The Step-by-Step Guide to Mastering Your Food Budget

TLDR: Food is the #1 budget priority for my money coaching clients. But it's complex! In this article I'll show you how to create a healthy food budget that takes everything into account. I'll also show you ways to conquer your eating out spending and I'll even show you how to start cooking at home to save even more!

How Food Affects Your Spending

My first career was in culinary arts. My second was finance. I've fused the two to provide you with a rare insight into how deeply connected these two areas are.

After essentials like housing and transportation, Americans spend most of their money on food.

- For an average couple that's around $444/month

- Throw in a few kids and you're closer to $1,000 per month.

- If you live in a big city or urban area, you can easily be spending $2,000 per month on food - that's twenty four thousand dollars per year on food!

“I knew I was spending a lot, but I didn’t realize it was so high!”

This is a common reaction from my clients after they track their food spending for a few months. How much do you think you spend on food? Most people think they know how much they spend on food, until they start following the Vibrant Money process.

A few lunches here, Uber Eats there, and a few Starbucks runs add up real fast.

I’m not here to wave a finger. All of us are doing the best we can. I DO want to wave my hand, inviting you to come over and take a look how to improve your food spending. It's easier than you think! You may even enjoy it!

It will also be a major part of your financial transformation.

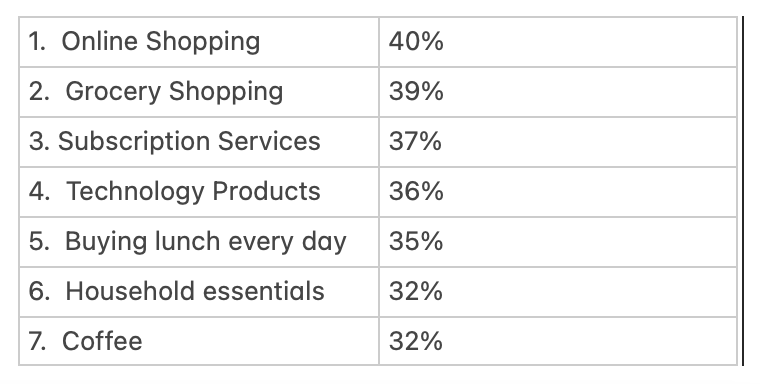

When doing research for my Complete Guide to Budgeting, I found that four of the top ten U.S. budget busters are related to food.

Source: SlickDeals

Our food spend-a-thon has risen sharply in the past 6 decades. Most of that increased spending has gone towards eating out, food pick-up, and delivery services like DoorDash and UberEats.

USDA, Economic Research Service

In addition, food prices have already risen 4.6% in 2021 alone, according to the U.S. Bureau of Labor Statistics.

So how much should you be spending? The general rule is that your food spending should account for no more than 10% of your monthly budget. But I can tell you, many of my money coaching clients clock in at 15% to 30% when they first start.

3 Ways Foods Feed Us

Healthier food spending habits start with taking an honest and holistic look at your food spending.

What and where we eat affects a lot more than our waist line and our checking accounts. It also affects our relationships and our mental well being.

Because food is something we need and something we crave, it is a more nuanced category than things like insurance, rent or taxes. It ties in to our basic survival instincts, our social lives and emotional well-being.

Three Ways Food Touches Our Lives:

1. Food is Essential for Survival

Strip away everything else and we still need food, water, air and shelter. Food is not like a Netflix subscription. It’s not a fixed monthly bill and it’s definitely not optional.

We eat every day yet our food spending's a blur in our chaotic schedules filled with competing priorities. We end up grabbing whatever's fastest. More often than not, that ends up being processed, high-calorie food in a wrapper listing dozens of gross ingredients. So, on top of feeling yucky and unsatisfied, we feel guilty, frustrated and exhausted.

I encourage my clients to think about food as fuel. This mindset helps defuse and deactivate unhelpful associations.

2. Food is Social

Certain aromas can snap us instantly back to childhood memories. Family recipes connect one generation to the next. Food plays a starring role in all of our holidays and family traditions. Everyday interactions like coffee breaks, dates and even work meetings also involve food.

We’re social beings. One of our most time-honored ways of staying social is eating together. Holing up in our room or cubicle with Cheetos isn’t good for us. When I was a kid, I tried assuaging my loneliness by going to the mall with friends. We'd shop and then have lunch or dinner. I loved everything about these outings. Only as an adult who had started tracking expenditures did I realize they'd come to cost me thousands of dollars a year. What I enjoyed most about these outings was simply spending time with my friends.

I started to substitute those costly dates with walks in the park, coffee meet-ups, bookstore browsing, and lower-cost happy hours. This allowed me to get my social fix without breaking my budget. I felt a new surge of pride and grown-upness.

3. Food is Emotional

I’ll be the first to admit that I'll eat my face off in stressful times. I wait until I'm alone and then I chow down. As a coping mechanism, it sucks. It's like hiring an artist to fix your transmission. Gorging on donuts never helps me feel better physically or emotionally.

What, when and how much we eat can indicate any number of emotions. The reverse is true as well. When we're in a good mood, we're more drawn to healthy foods while bad moods often trigger unhealthy food choices.

Research from the Journal of Consumer Psychology shows that we think more about our long-term goals when we’re in a good mood. Conversely, when we feel crummy, we focus more on immediate needs like mood management.

When we’re bored or lonely at night our minds may turn to chips or cookies. Personally, I have a hidden stash of cookies and sour gummy worms that I raid in stressful times. While I appreciate the numbing effects of sugar in the moment, I know it's covering underlying emotions.

Well into my finance work at Merrill Lynch I started to feel that same loneliness and restlessness. Being a desk jockey all day long curbed my social style. So, for my own mental health, I decided to get out of the office every day for lunch. I needed social contact. When I started my own financial freedom journey, I realized that my underlying need was to connect with others. To meet those needs for less money, I started packing a lunch and eating at a nearby park with friends. That way, I felt no guilt on days when I ate out.

It’s much easier to intercept these behaviors as we get better at tuning in to our social and emotional needs. Such awareness can help us identify an eating pattern before it gets out of hand. I use therapy, journaling or physical exercise as a way to connect to and transcend my feelings before burying them in a Jimmy John’s sandwich or greasy burrito.

Connecting to underlying emotions reveals hidden drives behind our food choices.

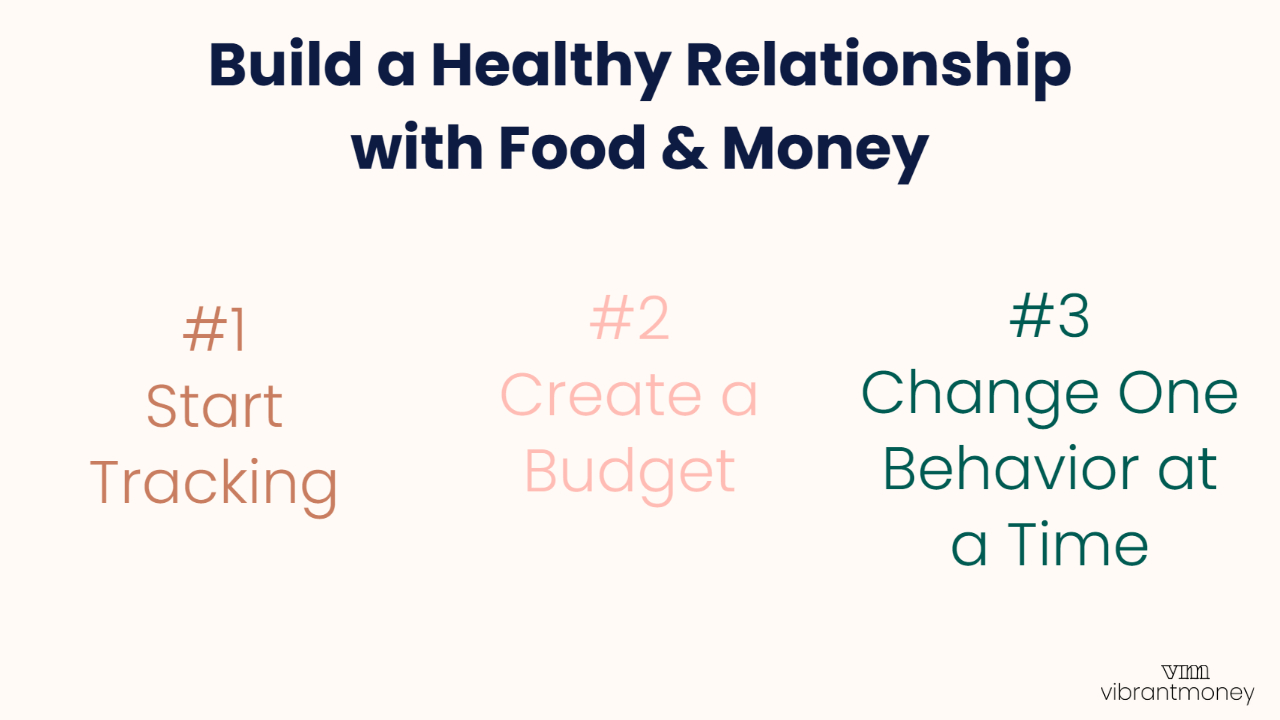

3 Steps to Building a Healthy Relationship with Food & Money

You know you need a food/money makeover, but where do you start? Here are three steps to building a healthy relationship with your food and money.

Step 1: Increase Your Awareness by Tracking Your Food Spending

You can’t get to point B if you don't know where point A is. Tracking your food spending is your GPS here. It'll be able to answer basic questions like these:

- Where are you buying food?

- When are you eating?

- Where do you notice you tend to spend more on food? Do you notice emotional or social triggers preceding these choices?

- How much does decision fatigue affect your choices?

- How does your hectic schedule shape what and where you eat?

Paying attention to these habits gets interesting quickly. Track your food spending for at least a month before even identifying any goals. Now’s not the time to judge or force behavior changes. Just focus on observing patterns at this stage.

Make your categories as broad or specific as you want. I recommend starting with at least these categories:

• Groceries

• Restaurants / Eating out

• Delivery / Pick-up

You may be surprised to discover patterns around when you stop at convenience stores or drive through Starbucks. For example, my husband tracked his Del Taco budget for an entire year, confirming that emotional and survival triggers coincided with those taco trips.

Set up a weekly date with yourself to review your food spending. You can track this easily with a monthly budgeting app (here are my top 5 online budgeting tools.)

You can also download transactions from your bank and review them in a spreadsheet or a paper money log.

Step 2: Create a Realistic Food Budget

After you’ve been tracking for at least a month, outline a proactive, conscious food budget that creatively reduces your spending.

Light bulbs start clicking on once you compare your actual spending to your budget. Food spending is a great place to start with when you’re building your budget. Although it’s a large category, it's less rigid than housing and utilities.

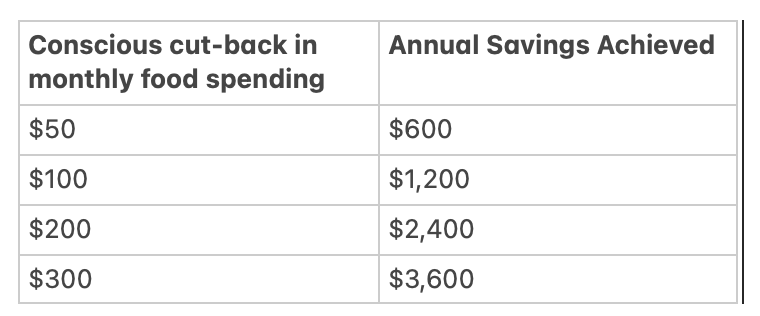

Clients who have followed the ideas outlined here have seen results quickly. Beyond just saving money, they’ve improved their mental and physical health. Even the smallest monthly reductions add up to some significant savings by year’s end. Here’s a snapshot of how monthly goals translate into serious annual savings or other important needs and wants like self-care, entertainment or eliminating debt.

Be gentle and realistic about what changes you can make, especially at first. Sometimes you’re going to need to use Instacart, order pizza or stop at the Del Taco drive-thru! That’s okay!

Track what you’re spending now and set goals for next month. Don’t worry about hitting some arbitrary 10% of your income goal. This is a lifestyle shift, not a fad diet.

Curious where you should land? This Grocery Calculator can give you an idea of what your food budget should be based on your individual situation.

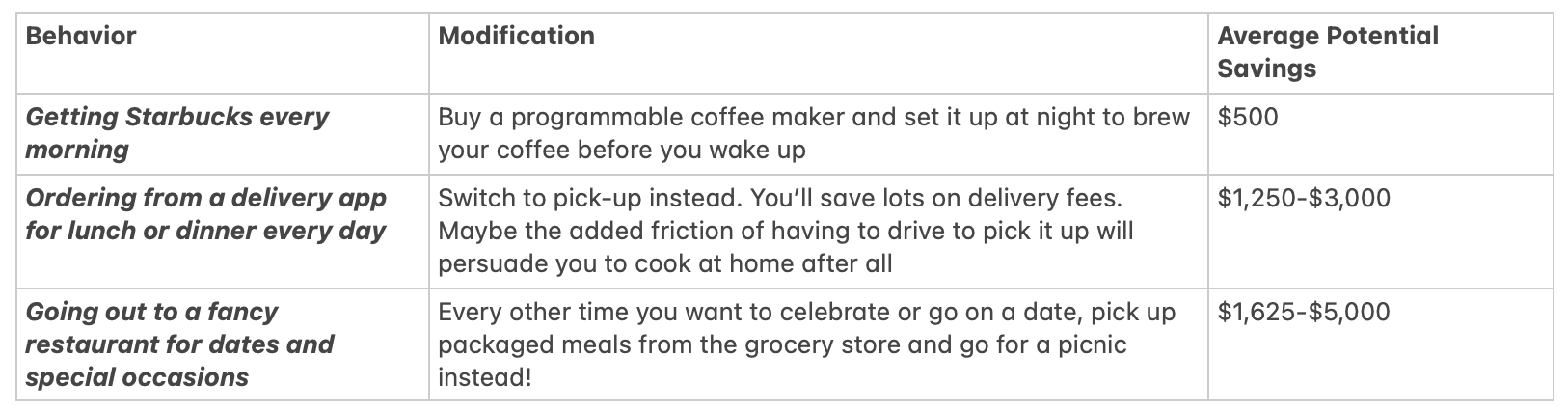

Step 3: Change One Behavior at a Time

To start dialing in your spending, focus on one adjustment at a time. This could be lunches at work, Starbucks runs or pizza delivery. Here are a few examples:

These are just a few ideas. The point is to target one category or behavior and make a modest adjustment. You don’t need to cut out all the good stuff. Even modest adjustments will add up over time!

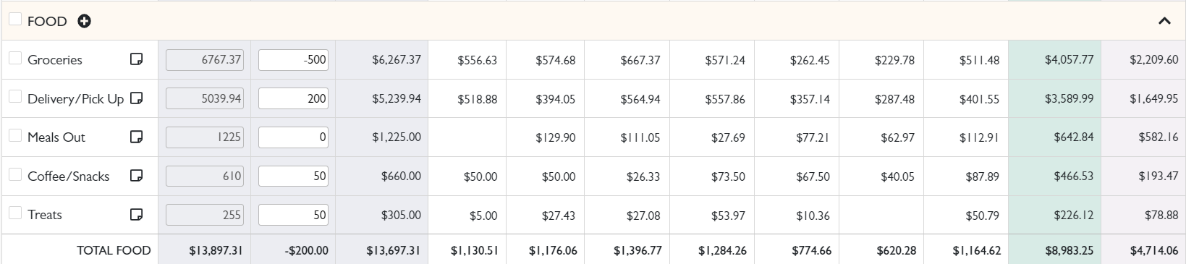

Here are some examples from my spending plan:

Conquer Your Eating Out Spending

Let’s dive deeper into your eating-out habits. That’s where you can save the most. Transitioning from eating out to more home-cooked meals frees up thousands of dollars a year. I’ve seen it hundreds of times at almost every income level and circumstance.

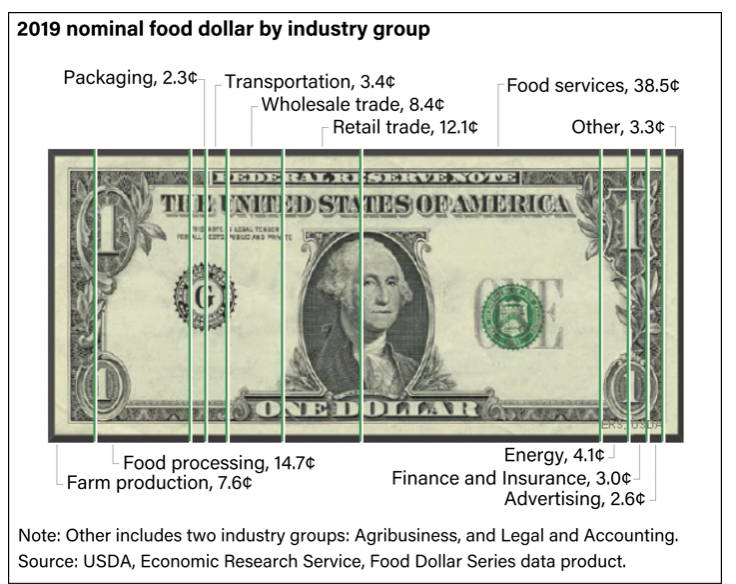

Americans spend over a third of our food dollars on eating-out services. According to the USDA, we spent 38.5% on food services such as restaurants.

USDA

Eating out “feeds” each aspect of our relationship with food – survival, social, and emotional needs. It’s fun, it feels good, and it sustains our biology.

Food Habits in the Age of Convenience

Our busy, stressful lifestyles place a premium on convenience. Wacky schedules push us into reactive mode. We forget to pack snacks in the car. We stop at 7-Eleven or McDonald’s “just this one time.” Caffeine emergencies land us at Starbucks. Typical everyday life. Eating establishments come to the rescue.

Eating out costs a lot more than cooking at home. When we use food delivery apps or stop by a convenience store, we’re not paying for the quality or even amount of food we’d get at home. We’re paying for the convenience and instant gratification of getting food quickly.

Paying more for food that’s less healthy for the sake of convenience is fine on the face of it. But recognize that it’s a trade-off.

In our household, we’ve been working on our food habits and spending for a couple of years. We schedule our shopping and cooking during the week but on Friday nights we order pick-up. We’re happy to pay those extra fees pay for the convenience and stress relief. I’ve learned to accept that takeout and dining out are legitimate subcategories of my food budget and I plan accordingly.

We also love eating out in a nice restaurant, not just for the food. We cherish the time out with people we love, relaxing in a pleasant environment and trying new dishes.

6 Creative Hacks to Reduce Your Eating-Out Spending

Instead of denying your love for convenience, embrace it by making smart choices. A few small hacks can go a long way in stretching your outside-food spending. The resulting savings make it easier to enjoy the nights you do choose to dine out without all that guilt.

Delivery Apps

#1 Support Local & Save: Switch from delivery apps to ordering on local restaurant websites. Restaurants that list on delivery apps like UberEats, DoorDash and GrubHub often mark up their prices to cover the fees these apps charge them. They’re passing the cost of the service onto you which is “baked-in” to the price.

#2 Be Your Own Delivery Driver: Switch from having food delivered to taking your happy ass to pick-up your own food. Delivery fees are outrageous these days. When ordering on GrubHub recently we found that the delivery option added $11 dollars in fees! That made the meal 29% more expensive!

|

Delivery options on apps like GrubHub can add 30% to your bottom line – this is like paying for an extra entrée every time you order delivery. |

Picking up your food instead can save a lot. There are no additional fees and sometimes the restaurant charges a little less for each item. |

|

|

Maximize Your Meals Out

#3 Stretch Your Dinners Out: When you go out to dinner, save a portion for lunch the next day. Take your lunch to work (also known as your bedroom if you’re still working from home!). Rolling one meal over once per week can save you $60 to $80/month.

#4 Hunt for Happy Hours: Check out neighborhood happy hours and meal specials, even noting them on your calendar. Taco Tuesday’s always popular in our household! This’ll save you a few bucks while giving you something to look forward to.

Bring it Home

#5 Eat-at-Home Challenge: Challenge yourself to eating at home during the workweek. Once you’re a pro at this, go for a "no take-out weeks" where you cook at home for 7 days in a row. Reward yourself with a weekly treat, meal out, or delivery. This can help you balance our eating at home and eating out budget.

#6 Caffeination Station: Make coffee at home instead of stopping at Starbucks. Make it fun with a French press or percolator. Even if you just 2 fewer Starbucks runs per week can add up to mover $500 per year.

Starting to Cook at Home

You can save some serious cash when you start cooking at home.

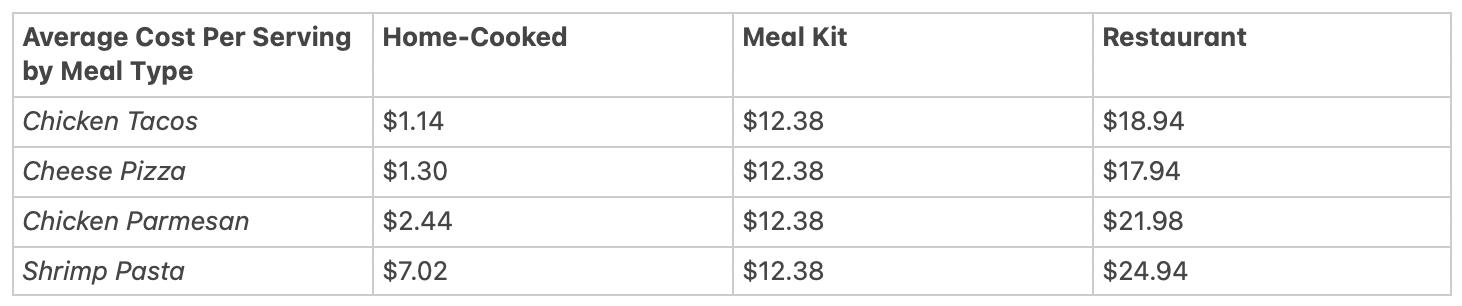

According to a getwellio.com study in Forbes.com, delivery is 5 times as expensive as cooking at home. Even meal kits are almost 3 times the cost of home-cooked meals.

It’s often healthier and takes less time than you’d think. That’s a guarantee if you use a crockpot or Insta Pot! Here's a snapshot of how much you can save by cooking dinner versus eating out or subscribing to a meal kit.

Americans have been cooking at home 6% more since 2018. During that same period, outside food spending has plummeted 32%, according to the Bureau of Labor Statistics. This is good news for our health. People who cook at home frequently are healthier and take in fewer calories than those who cook less, according to a study by the Johns Hopkins School of Public Health.

If the idea of cooking at home leaves you cold, you’re not alone. Nearly half of Americans say they don’t enjoy cooking and only 10% of us “love” it, according to a 2017 study in the Harvard Business Review by growth strategy expert Eddie Yoon.

Cooking at home can feel intimidating and overwhelming. If you never learned how to cook, you may think it’s a bigger deal than it is! Start with really simple stuff. I’m talking boiling some eggs or chopping celery sticks.

The goal is to build a habit, not to be Padma Lakshmi. I’ll show you how 4 steps to get started in simple, fun ways.

5 Steps to Successful Cooking at Home

Step 1: Find Tasty, Simple Recipes

Start out small. Keep a list of at least 3 easy and tasty recipes on your refrigerator door. This helps reduce decision fatigue. I highly recommend this for moms who cringe every time they hear “what’s for dinner?” When things get really desperate, anyone can do grilled cheese sandwiches and boxed tomato soup!

Here are some of our favorite recipes. They’re all quick, easy and inexpensive.

• Breakfast burritos

• Grilled cheese sandwiches

• Beef or vegan tacos

Step 2: Meal Planning & Scheduling

Meal planning doesn't have to be a whole thing. Just start by planning a couple of days at a time.

In our household, we now plan a week at a time. We pick which days we’ll eat out based on our schedules. Then we plan what to make on the other nights. Schedule time for cooking. If you have a partner, try alternating who cooks during the week. Plan your meals for a couple of days and eventually for the week. If you do nothing but this, you’ll be way less stressed. Even thinking ahead by one day makes a huge difference!

Try some new recipes. Once you decide what you’ll cook, buy enough to stretch each meal for lunch and/or leftovers. Throw in a few frozen dinners for fail-safe last-minute solutions. If you preheat the oven right when you get home, dinner can be ready shortly after you’ve settled in for the night. On the frazzled nights, I'm grateful to remember we always stock frozen Indian dishes and pizzas.

Step 3: Grocery Shopping

Millennials and Gen Z’-ers average 3 grocery trips per week. Nearly three quarters of their $700-$900 food expenditures comes from grocery shopping, according to Food Industry Executive. No matter what you're spending now, here are some ideas to help you save the next time go to the grocery store.

- Switch from Instacart Delivery to Instacart Pick-up (or use the grocery stores direct website instead).

- Make a detailed list and stick to it.

- Go grocery shopping on a full stomach!

- Schedule your shopping, ideally designating certain shopping days.

- Go less frequently. Even if you like fresh produce, you don’t need to shop every day.

- Don't buy too much produce at a time. If you do, you’re wasting the good stuff. Buy some frozen fruits and vegetables.

- When you get home wash and prep produce. You’re much more likely to eat it when it’s ready to go!

- Go shopping on a full stomach.

- Have this answer ready in advance: No. Practice saying it when you’re tempted to throw extra items in your basket.

- Before you get in line to check out, review your cart and remove at least 1 item you don’t really need

Want more? Try discount grocery stores like the ones in the chart below.

- Grocery Outlet - CA, OR, WA, PA, NV, ID

- Winco Foods - CA, WA, OK, MT, TX, UT, ID, AZ, NV, OR

- Aldi - East coast and California with some locations in AZ

- Food4Less/FoodCo - Chicago, California

- Costco - Nationwide

- Walmart - Nationwide

- Lidl - East Coast

- H-E-B - Texas

Step 4: Cooking

Even die-hard haters of all things cooking can get discover the magic of cooking. Create space for the magic by organizing your kitchen and getting rid of old stuff you don't use. Replace ugly, damaged or poorly made cookware. Get your knives sharpened. If they're beyond sharpening, replace them.

If you don't have one already, get a Crockpot and/or Insta Pot! These miraculous inventions allow you to simply throw ingredients in and hit “on!” They yield enough prepared food for the next day’s lunch or even lunch and dinner. Another easy trick is to roast or bake vegetables or frozen meals in the oven. This is healthier and more time-efficient than using a frying pan. While your food is baking, you can be tidying up the kitchen, reading or watching tv.

Now that you've found some fun recipes, make a list of tools and spices you need. Since spices are expensive, add them gradually from one grocery run to the next. If you're trying them for the first time, get the smallest amount possible.

Check out cooking podcasts and shows. They invite us right into other people's so we feel like we're cooking with friends. Even if you don't think of yourself as the "cooking type," try some of these shows just for the warmth, humor and beautiful meals.

One of my new favorite cooking shows on Hulu is Struggle Meals with Frankie Celenza. What I love is his recipes are simple, delicious, and affordable!

You can also watch a ton of his videos on YouTube for free!

Step 5: Stretching Your Meals

Batch meals are the nuclear option for stretching your food budget. Set aside a day a week to make a more elaborate meal that's so good you'll want to eat it days in a row. Store leftovers in glass food containers or re-use delivery containers from your former days of using delivery apps! If you prefer to use big ziploc bags, check out this genius gadget that holds the bag open for you while you pour in the food.

As you warm up to these new habits, your grocery shopping and cooking will take on new purpose. You’ll feel more personally invested and connected to how you spend your food dollars. Expect to boost your health, confidence, equanimity and your bank account.

Conclusion

The effects of our food choices reverberate through all areas of our lives. This can be as simple as choosing between an apple and a Twinkie or between a Lean Cuisine and a Sunday family dinner. Consciously choosing how, what and where we spend our food dollars powerfully affects our physical, emotional and financial well-being.

Make the most of all three by improving your relationship between food and money. Once you've tracked what your current behavior is you can choose where to adjust what, where and when you eat. You'll feel healthier, more "together" and less broke!

Appendix

Recommended Apps, Websites, Video and TV, Podcasts & Cookbooks

Regardless of your experience level or food preferences, you can find a ton of resources to get you excited about cooking. I’m constantly learning about new dishes and techniques from every media source imaginable. I’d like to share some of my favorites with you.

Apps

I’m not an app person, but a lot of my clients are! Through them I’ve learned about some powerful apps that can help you with food planning, shopping and recipes. Here are some of their faves:

•Paprika

•Allrecipes Dinner Spinner

•Yummly

Websites

Here are some great websites to get you excited about cooking at home:

•Help Guide

•Eat Well 101

YouTube Cooking Channels

•Mattie Matheson

•Bingeing the Basics

•America's Test Kitchen

Podcasts

Cookbooks

Did you like this article? Get the latest personal finance articles from Vibrant Money by subscribing to our weekly newsletter!

Enter your email address below to sign-up.

We will never sell your information, for any reason.