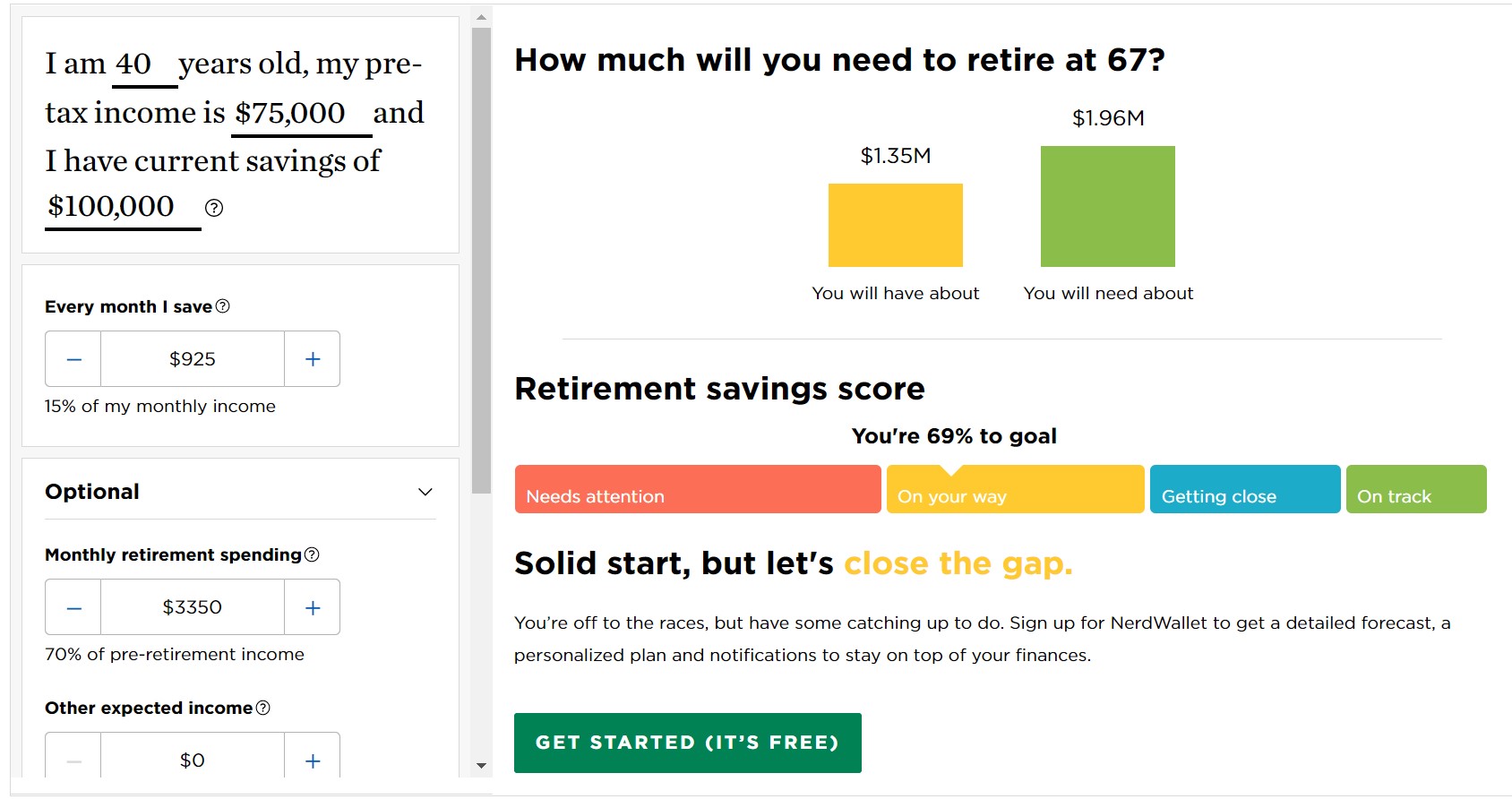

- NerdWallet has a good Red, Yellow, Green system.

- SmartAsset asks you one question at a time and then tells you clearly how much you should be saving each month.

How a Retirement Calculator Works

Begin with the basic facts:

- How old are you now?

- How much have you saved for retirement?

- What’s your annual income?

Now, add future-based information based on your best estimates.

Some of these variables are more in your control and some less so.

Variables You Can Control (at least somewhat:)

- Age at Retirement - The standard answer of 65 is very arbitrary. The truth is, these answers run the gamut. Lots of people choose to work beyond 65 while others want to stop working in their 40s. Play around with your numbers to see how different retirement ages affect your savings goals.

- Monthly Contribution - How much will you put aside each year toward retirement? At Vibrant Money we recommend our clients contribute 20 percent of their net take-home pay to their retirement. For example, if you make $50,000 per year you probably take home $40,000 after taxes. So 20 percent of $40,000 is $8,000 per year (or $666 per month.)

- Income Growth - How much will your income increase year-over-year, on average? This can be tricky. Most employers give 1 to 3 percent raises each year. However, recessions and bad labor markets can slow wage growth. On the other hand, advancing in your career can lead to big increases. I always recommend airing on the conservative side of 2 to 4 percent.

- Monthly Expenses during Retirement - This is expressed as a percentage of your pre-retirement salary. The lower this number, the more modest your lifestyle will be. The higher this number, the closer you can live to your pre-retirement lifestyle.

Variables over which you have less control:

- Length of Retirement - How many years will you need to withdraw money from your retirement accounts? Or put morbidly, when do you expect to die?

- Annual Rate of Return (before retirement) - How much will your money grow while you are still working?

- Annual Rate of Return (during retirement) - How much will your money continue to grow after you retire? This percentage is often lower than your “pre-retirement rate of return” because when you retire you move your money into more stable, less risky, lower-return investments.

- Inflation rate - Inflation has historically increased at 2.9 percent on average. Many economists predict that inflation will increase faster than it has in the past.

- Social Security - Many retirees today rely heavily on social security payments. You can include these payments in your retirement income, reducing how much you need to save by that amount. However, many economists and politicians believe that social security (at least in its current form) won’t be around in 15 to 30 years because it will run out of money. For that reason, I recommend calculating your retirement goal under both scenarios. But when it comes to creating your actual retirement plan, I’d say to be safe, don’t include the social security payment.

Method 3: 12x Your Pre-Retirement Salary

The next method provides a more realistic, tailored estimate of what you’ll need. Instead of pulling numbers out of the air, you’re basing your estimate on your actual salary.

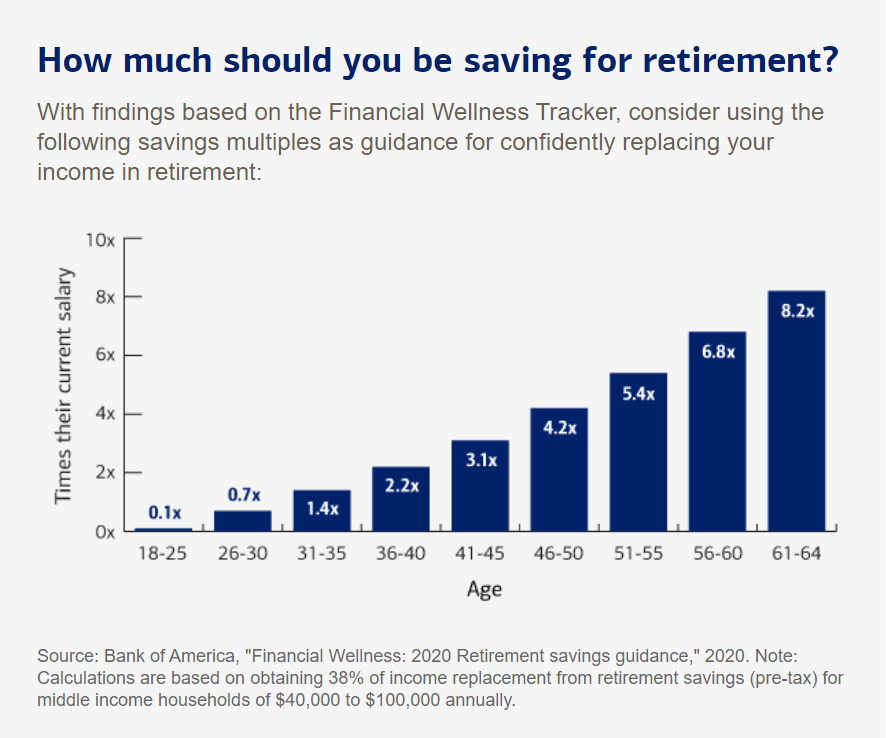

Using Method 3, you’ll save 12 times your pre-retirement salary. This is the annual income you earn in your last working year before retirement. For example, if you plan to retire at 65, you’d base it on your expected salary at age 64. To help simplify this estimate, I’ve included a list created by Merrill Lynch of “salary multiples” broken down by age.

Retirement Balances by Pre-Retirement Salary:

- If you make $150,000 at age 64 you would need to have saved $1,800,000 dollars

- If you make $100,000 at age 64 you would need to have saved $1,200,000 dollars

- If you make $50,000 at age 64 you would need to have saved $600,000 dollars

Recommended Retirement Balances by Age:

Based on the 12x pre-retirement salary principle, you can set certain benchmarks based on your current age.

- 18 - 25 years old... you should have 0.1x your current salary saved...

- 26 - 30 years old - 0.7x your current salary

- 31 - 35 years old - 1.4x your current salary

- 36 - 40 years old - 2.2x your current salary

- 41 - 45 years old - 3.1x your current salary

- 46 - 50 years old - 4.2x your current salary

- 51- 55 years old - 5.4x your current salary

- 56 - 60 years old - 6.8x your current salary

- 61 - 64 years old - 8.2x your current salary

Here are a few graphs showing the combined information from above - retirement balances by age depending on income.

Savings Balance by Age if You Make $150,000 Dollars per Year

Savings Balance by Age if You Make $100,000 Dollars per Year

Savings Balance by Age if You Make $50,000 Dollars per Year

Note that these charts assume your income does not change over your career which is unrealistic. However, this can give you a general snapshot of how much you need to have saved depending on how old you are and how much you make per year.

Method 4: Use the 4 Percent Rule

The 4 percent rule is a method of estimating your retirement goals based on your estimated expenses instead of your pre-retirement income.

The goal of this method is to save enough money that you can cover your annual expenses if you withdraw 4% or less each year from your retirement accounts. The 4% method asserts that if you withdraw 4 percent of your retirement funds every year, it should theoretically never eat into your retirement “nest-egg.” That’s because when you retire, your money will continue to grow. If you assume your money will continue to grow at 6 percent to 10 percent per year (this is an acceptable range of return for various types of investments,) you’ll always be able to withdraw at least 4 percent and never reduce your principal.

This method relies heavily on the “average rate of return” at which your investments grow each year. How you define a realistic rate of return is up to you. Some would argue it’s 10 percent but I prefer to stay more conservative estimate between 6% and 7%.

For example, if you withdrew 4 percent from a $1 million retirement account, you’d be able to spend $40k on expenses. As long as your investments are growing more than 4 percent per year, your balance will never dip below $1 million.

Some financial advisors say you should estimate your annual expenses in retirement to be about 80 percent of your pre-retirement salary. Ideally, when you retire you own your house outright and have no mortgage payment to inflate your expenses. However, you’ll still have increasing healthcare expenses.

If you earned a salary of $100,000 at age 64, you’d estimate needing to make $80,000 per year to cover living expenses. So using the 4 percent rule, you’d need to have saved $2 million by age 64.

The downside of the 4% rule is that it sets a very high bar for your retirement nest-egg because it assumes you will never dip below your original balance starting at retirement. In reality, many retirees draw down their retirement balances closer to $0 as they age. Preservation of your retirement principle is often important to those wishing to leave a legacy or inheritance to their children, but it is not as critical to those focused on simply supporting themselves. Keep this in mind as you're calculating your nest egg goal.

Savings Needed to Provide 60% to 80% of Pre-retirement Income

The table below shows how much you’d need to save by retirement so you could withdraw 4 percent per year and maintain a similar lifestyle (60 percent to 80 percent of your pre-retirement salary).

Pre-retirement salary |

60% of pre-retirement income |

70% of pre-retirement income |

80% of pre-retirement income |

| $50,000 | $750,000 | $875,000 | $1,000,000 |

| $75,000 | $1,125,000 | $1,312,500 | $1,500,000 |

| $100,000 | $1,500,000 | $1,750,000 | $2,000,000 |

| $125,000 | $1,875,000 | $2,187,500 | $2,500,000 |

| $150,000 | $2,250,000 | $2,625,000 | $3,000,000 |

| $175,000 | $2,625,000 | $3,062,500 | $3,500,000 |

| $200,000 | $3,000,000 | $3,500,000 | $4,000,000 |

Okay, Don’t panic!

Whatever method you use, you’ll likely conclude that you’ll need to save more than you expected. This is completely normal! Don’t panic. Even online calculators don’t account for every variable in your situation. For example, they may not include “catch-up” contributions when you’re closer to retirement. They may not allow you to control how much of your money is used in pre-tax or post-tax retirement accounts (more on this below.)

So don’t freak out if these calculations say you’re way behind or you’ll run out of money 15 years before you “plan” on dying (morbid, I know!)

Call in the Professionals!

No Matter What Method(s) You Choose, Seek the Expertise of a Financial Planner

Whether you use one or all 4 methods of estimating your retirement goal, I strongly recommend that you sit down with a licensed, fee-based financial planner to evaluate each of your personal variables so you can maximize your chances of achieving your retirement goals.

Look for a certified professional here. You can hire one hourly or on a flat-fee basis. I’d recommend that you start by asking for an objective CFP analysis to flesh out your investment strategy.

How Much Money Do You Need to Save Each Month for Retirement?

Now that you know how much you’ll need to save for retirement you can figure out how much you’ll need to save per month.

These are the top two ways to estimate your target monthly income.

Method 1: Save 20 Percent of Your Take-Home Pay

If you follow Vibrant Money’s Financial Freedom Process, you’ll recognize this as Step 5. Once you’re at this level, aim for saving 20 percent of your take-home pay. Your take-home pay is your "after-tax" income rather than your "gross" income. If you stick to this level of saving, you’ll build a consistently growing retirement fund.

FYI, 20% of your take-home pay is roughly equal to 15% of your total (gross) income every month.

Let’s say you earn $60,000/year before paying taxes (gross income). That comes to approximately $3,750/month in take-home (it will vary depending on your unique tax situation), which means your goal should be to save $750/month toward your retirement.

If you earn $120,000/year, your monthly take-home pay maybe closer to $7,500/month. In this case, shoot for saving $1,500/month.

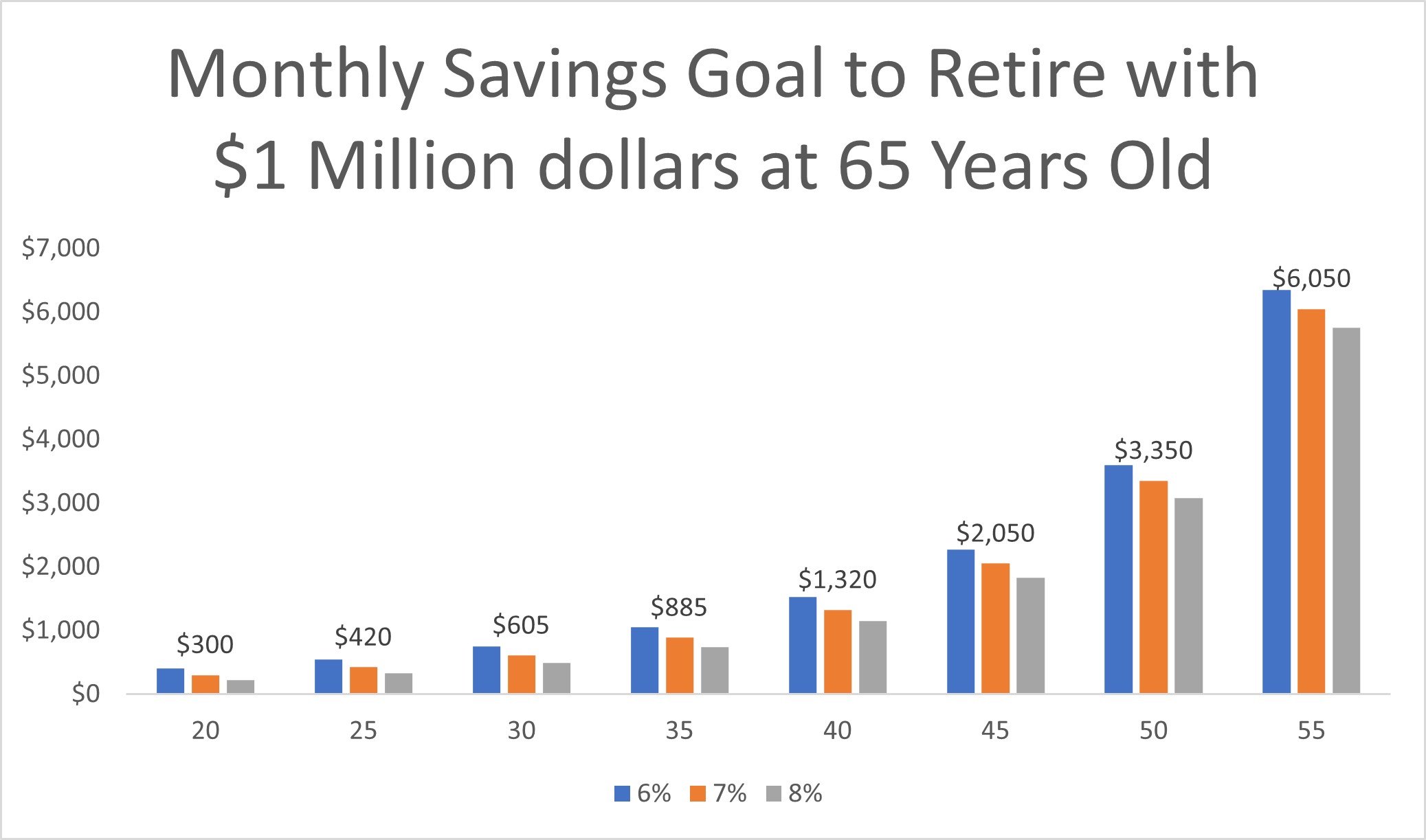

Method 2: Use Current Age and Average Rate of Return to Estimate Monthly Contribution.

If you know what your target "nest-egg" amount is , you can calculate how much you need to save each month depending on your current age and how much you expect your money to grow.

Let’s say you want to save $1 million dollars by age 65. We’ll calculate the monthly contributions needed based on various starting ages. The table below shows how much you’ll need to have saved each month to reach your goal. I’ll show you how different rates of return affect those monthly amounts.

The SmartAsset retirement calculator is a good calculator to use with this method because it will show you much you should save each month to hit your goal.

As you can see, the monthly amounts get exponentially higher the older you get. What starts out as a low monthly number in your 20s grows exponentially higher the closer you are to retirement, thanks to the power of compounding interest.

This chart also includes different rates of return between 6% and 8%.

Monthly retirement savings goals needed to accumulate $1 million by age 65:

- 20 years old: $225/month to $400/month

- 25 years old:$325/month to $540/month

- 30 years old: $485/month to $750/month

- 35 years old: $740/month to $1055/month

- 40 years old: $1,150/month to $1,530/month

- 45 years old: $1,825/month to $2,275/month

- 50 years old: $3,075/month to $3,600/month

- 55 years old: $5,750/month to $6,350/month

Variables That Affect Your Monthly Contribution Amount

Several variables affect how much you can save per month. The top three are your age, your annual rate of return, and how much you currently have saved for retirement.

Variable #1: Current Age

How many working years do you have left to earn an income and save?

Calculate this right now. If you retire at 65, how many years will you have left?

Months Until Retirement By Age:

- Age: 20; 45 years until retirement or 540 months

- Age 30; 35 years until retirement or 420 months

- Age 40; 25 years until retirement or 300 months

- Age 50; 15 years until retirement or 180 months

- Age 60: 5 years until retirement or 60 months

Basically, the younger you are, the less you need to save for retirement each month because your money has more time to grow (see compounding interest below.)

If you’re closer to retirement, you’ll need to save more since you don’t have as much time for the effects of compounding interest to benefit you.

Variable #2: Annual Rate of Return

How much will your money grow each year?

What do you estimate to be the rate of return on your investments while you’re working? Some financial advisors will use 10 percent. I recommend using a more conservative 6 to 7 percent to account for inevitable dips in the market.

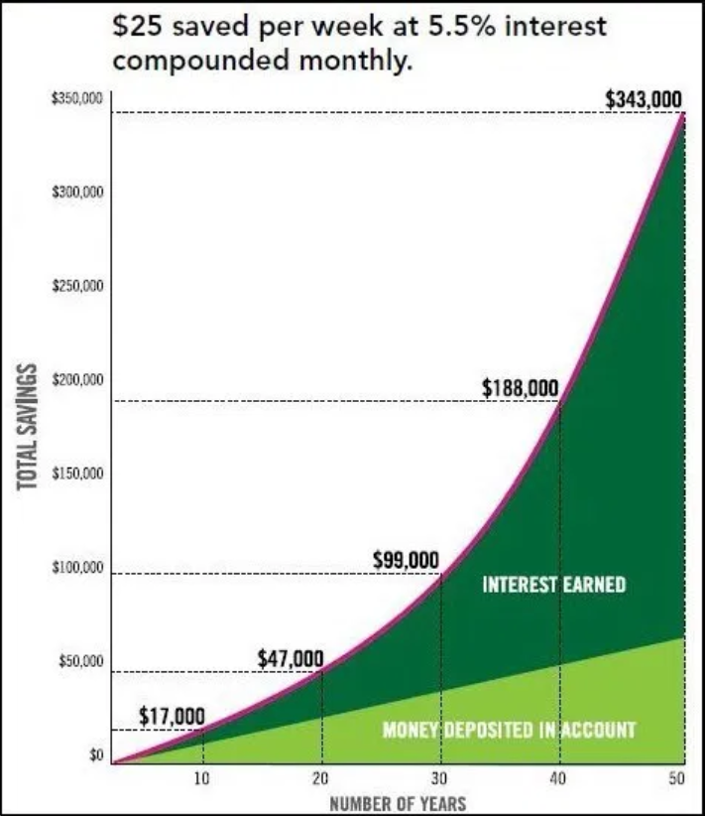

Variable #3: Compounding Interest

How much have you saved so far? This will affect how much time your money has to "compound."

Compounding interest is known as the 8th wonder of the world. This is because compounding interest is the magical principle that allows money to make money. Think of it like the interest you earn on your savings account earning it's own interest.

If you’re like most Americans, you have some catching up to do. According to the TransAmerica Center for Retirement Studies, the average U.S. worker has $63,000 dollars saved for retirement.

Here’s what that looks like broken down by age group:

- 20s: $16,000

- 30s: $45,000

- 40s: $63,000

- 50s: $117,000

- 60s: $172,000

So if you have a smaller nest-egg right now, your money has less time to compound than if you have more. Don't let this discourage you if you have a smaller nest-egg. The point of this whole article is to help you get started!

Even if you’re way behind on getting started, you’re not doomed to live in poverty or even discomfort. You’re in control of many of the variables that affect your ability to retire comfortably and there are many things you can do to catch up if you're behind.

What Types of Retirement Accounts Can I Open?

Now you have some idea of how much you’ll need to save. But where will you actually put all this money and how will you make sure it grows consistently?

We’ll cover the most common types of retirement accounts. It’s easy to get lost in this alphabet soup of plans. But let’s simplify. Just think of them as savings accounts that buy certain types of assets.

3 Most Popular Types of Retirement Accounts

401(k)s

A 401(k) account refers to a very specific type of account only offered by certain employers to their employees.

The 401(k) retirement system was established when Congress signed the Revenue Act of 1978. Section 401(k) of the bill allowed employees to contribute a portion of their salaries to a retirement account tax-free. This meant that employees would not pay income tax on any money they put into this account, allowing those funds to grow tax-free. However, once you withdraw any of the funds, you have to pay tax on it. One of the most popular benefits is when employers match their employees’ contributions to their 401(k)’s.

Here are some pro’s and con’s of a 401(k:)

Pros of a 401(k) account

- Lower your tax bill: Every dollar you put in is a dollar you don't pay taxes on this year.

- Possible employer match

- Higher contribution limits

- Maintained by employer

Cons of a 401(k) account

- Distributions are taxed: When you take the money out at retirement, you will pay income tax on this amount you withdraw.

- Fewer investment options

- Required minimum distributions

- Higher fees than self-directed IRA's or ROTH IRA's

Individual Retirement Accounts (IRA)s

An IRA is similar to a 401k with a few differences. The main difference between a 401(k) and an IRA is that you, not your employer, set up your IRA. Instead of making pre-tax contributions from your paycheck as you would with a 401(k), you’ll deduct the amount you’ve put in your IRA from that year’s taxes. The only difference is your employer sets up one and you set up the other. They’re both pre-tax contributions.

IRAs and 401(k)’s are both pre-tax retirement vehicles. They stay tax-free as they grow in your account. But once you take the money out, you’ll need to pay taxes on it, even if you’re of retirement age.

Here are some pros and cons of an IRA:

Pros of an IRA:

- More investment options

- Lower fees as compared to an employer 401k

- Up to $10,000 can be withdrawn to help purchase your first home

Cons of an IRA:

- Lower contribution limits than a 401k

- No employer match

- Requires more attention from you or a financial advisor than a 401k

- Required minimum distributions

ROTH IRAs

A ROTH IRA is a different but very popular type of retirement account. It is named after Senator William Roth who championed this new type of account in the Taxpayer Relief Act of 1997.

You can open a ROTH IRA on your own or through a financial professional. Some employers offer a ROTH 401k which acts similar to a ROTH IRA.

Unlike IRA and 401(k)’s, the money you contribute to your ROTH IRA isn’t taxed when you withdraw it at retirement. This is a huge advantage over 401(k) and IRA accounts because the money you contribute to a ROTH IRA grows tax-free and is NOT taxed when you withdraw it during retirement.

But you can’t deduct these funds from your taxes when you contribute them. You are using "after-tax" money to grow your retirement nest egg. Think of it like paying taxes now on money you wont use for 10 to 30 years.

If federal income taxes are higher in the future than they are now, you will benefit greatly from paying taxes now on your income and withdrawing it decades from now and paying zero taxes.

The other downside to the ROTH IRA is the income cap. Individuals making above $125,000 and married couples making above $198,000 are restricted from contributing to a ROTH IRA.

Here are some pros and cons of a ROTH IRA:

Pros of a ROTH IRA:

- Withdrawals are tax-free in retirement

- More investment choices

- No Required Minimum Distributions (RMDs) during your lifetime

- Up to $10,000 can be withdrawn to help purchase your first home

Cons of a ROTH IRA:

- Post-tax contribution: You pay taxes on your contribution now.

- Lower contribution limits than a 401k

- Income limits can prevent you from contributing

- No employer match

Comparison of 401(k), IRA, and ROTH IRA Retirement Accounts:

401(k) |

IRA |

ROTH IRA |

|

|

Contribution limits |

$19,500 ($26,000 if you’re over 50) |

$6,000 ($7,000 if you’re over 50) |

$6,000 ($7,000 if you’re over 50) |

|

Income limits |

No income limits |

No income limits to contribute but tax-deductions may be capped if you or your spouse has an employer 401(k) plan. |

$125,000/year filing single / $198,000 filing married |

|

Withdraw |

Taxed as ordinary income |

Taxed as ordinary income |

Tax-free withdraws |

|

Employer match |

Yes |

No |

No |

|

Maximum contribution |

$19,500 from employee ($26,000 if you’re over 50). With employer match; $57,000 ($63,500 if you're over 50). |

$6,000 combined IRA and ROTH IRA limit ($7,000 if you’re over 50) |

$6,000 combined IRA and ROTH IRA limit ($7,000 if you’re over 50) |

|

Tax structure |

Contributions are tax-deductible |

Contributions are tax-deductible |

Contributions are not tax-deductible |

|

Early withdrawal penalty |

Yes. No penalty age 59 ½. |

Yes. No penalty at 59 ½. |

No. Withdraw money you’ve contributed at any time. Withdraw earnings at 59 ½ |

|

Fee structure |

High |

Medium |

Low |

|

Investment options |

Fewer |

Many |

Many |

|

Required Minimum Distributions |

Yes. You must withdraw a specified % of your funds after age 70 1/2. Percentages vary from 5% to 1% depending on your age. |

Yes. You must withdraw a specified % of your funds after age 70 1/2. Percentages vary from 5% to 1% depending on your age. |

No Required Minimum Distributions |

In addition to these top three types of accounts, you might consider some others depending on your situation. Here are three other options to consider if you meet the criteria:

- ROTH 401(K) - This is basically the same as a ROTH IRA except it’s through your employer.

- Simple IRA - Business owners generally use this one. It has higher contribution limits than a traditional IRA.

- Simplified Employee Pension (SEP) IRA - This one is for self-employed individuals and allows for contributions up to $58,000.

- Self-Directed Solo401k - This is a 401k plan established by small business owners which allows entrepreneurs to contribute both as an employee and employer to their retirement accounts. These types of plans can own more diverse assets like real estate, precious metals, and more.

Which Type of Retirement Account is Right For You?

These options aren’t mutually exclusive. A better question would is which ones do you qualify for? If you qualify for a tax-deferred retirement account (such as a 401(k,) an IRA) you should take advantage of them. If you are below the income limit you should open a ROTH IRA. If you are an entrepreneur or small business owner you should explore Simple, SEP or Solo401k plans.

Ideally max them out and balance investments in all of them. Contributions to ROTH IRAs cap out at a certain income level.

Now that you know where you can save your money for retirement, let’s look at how to do it.

4 Steps to Saving for Retirement

Step 1: Open a Retirement Account

How to open individual retirement accounts with a financial advisor or retirement professional:

If you work with an investment advisor, you can usually open either an IRA or a ROTH IRA with them. They’ll likely recommend opening a brokerage account with their company. These can include companies like Merrill Lynch, Ameriprise, Fidelity, Lincoln Financial, Prudential Financial, EdwardJones, CharlesSchwab and more.

An investment advisor will typically meet with you in-person or online and ask you about your financial situation and goals.

They’ll make recommendations for what types of assets to purchase with your retirement contributions. They can also suggest how to adjust your investments as you get older and your money grows.

Beware that some financial advisors are incentivized to sell you certain types of investments such as stocks, in-house mutual funds or annuities because they earn higher commissions. At the end of the day, it’s your money and you get to choose how you invest it. Just be aware that some firms won’t offer all of the types of investments you may want to make.

If they are an investment advisor (acting as a fiduciary) they have a legal obligation to act in your best interest. This is an important distinction when working with a retirement professional. Ask them if they’re an investment advisor or fiduciary. If they say no, that means they DO NOT have a legal obligation to act in your best interest. Therefore, they may be recommending investment decisions that benefit them more than they benefit you.

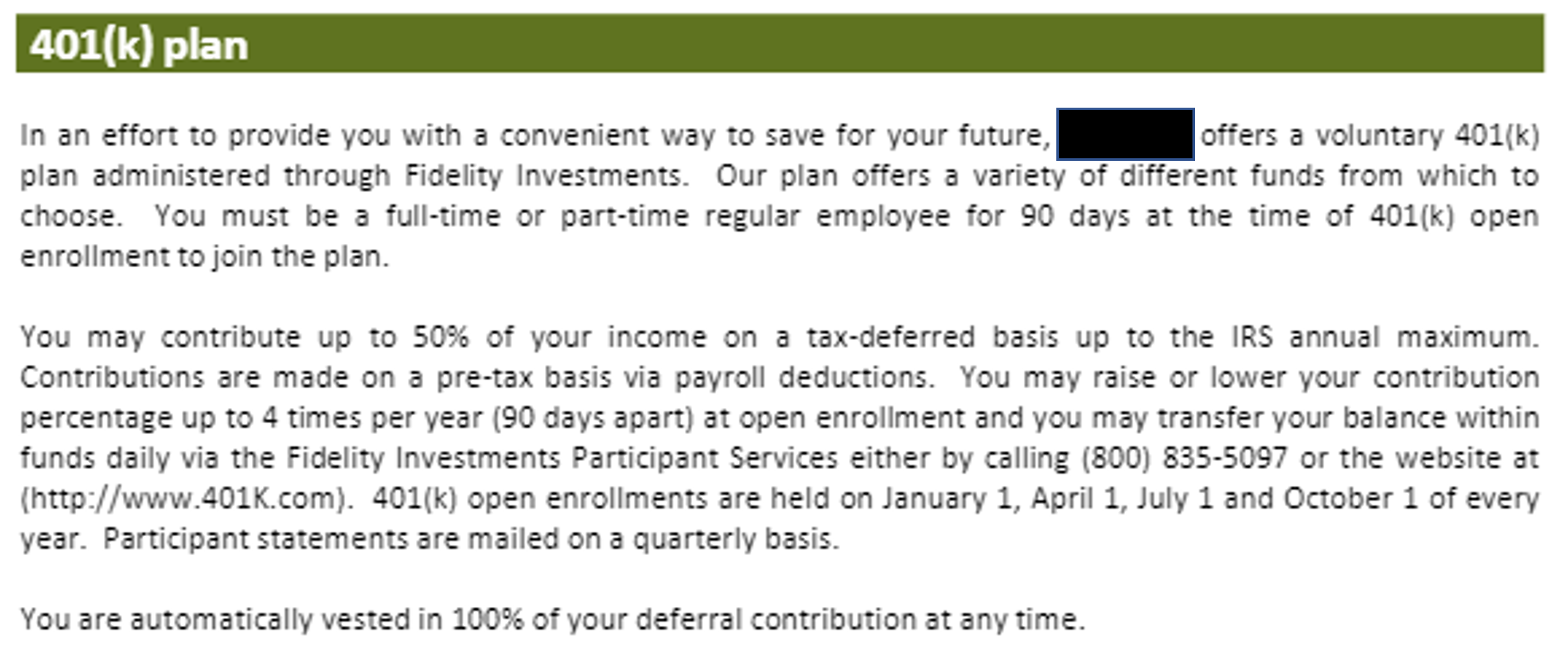

How to open a retirement account with your employer:

If your employer offers a 401(k) plan, I highly recommend that you join.

Employers sometimes allow their new hires to join their 401(k) immediately. But it’s more common to have a 60-90-day waiting period before you can sign up. Some employers will only allow employees to join their 401(k) during their annual benefits update period.

Contact your HR department to confirm that they offer a 401(k). If so, ask for the benefits package/handbook and read it carefully.

Here’s an example of what an employer may include in their employee benefits handbook about their 401(k) plan:

What About Company Matches?

If your company offers a match, take advantage of it! This is the closest you’re going to get to “free” retirement money. Review any 401(k) plan carefully with a financial advisor. Make sure you understand what kinds of investments they offer and any associated fees. Most 401(k)’s don’t give you the option to customize what you want to invest in. They also usually carry high annual fees that eat into your annual rate of return.

John Oliver covered this topic in his Retirement Plans segment in 2016.

If you’re reviewing your 401(k) plan at work, this is the time to sit down and do the research. You won’t regret it.

How to open a retirement account on your own

If you’re dreading opening a retirement account, you can relax. This is a surprisingly simple process if you work with the right company. We recommend sticking with established firms like Vanguard, Fidelity, TDAmeritrade and CharlesSchwab.

Setting up an IRA or Roth IRA is pretty easy. Here’s what you’ll need to get started.

- Personal information such as social security number.

- A funding account such as your bank account or another brokerage account.

- A general investing strategy that you’ll use to buy different types of assets.

Passive investors typically buy mutual funds, index funds and ETFs. Active investors buy more stocks and bonds.

Step 2: Define Your Risk Profile to Help Select Investments

Now that you know where and how to invest for retirement, let’s look at what risk profile would be most appropriate for you.

How Much Risk are you Comfortable Taking? Aside from how much money you have, your risk tolerance is probably the second greatest factor in your retirement plan. Of course this is a very personal choice but I’ll show you some broad risk personalities and you can see which one resonates most with you.

Think of these as clumps of people at a party. Which group would you feel most comfortable hanging out with? These categories are often called “investor profiles.”

5 Main Investor Profiles:

- Conservative

- Moderately conservative

- Moderate

- Moderately aggressive

- Aggressive

Ask yourself this question: “How would I feel if my investments dropped by 15 percent in one year?”

- freaked out

- nervous

- scared

These reactions are typical of a more conservative investor.

How upset would you be if that same investment that dropped by 15% later rebounded and grew by 35 percent?

- Pissed off

- Frustrated

- Disappointed

A more moderate or aggressive investor would rather take the risk of down years with the chance at big growth.

The more aggressively you invest, the more your rate of return will fluctuate. You can’t have everything. If you don’t feel comfortable with a lot of risk, stick to steady, conservative investing. Of course, the trade-off for this market insulation is lower returns. If you want to take bigger risks, you’re risking bigger losses (or gains!)

As we get older we tend to feel more comfortable with lower-risk investments. You don’t have as much time to invest, which makes risk-taking scarier. Younger investors have more time to make up for losses so taking risks is not as “risky.”

For example, when you’re in your 20s and 30s you can take a more aggressive tack. Some younger investors get spooked easily despite their lower risk. The key is to match your comfort level, regardless of your age. When you’re in your 30s and 40s, you may tone down your risk profile in hopes of balancing the market’s ups and downs. Once you reach your 50s or 60s, you’ll be more likely to steer more into the conservative lane since you’ll be living off these investments in just a few years.

Step 3: Use Your Retirement Account to Purchase Assets

Finally, you’re ready to choose which assets you want to buy with your retirement accounts. The above retirement plans are fairly low-risk and low-maintenance. If you want to increase your risk in pursuit of possible higher returns, add in some higher-risk investments.

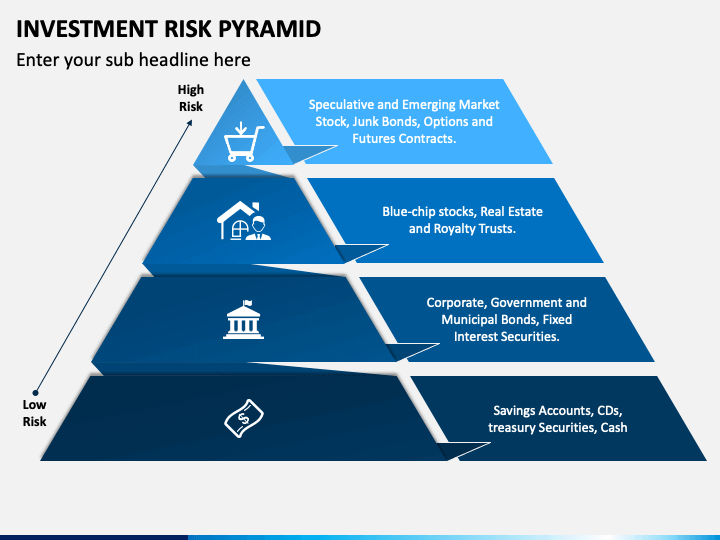

Now that you know your risk profile you can explore what types of assets your retirement account should purchase. The diagram below includes some examples of assets by risk-tolerance.

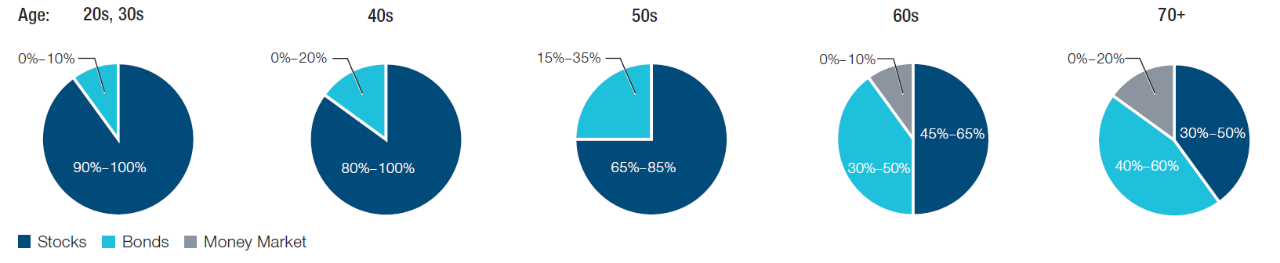

The diagram below breaks down asset allocation even further by showing what percentage of your retirement portfolio should be invested in each asset type depending on your age. Let’s use it to review the various types of assets your retirement account will purchase:

You can see that the younger age groups (20 to 40) are more heavily invested in Stocks than investors aged 50+. As you get older, you will often want to purchase more bonds to protect your nest-egg. This is because a stock can theoretically drop to $0 whereas a bond holder will always be paid the interest rate that they were promised. Bonds can lose value but they are less risky than stocks. If you’re 60 years or older, a financial advisor may recommend you split your allocation between stocks, bonds, and cash deposits.

The Most Common Retirement Assets

Stocks - when you purchase a stock you are purchasing ownership of a company. As a stockholder you have rights to the future profits of a company you buy. Some companies share those profits with shareholders in the form of a dividend. Others share those profits by becoming more profitable and, in turn, increasing the price of the stock. Below si a good 2-minute video explaining stocks from Investopedia:

Bonds - Bonds are IOU's issued by companies, local governments, and countries. They promise to pay you back your original investment (principal) plus interest on a certain date. Bonds are considered less risky than stocks in many cases because it's more likely a government will pay back their debt than a company will increase profits and their stock price will go up. However, bonds also have a lower rate of return than stocks. Below is a good 2-minute video explaining bonds from Investopida:

Index funds - an index fund tries to mimic the price of an entire stock market like the S&P500 or the Dow Jones. Investopedia has a list of the top index funds that follow the S&P500. TDAmeritrade has a good video explaining Index Funds below:

Exchange-traded funds (ETFs) - ETFs are similar to index funds but instead of mimicking an entire market, they allow you to invest in sectors of an economy. ETFs are a way for you to purchase exposure to a "basket" of companies. ETFs can vary greatly in the types of companies or sectors they invest in. For example, some ETF's will invest in the entire Gold market while others will focus on the growth of a particular region or country. ETF's can include stocks, bonds, and other types of assets. Here is a complete list of the largest ETFs by volume. Here is a video explaining Exchange Traded Funds from Investopdia:

Mutual Funds - Mutual funds are similar to ETFs in that they are professionally managed funds that purchase underlying assets. Mutual funds can purchase stocks, bonds, and other types of assets. As an investor you can invest in a broad part of the economy by purchasing mutual funds. The key difference is that mutual funds are sold by a 3rd party whereas ETF's can be purchased directly by investors in the open market. This means that you can purchase mutual funds that your brokerage account sells (like Vanguard sells their Vanguard US Growth Fund and T.RowePrice sells their Emerging Market Stock Fund) Mutual funds can also vary in their investing style. Some mutual funds are very actively managed meaning the person managing the money (the fund manager) will buy and sell different stocks throughout the year. Other mutual funds may be more passive that are only updated once or twice per year. Here is a list of the top mutual funds. Also, here is another video from Investopedia explaining Mutual Funds:

Other types of assets:

- Precious metals such as gold and silver

- Real Estate

- Cryptocurrencies like Bitcoin (Should You Invest in Cryptocurrencies Like Bitcoin?)

- Certificates of Deposit (CDs)

- Annuities

Step 4: Contribute to Your Retirement Every Month and Review Once Per Year

Contribute Every Month

Live from a budget: Use a zero-based budgeting approach to give every dollar a job every month (including retirement contributions). In general, you want to pay yourself first. This means that you set up your budget each month to include savings contributions. Some people like to set this up automatically from every paycheck so they can create their budget assuming that income doesn't exist. To ensure consistent contributions, set up an auto withdrawal that goes straight into your IRA or 401(k.)

Set-up automatic contributions each month to your retirement accounts from your checking account.

Review Your Accounts Annually

Try to avoid looking at your portfolio every month and definitely not every day. Once per quarter or once every 6 months is fine. If you're not planning to touch this money for 10 or more years, daily or weekly swings in price should not affect your overall goal. That is because, over the long term, the stock market has consistently increased in value.

Max out your retirement contributions: IRAs and 401ks have contribution limits based on your age. You can make contributions up to April 15 for the previous tax year.

Re-balance your portfolio: As your money grows it may get "out of balance." This can happen if your portfolio consists of 50 percent stocks, 40 percent bonds, and 10 percent cash but the stock market did really well this year. Your portfolio may actually reflect 55 percent stocks, 37.5 percent bonds, and 7.5 percent cash. You may not be comfortable with that much exposure to risk. In that case, you or your financial advisor may have you sell some of your stock positions and transfer them into bonds, cash or other assets to "re-balance." As you get older, you’ll likely rebalance to a less risky position which typically means buying more "fixed income" assets like bonds or index funds and less volatile assets like individual stocks.

Update your net-worth: Use a spreadsheet or online banking tool to calculate your net-worth. Update this every year so you can see your progress.

How Do You Catch Up if You're Behind?

Congratulations! You’ve made it to the home stretch of this guide! But I hear some of you saying that’s all great but what about me? I’m right around retirement age and I haven’t saved a damn thing! Okay, I hear that. Do not panic. You’re here.

Make Your Goal More Achievable:

Own your home - Secure housing by purchasing a home and paying it off before you retire. If you own your house in retirement you can rent it out or add roommates.

Be healthy - Take care of your health now and maintain your health so you can control your healthcare costs later in life.

Relocate - Consider relocating to an area with a lower cost of living.

Increase your annual rate of return - Yes I did just say you should focus on lower-risk investments if you’re older. I stand by that. But the flip side is that those who have little time left before retiring may also need to put some of their savings into higher-risk investments. Start with a modest percent of your overall savings, perhaps 2-5 percent. That way if your investments perform well, you’ll see a heftier gain and if they tank, you’ll keep your losses to a minimum. Once you’re in your 50s or 60s and you feel like you’re behind on retirement savings, consider buying a few individual stocks on top of your mutual funds. Besides, it’s always smart to diversify your risk exposure, no matter what your age.

Include any Expected Federal Benefits - If you’ve paid into social security and Medicare for at least 10 years, you should be eligible to receive those benefits when you reach retirement age. Click here to find out more about the Social Security Administration’s eligibility rules. If you’ve paid into Medicare for at least 10 years through your employee withheld taxes, check here for details about Medicare eligibility rules.

Eliminate all Debt: Begin with a clean slate by paying off all of your debt first. After that, make your way to Step 5 of The Vibrant Money Financial Freedom Process! The variable you can control most is how much you save each month.

Increase Your Monthly Retirement Contribution:

Consciously Cut Back on Expenses - Cut back expenses so you can start contributing to retirement. The lower your expenses the more flexibility you’ll have. If you're looking for tips to save money - check out the Vibrant Money eBook on 10 Ways to Save $10,000 eBook

Increase Your Income - This may seem like an over simplified solution to help with your retirement and it is often easier said than done. However, that doesn't make it less true that taking actions to earn more money can help you grow your retirement account. After reviewing this article, you may realize you need to do more to grow your income and reduce your expenses so you can contribute more to retirement.

There are many ways to increase your income from side-hustles, gig-work, to overhauling your career. To help in this exploration, we have created a useful infographic and on-demand training covering the 7 most powerful ways to increase your income. Get the infographic and video training by filling out the form below.

Track Your Spending - At this point you should be tracking your money with a monthly spending plan. As you follow the plan, consciously work toward reducing your expenses. This is like a test-run for how you’ll live in retirement.

Use a zero-based budgeting approach to give every dollar a job every month (including retirement contributions.) Pay yourself first. This means making savings contributions part of your budget. Some people like to set this up automatically so a certain amount from every paycheck goes directly into their retirement savings.

If you're not living from a monthly budget, you can start by using our free Monthly Budget Spreadsheet. Fill out the form below to get a free copy of our budgeting spreadsheet plus a 25-minute training video on how to start budgeting all for free!

Follow The Vibrant Money Financial Foundations Process

Many Americans are not saving enough for retirement planning. If you’ve read this far, you’re one of the brave ones who knows it’s time to put plans in place to accelerate your retirement savings. This is one of the pivotal stages in The Vibrant Money Financial Foundations Process.

I take you through a logical, elegant series of steps that bring order to chaos. In short, the Vibrant Money Financial Foundations process follows these steps.

- Stop borrowing money

- Save 1 month of take-home pay

- Eliminate all debt using a debt snowball

- Save 6 months of take-home pay

- Invest 20 percent of your take-home pay for retirement

If you don't go through Steps 1-4, you'll be putting water back into your own canoe. You have to build on a solid foundation. If you're still borrowing money while paying off debt, you're running in place. Likewise, if you don't have a safety net but you're saving, you'll have to rob your retirement for expenses or emergencies, giving up earned interest.

Once you’re in Step 5, you’ll start your monthly contribution to retirement.

If your company offers a 401(k) with a matching contribution you may want to continue investing in your 401(k) to secure the company match. This is as close to “free money” as you’re ever going to get so you should try to take advantage of it, assuming you have enough resources to continue working through steps 1 through 4.

Summary

Now that you have some basic knowledge of investing for retirement, you can start your baby steps. If you start to feel overwhelmed by all of the choices, remember the simple goal. You just want to save enough money to live comfortably for the rest of your life. The advantage of all these choices is they allow you to tailor your decisions to your age, bank account and appetite for risk.

I’ve included a glossary to help decipher the language of retirement.

Definitions and Terms for Retirement Planning:

Annual rate of return - The average rate of return from your retirement accounts (e.g. stocks and bonds) determines how fast and how much your money will grow. Every year will be different. Over the last 10 years, the stock market grew by 15 percent. But if you go back 20 years, the returns were a more modest 6 or 7 percent. If you can take a more conservative approach of 6 or 7 percent, you’re more likely to succeed over the long-term.

Annual retirement contributions - This is the amount of money you contribute to retirement each year. This is the “principal” you’re investing that grows.

Annuity - According to Investopedia, annuities are contracts issued and distributed (or sold) by financial institutions where the funds are invested with the goal of paying out a fixed income stream later on. They are mainly used for retirement purposes and help individuals address the risk of outliving their savings. Upon annuitization, the holding institution will issue a stream of payments at a later point in time.

Bond - Investopedia defines a bond as a fixed income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Bonds are generally seen as less risky investments than stocks whose returns are, in kind, generally lower than stocks.

Compounding Interest - Compounding interest (AKA the 8th wonder of the world) is interest on interest and money making money. When your money grows every year, there’s more in your account at the beginning of the following year. This larger amount is made up of principal + earned-interest. You didn’t actively contribute this earned interest. Instead, it grew via compounding interest from the previous year. That money itself then earns interest which is where the compounding comes into the picture. When you contribute early and consistently, compounding interest can build large balances 10, 20, and 30 years down the road.

Inflation - Inflation happens when prices increase over time. This explains how a tank of gas that cost $5 in 1970 costs $50 today. In good times, wages have risen alongside inflation rates. But inflation’s unpredictable. If you’re living off a “fixed income” like a 4 percent distribution from your retirement accounts, you’re not keeping up with inflation. This means your future spending power has decreased. In order to stay ahead of inflation, you’ll have to save more than you’d have thought because by the time you retire, your savings will be worth less.

Exchange Traded Fund (ETF) - Nerdwallet defines Exchange-traded funds (ETFs) as a type of investment fund that offers the best attributes of two popular assets: diversification benefits of mutual funds and the ease with which stocks are traded.

ETFs can be bought and sold on an exchange throughout the trading day like a stock. ETF fees are often lower than those of other types of fund. You can choose which ones you want to invest in based on your appetite for risk.

Other factors to consider when choosing an ETF include management costs and commission fees (if there are any), liquidity, and investment quality.

Fiduciary - Investopedia defines a fiduciary as a person or organization that acts on behalf of another person or persons, putting their clients' interest ahead of their own, with a duty to preserve good faith and trust. Fiduciaries are bound legally and ethically to act in their clients’ best interests.

Fiduciaries may include money managers, financial advisors, bankers, insurance agents, accountants, executors, board members, and corporate officers.

Financial Advisor - According to NerdWallet, a financial advisor is someone who helps you create a plan for meeting your financial goals and guide your progress along the way. They can help you save more, invest wisely or reduce debt.

They can also help you with, or completely manage, your finances. “Financial Advisor” has become a catch-all term to describe a wide variety of people and services, including investment managers, financial consultants and financial planners. Some even consider financial digital investment management services (AKA robo-advisors) to be financial advisors.

Income Taxes - Different retirement accounts affect your taxes differently. Some (such as a ROTH IRA) require that you pay into the account with pre-tax money. This saves you from getting taxed in the future when you take the money out. Other accounts [such as a 401(k)] allow you to contribute tax-free now but you’ll be taxed later. I recommend a balance of pre-tax and post-tax contributions to even out your tax liability in retirement.

Investing Strategy (Passive) - At Vibrant Money, we recommend a more passive approach. Most people don’t have the time or interest in becoming experts in all the companies they’re investing in.

Even if you study your investments, you’ll likely be tempted to buy or sell at the wrong time based on emotions or market sentiment.

We’ll focus on traditional retirement vehicles such as accounts that can purchase stocks, bonds, mutual funds, and ETFs. Some of the assets we recommend for our clients include:

- ETFs and index funds

- Mutual funds (note that these carry higher fees because they’re actively managed by someone else.)

When you go this route, you’re turning over the management of your funds to a (“broker?”) This simplifies your investment strategy. But you’ll still need to make a couple of decisions about timing and taxes.

- Pre-tax or After-tax contributions

- Taxed upon withdrawal?

- Contribution limit per year

- Catch-up contributions starting at age 50

- Penalty if withdrawn before 59.5

- 72 withdraw age

- Individual or offered by employer

- Employer contribution/match limits

Investing Strategy (Active) - An active investor is someone who actively manages their own retirement accounts and investment decisions. They buy individual stocks, usually seek higher returns, enjoy researching companies to invest in, and have the time available to manage their portfolio. Unlike passive investors, these types of investors generally purchase individual stocks and bonds instead of purchasing assets that "buy the market."

Money Manager - Investopedia defines a money manager as a person or financial firm that manages the securities portfolio of an individual or institutional investor. Typically, a money manager employs people with various expertise ranging from research and selection of investment options to monitoring the assets and deciding when to sell them.

In return for a fee, the money manager has the fiduciary duty to choose and manage investments prudently for clients, including developing an appropriate investment strategy and buying and selling securities to meet those goals. A money manager may also be known as a "portfolio manager," "asset manager," or "investment manager."

Mutual Fund - According to Investopedia, a mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund's assets and attempt to produce capital gains or income for the fund's investors. A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus.

Mutual funds give small or individual investors access to professionally managed portfolios of equities, bonds, and other securities. Each shareholder, therefore, participates proportionally in the gains or losses of the fund. Mutual funds invest in a vast number of securities, and performance is usually tracked as the change in the total market cap of the fund—derived by the aggregating performance of the underlying investments.

Non-Traditional Asset - includes Real Estate, Cryptocurrencies, Fine Art & Collectables, Intellectual Property, Business Ownership

Fees (Assets under management fee) - According to Investopedia, Assets under management (AUM) fees is the total market value of the investments that a person or entity manages on behalf of clients. Assets under management definitions and formulas vary by company.

In the calculation of AUM, some financial institutions include bank deposits, mutual funds, and cash in their calculations. Others limit it to funds under discretionary management, where the investor assigns authority to the company to trade on their behalf.

Overall, AUM is only one aspect used in evaluating a company or investment. It is also usually considered in conjunction with management performance and management experience. However, investors often consider higher investment inflows and higher AUM comparisons as a positive indicator of quality and management experience.

Fees (trading and transaction fees) - According to NerdWallet, it's easy to overlook one thing: investment and brokerage fees. NerdWallet defines brokerage fees as what a broker charges for various services, like subscriptions for premium research and investing data or additional trading platforms. Some even charge maintenance and inactivity fees, but generally, you can avoid paying these brokerage fees with the right broker.

Finding the right broker can make a huge difference in the long-term; fees can seriously eat into your investment returns. Whether they’re baked into the funds you’ve selected as an expense ratio, charged as a brokerage fee on your investment account, added on as a stock trading commission when you buy or sell or levied by an advisor who is helping you sort through it all, it’s important that you know what you’re paying.

Portfolio - According to Investopedia, a portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). People generally believe that stocks, bonds, and cash comprise the core of a portfolio. Though this is often the case, it does not need to be the rule. A portfolio may contain a wide range of assets including real estate, art, and private investments.

You may choose to hold and manage your portfolio yourself, or you may allow a money manager, financial advisor, or another finance professional to manage your portfolio.

Retirement Income - The amount of money you will spend each year during retirement. If you own your home outright and you’ve lowered your expenses, you won’t need to withdraw 100 percent of your income. Most retirement planners estimate that you’ll need 80 to 90 percent of your pre-retirement income as an annual distribution.

Stocks - Investopedia defines a stock (also known as equity) as a security that represents the ownership of a fraction of a corporation. This entitles the owner of the stock to a proportion of the corporation's assets and profits equal to how much stock they own. Units of stock are called "shares."

Stocks are bought and sold predominantly on stock exchanges, though there can be private sales as well, and are the foundation of many individual investors' portfolios. These transactions have to conform to government regulations which are meant to protect investors from fraudulent practices. Historically, they have outperformed most other investments over the long run. These investments can be purchased from most online stock brokers.

Legal Disclaimer: Vibrant Money is an education company. Professional retirement planning is not out field. The information contained below is for informational and entertainment purposes only. If you have questions please seek the advice of a certified financial professional.

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.